The board of the Central Bank of Russia (CBR) resolved to keep the key interest rate unchanged at 21% at the policy meeting of April 25, according to the press-release of the regulator.

As followed by bne IntelliNews, a broad consensus expects the key interest rate to remain unchanged at record-high 21%. This made the fourth consecutive policy meeting at which the key interest rate is maintained flat.

Russia’s inflation slowly moderates and the regulator is wary of global economic uncertainty that might slow down the long-awaited monetary easing of the overheated Russian economy. As a reminder, at the previous March 21 policy meeting the CBR also acknowledged that inflationary pressures are easing, but resolved to keep the key interest rate unchanged at 21%.

In April, too, "current inflationary pressure continues to decline, although it remains high," the CBR wrote in the press-release, adding that "domestic demand growth still significantly outpaces the expansion capacity of goods and services supply".

While latest economic indicators show signs of “soft landing”, increasing global economic slowdown risks and falling oil prices also mean heightened risks of a sharper Russian economic slowdown.

The CBR seems to see a higher likelihood of "soft landing". "According to operational data, the economy has started to gradually return to a path of balanced growth," the CBR said in its press-release.

However, this does not mean that the regulator will rush to cut interest rates. The analysts surveyed by RBC business portal remind that the CBR will not be in a rush to ease the monetary policy, as between September 2022 and July 2023, the regulator held rates steady for six meetings in a row.

Still, the wording of the CBR was slightly more dovish than in March. The regulator removed previous signals about the possibility of future rate hikes, instead pledging to "maintain such tight monetary conditions as necessary to return inflation to target by 2026."

Renaissance Capital argues that the hawkishness in CBR’s Governor Elvira Nabiullina’s speech following the meeting has decreased even more noticeably than the press-release.

The Governor noted that this time the regulator had greater confidence in the sustainability of the disinflationary trend. Additionally, she mentioned the potential lowering of the oil cut-off price in the fiscal budget rule, noting that if implemented, this would also be a disinflationary factor.

However, the CBR remains aware of external risks and still mentioned in the press-release that "a further slowdown in global economic growth and oil prices in case of escalating trade tensions could have pro-inflationary effects through the ruble exchange rate dynamics".

This statement “carries a lot of weight”, RenCap analysts believe, noting that the external situation will continue to be the decisive factor for the dynamics of the domestic economic picture and monetary policy decisions.

There is no consensus among the analysts surveyed by RBC on the future rate action. While previously the analysts expected the key rate to fall from June to 16% and reach 12% by end-2025 and 2026, now the outlook shifted for the key interest rate to remain at 21% for a longer period and potentially falling to 12% by mid-2026.

Some analysts surveyed by RBC still predict the beginning of a rate-cutting cycle at the CBR’s next scheduled board meeting on June 6.

RenCap analysts argue that “it is reasonable to expect the beginning of monetary policy easing at one of the next three meetings (and possibly as early as June–July, if the ruble remains strong), but everything will largely depend on the volatility of the external environment, both regarding trade wars and negotiation processes [of Russia’s full-scale military invasion of Ukraine]”.

“The decision to leave interest rates on hold was widely expected by analysts, and marks the fourth meeting at which rates have been left unchanged. The press statement today removed the line that “if disinflation dynamics do not ensure achieving the inflation target, the CBR will consider raising the key rate” and replaced it with guidance that the bank “will maintain monetary conditions as tight as necessary”, said Nicholas Farr, an emerging Europe economist with Capital Economics.

“This seems to reflect growing confidence among policymakers that the extent of overheating in the economy is easing. The CBR highlighted that “the impact of tight monetary conditions on demand is becoming increasingly evident in decreasing inflationary pressures”. Admittedly, the CBR did add a line in its statement highlighting inflationary risks from escalating trade tensions if lower oil prices were to put downward pressure on the ruble. But overall, the tone of the communications felt more dovish than previously. And the ruble is up more than 20% against the dollar this year, so the currency probably won’t be a major concern for the central bank,” Farr added. “We doubt the CBR will cut interest rates as soon as its next meeting in June. But today’s communications support our view that monetary easing could arrive in Q3 once its clear inflation has peaked.”

Data

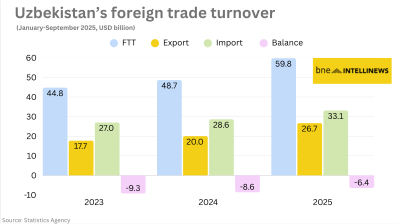

Uzbekistan’s nine-month foreign trade nears $60bn

Export growth of 33% and import expansion of 16% y/y produce $6.4bn deficit.

Hungary’s central bank leaves rates unchanged

National Bank of Hungary expects inflation to fall back into the tolerance band by early 2026, with the 3% target sustainably achievable in early 2027 under the current strict policy settings.

Germany slowdown weighs on Lithuania’s export-driven manufacturing sector

Lithuania’s economy remains highly sensitive to the industrial cycle in Germany, its third largest trade partner.

Chobani yoghurt king Hamdi Ulukaya becomes richest Turk

Knocks Murat Ulker into second place in Forbes ranking as his company's valuation leaps to $20bn.