India is one of the world’s major consumers of edible oil, with palm oil being the most popular. A significant portion of the country’s domestic demand is met through imports, primarily from Malaysia and Indonesia. Changes in import duties tend to have a pronounced impact on the industry.

The government of India has recently slashed import duties on major crude edible oils. According to an analysis by ICRA, this move is expected to provide a significant boost to the sector. The reduction in duties is aimed at supporting domestic edible oil refiners, improving capacity utilisation, easing working capital pressures, and ultimately lowering prices for end consumers.

On May 30, 2025, New Delhi cut the basic customs duty (BCD) on crude edible oils — including palm, sunflower, and soyabean — from 20% to 10%. As a result, the effective import duty on crude edible oils dropped sharply to 16.5%, down from 27.5%. In contrast, the import duty on refined edible oils has remained unchanged at 35.75%. This has created a historically high duty differential of 19.25%, one of the widest gaps seen in recent years.

By encouraging refiners to process crude oil locally, the government aims to strengthen India’s refining sector, enhance value addition within the country, and reduce reliance on direct refined oil imports.

In 2023–24, the country imported around 15.6mn metric tonnes (mmt) of edible oils, marking a 5.2% decline from the previous year. This was the first decline since 2019–20, primarily attributed to adjustments in import duties and fluctuations in global prices.

Palm oil remains the most significant component of India’s edible oil imports, accounting for 45% of the total, followed by sunflower oil at 22% and soyabean oil at 20%. Despite efforts to boost local production, imports continue to fulfill over 95% of India’s palm and sunflower oil requirements. Domestic palm oil production increased modestly from 0.28 mmt in 2020–21 to 0.39 mmt in 2023–24 but still covers only 3–4% of the country’s total demand.

To cut this reliance, the government launched the National Mission on Edible Oils – Oil Palm (NMEO-OP) in 2021. The mission aims to increase domestic palm oil production through expansion of oil palm cultivation, particularly in the north-eastern states and other suitable regions. However, the long gestation period of oil palm cultivation means significant results are likely to take time.

ICRA’s report highlights that the new import duty structure will not only encourage local refining but also support domestic refiners’ financial health. Refiners invariably hold both duty-paid and duty-unpaid crude oil inventories. Duty-unpaid inventory is kept in bonded warehouses, with duty paid only upon withdrawal. By lowering import duties, refiners will face reduced cash outflows when clearing crude oil from bonded warehouses, easing working capital requirements.

Furthermore, the higher duty on refined oils ensures that Indian refiners remain competitive against cheaper imported refined oils. This policy measure is expected to lead to higher capacity utilisation in FY2026. ICRA’s sample set of major edible oil refiners — including AWL Agri Business Ltd, Gokul Agro Resources Ltd, Marico Ltd, and Patanjali Foods Ltd — had faced margin pressures during FY2023 and FY2024 due to global price volatility and earlier duty hikes. The recent policy changes are projected to improve these companies’ operating profit margins (OPM) in the coming financial year.

The impact is not limited to refiners alone. Food processors, fast-moving consumer goods (FMCG) companies, and the hotel, restaurant, and catering (HoReCa) sectors, which are among the largest consumers of edible oils, are also set to benefit from the expected moderation in domestic prices. Palm oil, in particular, is widely used across these segments due to its affordability, high smoke point, and thermal stability, making it ideal for deep frying and large-scale food preparation.

Edible oil is one of the most significant raw material costs for food processors, accounting for approximately 25–27% of total input value. Volatility in edible oil prices directly affects margins in this sector. According to ICRA, following the increase in import duties in September 2024, domestic retail prices surged, leading to a sharp decline in food processors’ operating profit margins, which fell from 11% in Q2 FY2025 to just 4% in Q3 FY2025.

However, with the recent duty reduction, ICRA forecasts a sequential improvement in food processors' margins by 100–200 basis points as domestic retail prices are expected to decline by INR5-10 ($0.059-0.12) per kg. Companies in the food processing segment have already started implementing measures such as grammage adjustments and price calibrations to navigate earlier volatility, and the latest duty cut is likely to offer further relief.

India’s per capita edible oil consumption jumped from 19.8 kg in 2019–20 to 23.5 kg in 2022–23, due to higher availability and rising demand. However, per capita consumption dipped to 21.8 kg in 2023–24 amid price increases. With lower expected retail prices, consumption levels may stabilise or improve slightly in the coming year.

ICRA concluded that the dual impact of lower duties on crude oils and stable duties on refined oils creates a favourable environment for domestic refiners and food processors, while also promising relief to consumers through lower edible oil prices. The measures align with broader national objectives to reduce import dependence, promote value addition within India, and support rural livelihoods through enhanced agricultural and processing activities.

Features

South Korea, the US come together on nuclear deals

South Korean and US companies have signed agreements to advance nuclear energy projects, aiming to meet rising data centre power demands, support AI growth, and strengthen the US nuclear fuel supply chain.

World Bank seems to be having second thoughts about Tajikistan’s Rogun Dam

Ball now in Dushanbe’s court to justify high cost.

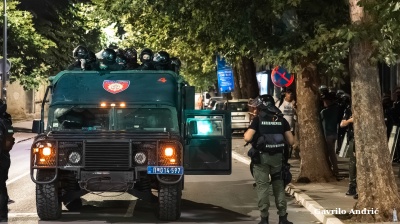

INTERVIEW: From cinema to Serbian police cell in one unlucky “take”

An Italian software engineer caught in Belgrade’s August protests recounts a night of mistaken arrest and police violence in the city’s tense political climate.

_Cropped_1756210594.jpg)

Turkey breaks ground on its section of the TRIPP rail corridor

Turkish project would help make TRIPP the go-to route for Middle Corridor freight.