A US court has ordered Argentina to surrender its 51% controlling stake in national oil company YPF as partial compensation for its controversial 2012 nationalisation of the energy giant, dealing a significant financial blow to President Javier Milei's administration.

This comes after the US Department of Justice (DOJ) intervened in the case, supporting the Argentine government’s position against forced divestment of its stake.

Judge Loretta Preska's ruling, announced on June 30, stems from Argentina's seizure of YPF from Spanish oil major Repsol in 2012, a move orchestrated by former President Cristina Fernández de Kirchner, who happens to be Milei’s political rival. The 2012 seizure raised serious questions about investment security in South America's third-largest economy.

Two minority shareholders, Petersen Energia and Eton Park Capital, who together held 25.4% of YPF's capital, filed suit the US in 2015 alleging they received inadequate compensation during the nationalisation process. The plaintiffs claimed Argentina failed to submit a proper takeover bid as required by law.

In 2023, Judge Preska had ordered Argentina in 2023 to pay damages and interest, which now amounts to $7.5bn in damages plus $6.85bn in interest to Petersen Energia, while Eton Park Capital it is approximately $1.7bn in combined damages and interest. The judge had also previously weighed the possibility of seizing YPF assets as compensation.

"We will appeal this decision in all appropriate courts to defend national interests," Milei wrote on X shortly after the June 30 judgment was published, signalling the government's intention to fight the ruling through higher courts.

“With this judgment, Preska is saying that Argentina has been ignoring all of this court’s decisions and now it’s time to pay up,” Sebastian Maril, a director at consultancy Latam Advisors, told the FT.

“This is a wave that has been building for years and is now breaking over Milei.”

La Nación noted that the party that loses the case has the right to file an appeal to the United States Supreme Court.

YPF, a century-old Argentine institution employing over 22,000 workers, was privatised in the 1990s before gradually falling under Repsol's control. Although Argentina reached a $5bn settlement with Repsol in 2014, the minority shareholders' case has persisted for around a decade.

This latest legal setback represents a significant challenge for Milei's administration, forcing him to defend policies implemented by his political rival Kirchner while potentially jeopardising state control of Argentina's most strategic energy asset at a time when the country seeks to maximise revenue from its vast Vaca Muerta shale reserves.

News

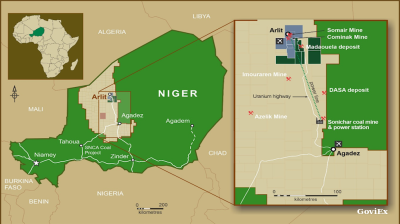

GoviEx, Niger extend arbitration pause on Madaouela uranium project valued at $376mn

Madaouela is among the world’s largest uranium resources, with measured and indicated resources of 100mn pounds of U₃O₈ and a post-tax net present value of $376mn at a uranium price of $80 per pound.

Brazil’s Supreme Court jails Bolsonaro for 27 years over coup plot

Brazil’s Supreme Court has sentenced former president Jair Bolsonaro to 27 years and three months in prison after convicting him of attempting to overturn the result of the country’s 2022 election.

Iran cleric says disputed islands belong to Tehran, not UAE

Iran's Friday prayer leader reaffirms claim to disputed UAE islands whilst warning against Hezbollah disarmament as threat to Islamic world security.

Kremlin puts Russia-Ukraine ceasefire talks on hold

\Negotiation channels between Russia and Ukraine remain formally open but the Kremlin has put talks on hold, as prospects for renewed diplomatic engagement appear remote. Presidential spokesman Dmitry Peskov said on September 12, Vedomosti reports.

_1757593919.jpg)