One of the clearest examples of Asia’s rising prominence in the global banking sector can be found in the domain of everyday transaction banking – the backbone of international trade, treasury management and cash handling for corporates.

Asian banks, particularly in countries such as Singapore, China, and Japan, have expanded their transaction banking capabilities at an impressive pace. Singapore’s DBS Bank, has consistently been recognised for its advanced digital transaction banking services, and through its IDEAL platform, DBS provides clients across Asia with real-time FX conversions, centralised cash visibility and integrated trade finance solutions. This level of digital infrastructure has enabled it to challenge and even surpass traditional Western players such as Citi and HSBC in key regional markets.

China’s major state-owned banks, notably the Industrial and Commercial Bank of China (ICBC) and the Bank of China, have also aggressively expanded their transaction banking services across Belt and Road Initiative countries. By leveraging China’s growing trade relationships and infrastructure investments, these banks are offering bespoke services tailored to regional trade flows, often priced more competitively than their Western counterparts.

In addition Japan’s MUFG Bank, one of the leading banks in the world’s third biggest economy, has utilised its regional network and technology partnerships to streamline cross-border settlement systems, especially across Southeast Asia. The acquisition of minority stakes in fintechs and regional banks has allowed this and other Japanese institutions to combine local knowledge with high-quality back-end processes, placing them in a strong position to challenge the long-established dominance of European and American banks.

Wealth management across the world

In the realm of wealth management too, Asia is home to some of the fastest-growing high-net-worth populations in the world. According to Capgemini’s World Wealth Report, the Asia-Pacific region had more millionaires than any other region by 2023, outpacing even North America. This surge in affluence has provided fertile ground for regional banks to strengthen their wealth advisory and private banking services.

Singapore and Hong Kong have become regional hubs for private wealth, with banks like OCBC, UOB and Bank of Singapore expanding their platforms for affluent and ultra-high-net-worth individuals. These institutions now compete head-on with Western powerhouses such as Credit Suisse and UBS, offering tailored investment portfolios, estate planning and family office services, often with a stronger understanding of local cultures, languages and regulatory nuances.

Meanwhile, Chinese banks, including China Merchants Bank, have significantly upgraded their wealth management arms to cater to the burgeoning middle class and the rise of digital investment channels.

Rather than relying solely on traditional relationship management, many Chinese banks have turned to robo-advisors, AI-powered investment platforms, and integrated super-apps like Ant Group’s Alipay or Tencent’s WeBank, to distribute wealth products at scale. This contrasts with the more conservative, face-to-face service models still prevalent in parts of the West.

Tech: a key advantage

Nowhere is Asia’s modern edge more evident than in banking technology. The continent’s rapid digital transformation, fuelled by mobile-first populations and supportive government policies, has been crucial in enabling Asian banks to leapfrog legacy systems that still encumber many Western institutions.

In countries like India, the introduction of the Unified Payments Interface (UPI) has revolutionised peer-to-peer and merchant payments. Indian banks, in partnership with the Reserve Bank of India and private tech firms, have successfully embedded UPI into a vast array of services, from rural microfinance to urban e-commerce. Western banks, by contrast, continue to grapple with fragmented payments infrastructure, particularly in cross-border transactions.

In China meanwhile, Ant Financial’s MyBank and Tencent’s WeBank have redefined what it means to be a digital bank. With AI-driven credit scoring, real-time loan disbursement, and facial recognition for account security, these institutions represent the cutting edge of retail banking. Their ability to operate with lower overheads and tap into ecosystems of data, from e-commerce platforms to social networks, gives them a level of agility unmatched by most traditional Western banks.

Even traditional Asian banks are investing heavily in tech.

DBS has rebranded itself as a “technology company offering banking services”, with over 80% of its services digitised. Its use of APIs, cloud computing, and data analytics has made it a global benchmark for digital transformation, earning accolades that were once the preserve of American banks like JPMorgan or Bank of America.

Regulatory and cultural agility

Another factor working in Asia’s favour is regulatory flexibility. Several Asian jurisdictions, particularly in Southeast Asia and East Asia, have adopted sandbox frameworks and open banking regulations faster than much of the West. This has encouraged banks and fintechs to experiment, iterate and bring new products to market with fewer bureaucratic hurdles.

In Singapore, the Monetary Authority of Singapore (MAS) has been lauded for its forward-thinking policies, such as enabling digital-only banks and setting clear standards for crypto assets.

Similarly, South Korea has implemented an open banking framework that allows for seamless integration between financial service providers and third-party apps, fostering competition and consumer choice.

Furthermore, cultural factors such as higher digital trust and greater comfort with mobile technology among consumers in Asia, particularly in China, Indonesia, and Vietnam, have made it easier for banks to push ahead with bold tech-driven initiatives while Western institutions often face slower adoption due to privacy concerns, ageing populations and resistance to change from entrenched customer segments.

The road ahead

Despite their many advantages, Asian banks are not without challenges, though. Some remain too domestically focused, and regulatory support may not always be consistent across the region. In markets such as China, concerns over state interference, data control and capital controls can also dampen investor confidence.

Moreover, while Asian banks have excelled at digital delivery and regional expansion, many still lag behind their Western peers in global investment banking, risk management practices and corporate governance. Institutions like Goldman Sachs and Morgan Stanley continue to dominate M&A advisory and structured products globally – areas in which most Asian banks are only just beginning to build credibility.

Nevertheless, the direction of travel is clear. With technological sophistication, a booming middle class and increasingly global ambitions, Asian banks are rapidly catching up with and, in some areas, overtaking their Western counterparts. In transaction banking, wealth management and especially digital innovation, they are not only competing but often leading. The future of global banking may well be written in the East.

Features

World Bank seems to be having second thoughts about Tajikistan’s Rogun Dam

Ball now in Dushanbe’s court to justify high cost.

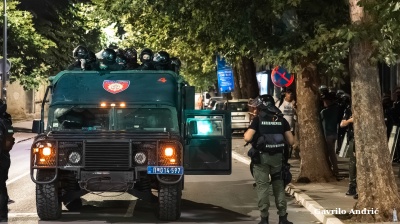

INTERVIEW: From cinema to Serbian police cell in one unlucky “take”

An Italian software engineer caught in Belgrade’s August protests recounts a night of mistaken arrest and police violence in the city’s tense political climate.

_Cropped_1756210594.jpg)

Turkey breaks ground on its section of the TRIPP rail corridor

Turkish project would help make TRIPP the go-to route for Middle Corridor freight.

Disastrous harvest gives bitter taste of food inflation in North Macedonia

Cash-strapped shoppers tell bne IntelliNews’ Skopje correspondent that preparing ajvar and other traditional winter preserves is becoming prohibitively expensive.