Across Asia, from hillsides in Thailand to plantations in the Philippines, and highland farms in Vietnam, Asian fruit exports are booming, and global consumers are increasingly developing a taste for everything from mangoes and mangosteens to durians and dragon fruit.

Asia has long been a powerhouse in the global food trade, but in recent years, the continent’s share of global fruit exports has expanded significantly. Thanks to rising demand from the growing middle-classes in China in particular, the United States, the Middle East, and Europe coupled to improved cold chain logistics, Asian growers are now tapping into global markets more aggressively than ever before.

Diversity reigns

What sets Asia apart in the fruit trade is not just volume but variety. The region is home to a rich biodiversity of tropical and subtropical fruits, many of which are not grown widely enough outside the continent to make commercial. Thailand’s durians, Vietnam’s dragon fruit, and pineapples from Taiwan and the Philippines are prime examples. Each has become a flagbearer of its country’s export ambitions.

Thailand is the world’s largest exporter of durian, often dubbed the “king of fruits” for its pungent aroma and creamy texture. In 2023 alone, Thailand exported over $3.5bn worth of durian, with China accounting for more than 90% of that figure. To meet demand, Thai growers have expanded plantations and embraced improved grading and packaging techniques to maintain quality over long distances.

Meanwhile, Vietnam has seen a dramatic rise in dragon fruit exports. The fruit, known for its striking pink skin and speckled purple or white flesh, has become a symbol of Vietnam’s rise as a horticultural exporter. In 2022, dragon fruit made up nearly 40% of the country’s fresh fruit exports, with shipments reaching over 40 countries.

Indonesia is following a similar path in coconut production and export too while Taiwan is carving out a similar market in the mango, lychee and longan sectors.

The Philippines remains a global leader in pineapples and bananas. Its long-standing partnerships with multinational firms such as Dole and Del Monte have helped ensure steady supplies to North America, the Middle East, and East Asia. Despite competition from Latin American producers, Philippine bananas remain the top choice in markets like Japan, Taiwan and South Korea.

Global demand

Part of Asia’s fruit export success lies in its ability to align with evolving global preferences. Consumers in Europe and North America are increasingly seeking exotic and health-conscious foods. Tropical fruits, rich in fibre, vitamins, and antioxidants thus come under the spotlight. As awareness grows, so too does willingness to pay a premium for freshness, flavour, and novelty value.

China has emerged as a particularly important driver of this regional demand for freshness. As Chinese consumers become wealthier and more health-conscious, they are seeking high-quality imported fruit – seen as a status symbol by many. Cross-border trade deals and improved logistics have also made it easier for countries like Laos, Cambodia, and Malaysia to gain entry into the 1.4bn strong Chinese market.

Malaysia's Musang King durian, once a domestic delicacy is a classic case in point and has become a sought-after item in China, often sold at luxury prices in high-end supermarkets from Hong Kong in the south to Beijing in the north. Malaysia’s durian exports to China alone are now expected to exceed $500mn annually within the next few years.

Back end support

Behind the export surge lies a quiet transformation in logistics and infrastructure. Cold chain networks which keep fruit fresh from farm to market have expanded dramatically. Vietnam, Thailand, and the Philippines as well as Taiwan, Indonesia and elsewhere in Asia have all invested in refrigerated trucks, improved warehousing, and air freight capacity. This has allowed for more distant and time-sensitive markets to be reliably served.

Moreover, digital agriculture is playing a growing role. Farmers and cooperatives are increasingly using data tools to forecast demand, monitor crop health, and plan harvests. Even blockchain technology is gaining traction in some areas to help in verifying quality and traceability, especially for premium fruit categories destined for export.

Challenges ahead

Despite the success, Asian fruit exporters face a number of challenges. Climate change is an ever-present threat, with extreme weather patterns affecting crop yields and quality. Droughts, typhoons, and rising temperatures can devastate harvests, especially for water-intensive fruits like mangoes and bananas. Citrus fruit are similarly affected.

Market access remains another hurdle. Although bilateral agreements have opened doors, non-tariff barriers such as packaging regulations, and border inspections continue to limit market entry, particularly in the regulation loving EU and US markets. Some exporters also face competition from Latin American producers, who benefit from larger-scale farms and long-standing trade ties with the West.

Labour shortages and rural depopulation are pressing concerns as well. Many Asian countries are seeing young people leave agriculture for urban jobs, making it harder to maintain and expand orchards. Mechanisation is limited in many fruit sectors, particularly those relying on delicate hand-maintenance and harvesting techniques.

A fruitful future

Still, the future for Asian fruit exports looks bright. Rising demand, improved technology, and expanding trade routes all suggest continued growth in the years ahead. As markets diversify with the Gulf states, India, and even the richer parts of Africa showing increasing appetite for tropical fruits Asian producers are well positioned to lead.

Governments across the region are also stepping up. With support for farmer training, irrigation infrastructure, and trade facilitation, many are laying the groundwork for long-term export resilience. Ultimately, Asia’s fruit boom is about more than economics. It represents a region making its mark on the global palate one bite at a time.

Features

South Korea, the US come together on nuclear deals

South Korean and US companies have signed agreements to advance nuclear energy projects, aiming to meet rising data centre power demands, support AI growth, and strengthen the US nuclear fuel supply chain.

World Bank seems to be having second thoughts about Tajikistan’s Rogun Dam

Ball now in Dushanbe’s court to justify high cost.

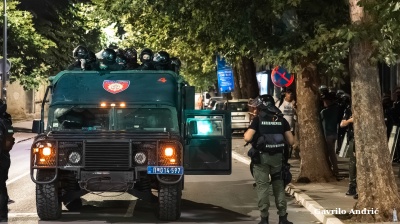

INTERVIEW: From cinema to Serbian police cell in one unlucky “take”

An Italian software engineer caught in Belgrade’s August protests recounts a night of mistaken arrest and police violence in the city’s tense political climate.

_Cropped_1756210594.jpg)

Turkey breaks ground on its section of the TRIPP rail corridor

Turkish project would help make TRIPP the go-to route for Middle Corridor freight.