July 12 did not bring stabilisation to Turkish markets that have been tumbling since President Recep Tayyip Erdogan announced late on July 9 his new cabinet under a full-blown “Turkish-type” presidential system.

The Turkish lira (TRY) rebounded on July 12 from historical lows it tested against the US dollar late on July 11, but Borsa Istanbul dipped further to the lowest levels seen since April 2017. Yield on 10-year benchmark domestic bonds tested fresh record highs.

“TRY close to 5 again, market expects to see concerted action from (newly-appointed economy czar) Albayrak and (central bank governor) Cetinkaya to stop the rot. July 24 MPC meeting is too far off at this stage. Erdogan sold the Executive Presidency (EP) as bringing more effective economic [management] — time to prove it,” Tim Ash of Bluebay Asset Management tweeted.

“Guess if inaction to stabilise the lira and markets — this will just prove those claiming that the EP is part of the problem,” Ash added.

Market reaction to Erdogan’s new cabinet was fairly negative on July 10 and on July 11. Markets especially did not like the appointment of Erdogan’s son-in-law Berat Albayrak as finance minister, replacing former economy head and investors’ darling, Deputy Prime Minister Mehmet Simsek and market-friendly former finance minister Naci Agbal, who were widely seen by investors as among the few top Turkish officials who could rein in Erdogan’s unorthodox obsessions.

Also on July 10, Erdogan did what investors into Turkey feared the most: he took sole control of the appointment of the central bank governor, deputies and monetary policy committee (MPC) members for a four-year period, according to a presidential decree published on the day.

The lira tumbled from 4.55 to 4.73 to the dollar within an hour of Erdogan’s cabinet announcement late on July 9 — falling more than on the eve of the coup attempt against Erdogan two years ago.

On July 11, the local currency hit a fresh record high of 4.9777 during late trading hours after Erdogan told a group of journalists on his way to Brussels from Northern Cyprus that Turkey’s economy was on the right track and interest rates would soon decrease.

“As a house we are pretty negative about the changes in the government and very sceptical that the central bank will maintain a tight policy for as long as they need to,” Paul Fage of TD Securities told Reuters, adding that the timing of Erdogan’s latest comments was “just awful”.

As of 19:30 local time, the lira was trading at 4.8318 against the US dollar, down 0.92% d/d.

The lira’s recovery was helped by close to $700mn in FX sales by local retail investors, an unnamed Istanbul-based trader told Bloomberg.

The benchmark BIST-100 index has also extended its nosediving trend. The index lost further by 1.18% to 89,571 at closing on July 12 after falling 3% d/d on July 10 and 5.18% on July 11, the highest daily fall in two years.

Before the current market turmoil, BIST-100 saw its historically highest level of 121,531.5 during intra-day trading hours on January 29 before gradually descending to 92,721 on June 18. BIST-100 went on to follow a rising trend to as high as 100,808 on July 9, especially after the June 24 snap polls ended in the first round.

Losses in the banking index were higher. The banking index stood at as high as 135,867 at closing on July 9 while it gradually fell to 114,436 on July 12.

Erdogan’s latest comments on interest rates especially hit banking shares on the expectations of mounting pressure on local lenders to cut rates.

Yield on two-year benchmark domestic bonds rose as high as 20.52% during trading hours on July 12 and closed the day at 20.28%.

The 10-year benchmark yield tested a fresh record high of 18.85% and it stood at 18.55% at closing.

“Turkish government bonds market saw a knee-jerk reaction in response to a threat of central bank losing its independence as President Erdogan would use his powers to appoint central bank board members,” Gintaras Shlizhyus of RBI Vienne said in a research note, adding that “the 10-year yield jumped 80bp to nearly 18% yield in what looks like a bearish flattening on the curve, which became a negative surprise for us.”

“In our opinion such a development could be hardly predicted since Turkey already has paid a hefty price for mismanaging its monetary policy and suffered from TRY devaluation,” said Shlizhyus. So RBI’s assumption that Erdogan would exercise more restrain in his post-election actions proved to be wrong.

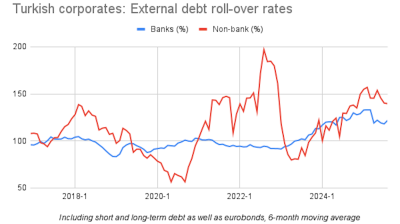

In RBI’s opinion the continuation of such dubious practices can destroy market confidence in Turkey and, in a more dramatic escalation, would lead to debt rollover problems for private sector with consequences ranging from larger losses for the economy to a devaluation spiral leading to more insolvencies.

Data

Ruble strengthens as sanctioned oil companies repatriate cash

The Russian ruble strengthened after the Trump administration imposed oil sanctions on Russia’s leading oil companies, extending a rally that began after the Biden administration imposed oil sanctions on Russia in January.

Russia's central bank cuts rates by 50bp to 16.5%

The Central Bank of Russia (CBR) cut rates by 50bp on October 24 to 16.5% in an effort to boost flagging growth despite fears of a revival of inflationary pressure due to an upcoming two percentage point hike in the planned VAT rates.

Ukraine's trade deficit doubles to $42bn putting new pressure on an already strained economy

Ukraine’s trade deficit has doubled to $42bn as exports fall and imports balloon. The balance of payments deficit is starting to turn into a serious problem that could undermine the country’s macroeconomic stability.

BYD surpasses Tesla to become EV market leader – Statista

While Chinese manufacturer BYD already pulled ahead of Tesla in production volume last year, with 1,777,965 battery electric vehicles (BEV) produced in 2024 (4,500 more than Tesla), the American manufacturer remained ahead in sales.

_Cropped_1761809941.jpg)