Euroclear's CEO Lieve Mostrey slammed the G7 plan to use Russia’s frozen assets to fund the war in Ukraine and finance its reconstruction, speaking to The Financial Times in an article published on February 15.

Mostrey suggested that the idea borders on an indirect form of asset seizure and highlighted the complexities of using another entity's assets as collateral.

"Using assets that don’t belong to you as collateral is pretty close to an indirect seizing or a commitment to future seizing, which could have exactly the same effects on the markets as a direct seizing,” Mostrey said.

The West has been moving closer to seizing some $300bn of Central Bank of Russia (CBR) reserves. The US has been pushing for the entire sum to simply be seized and given to Ukraine, and passed a law to that effect in December.

However, Europe has been a lot more reluctant, worried about the damage it would do to the European banking system and trust in the euro. Around two thirds of the frozen funds are in Europe, with the lion’s share invested into assets held by Euroclear.

Brussels has offered various compromises. This week it passed a law that allows European governments to tax away the profits the investments make worth an estimated $4bn a year. but this scheme will leave the principle untouched and the property of the CBR.

Another European proposal to tap the principal capital that is currently under discussion is to use the frozen assets as collateral and raise debt against the money that can be given to Ukraine. This scheme dodges the question of the ownership of the Russian assets, which technically continue to belong to Russia, and kicks the question of what would happen in the case of a default on the debt by Ukraine down the road. However, no decision on this scheme has been reached.

The approximately €191bn of Russian assets under its management currently frozen, Euroclear is at the heart of this issue. The US only froze some $5bn of Russia’s money.

Mostrey expressed scepticism about the Russian Central Bank's likely response to such measures, saying: "We don’t see how the Central Russian Bank would simply accept that it has been seized and that Euroclear’s obligations towards them have stopped to exist."

In recent statements the Kremlin has threatened massive legal action should its reserves be seized, something that no government sanctioning another has ever done. Usually the frozen money is returned to the sanctioned government once the dispute is over.

The Euroclear chief executive further emphasised the potential repercussions of such actions on the broader financial ecosystem, particularly concerning trust in Euroclear, European capital markets and the euro as a currency. "I trust that the prudent, rational will prevail," Mostrey said, warning of the significant impact that seizing assets could have on market confidence and stability.

News

US strikes on drug vessels kill 14 in deadliest day of Trump's narcotics campaign

The US military killed 14 people in strikes on four vessels allegedly transporting narcotics in the eastern Pacific Ocean, marking the deadliest single day since President Donald Trump began his controversial campaign against drug trafficking.

Russia withdraws from Cold War plutonium disposal pact with US

Russian President Vladimir Putin has formally withdrawn from a key arms control agreement with the United States governing the disposal of weapons-grade plutonium, as the few remaining nuclear security accords between the two powers vanish.

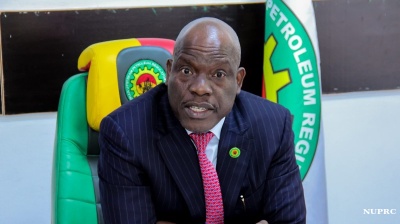

Nigeria’s NUPRC holds exploratory talks with Bank of America on upstream financing

Nigeria's upstream regulator, NUPRC, has held exploratory talks with Bank of America as the country looks to attract new capital and revive crude output, after falling short of its OPEC+ quota.

European diplomacy should have stopped war, Orban tells Italian broadcaster

The job of European diplomacy would have been stopping the war in Ukraine, but Brussels has become "irrelevant" by deciding not to negotiate, Prime Minister Viktor Orban told an Italian TV channel on October 28.