Particularly constrained by the high share of rigid spending in the last few years, Romania's 2021 budget plans could hardly have been more ambitious.

Romania's long-awaited 2021 budget draft has been published by the Finance Ministry yesterday, including projections for 2022-2024.

Revenues: Composition and dynamic

On the revenues side, all main categories should improve in 2021 in line with the economic recovery, leading to a 13.1% increase in revenues.

The situation on the expenditure side is more nuanced.

Expenditures are estimated to rise by 4.8% in 2021.

Essentially, public wages and pensions are capped at their December 2020 level, subsidies and goods & services expenditures have been reduced, while investment spending is estimated to increase by 15.7%.

The coronavirus (COVID-19) related spending is envisaged to drop from 4.85% of GDP to 3.65% but – interestingly enough – there is a rise in the estimated amounts for public guarantees related to funding schemes for the SMEs and large companies. These guarantees are planned to increase from 1.20% of GDP in 2020 to 2.52% of GDP in 2021 and are also included in the total COVID-19 related support measures.

Public debt to stabilise below 55%

Under the above assumptions, gross public debt is expected to rise and stabilise close to but below 55% by 2024.

Financing the deficit

2021 financing needs have started to look more than just marginally better.

Total needs should be around RON126bn (€25.8bn) (compared to RON149bn in 2020), split into RON80bn budget deficit and RON46bn redemptions.

Given the strong primary auctions seen recently (year-to-date the Ministry of Finance issued RON13.4bn and €1.2bn) and the likely generous FX buffer at the Finance Ministry's disposal, the time for a more opportunistic issuance behaviour is looking closer. Compared to 2020, when Romania issued almost €12bn in Eurobonds (plus c.€2.3bn on the local market), the funding split is likely to be less tilted towards the hard currency, though we still expect a decent issuance here as well (say around €7.5bn of Eurobonds).

Rating impact

Rating agencies and investors are keeping a close eye on Romania’s ratings (Baa3 neg/BBB- neg/BBB- neg), with the budget draft a key indicator of the post-election fiscal setting. The budget should – at the very least – please the rating agencies but the downgrade threat is still very much hovering in the background.

Positively, with the social spending increase broadly contained and investments share in GDP at historical highs, we believe rating agencies will again look past elevated deficits in 2020 and 2021, with more importance given to medium-term fiscal and growth prospects. The 2021 budget deficit is roughly in line with the rating agencies' forecasts for the year and, more importantly, the budget draft indicates a narrowing deficit to below 3% of GDP by 2024.

Arguably, the pace of improvement in the budget isn't all that impressive, but we think growth will save the day for Romania, once again, as has generally been the case throughout the years.

So what should we make of this?

The pace of fiscal consolidation might not look very ambitious, but it does strike a realistic balance in our view, between the need to preserve some support for the economy while bringing the deficit closer to more acceptable levels.

We maintain our forecast of 7.3% for this year’s budget gap, based on a more conservative GDP growth figure as well (3.7% vs the 4.3% official estimate). We believe GDP growth risks are skewed to the upside.

This year’s budget could prove to be a small but crucial element towards Romania’s medium-term fiscal adjustment, hence our beloved saying “a little bit of everything” approach to fiscal consolidation.

-

Valentin Tataru is the chief economist of ING in Romania. Trieu Pham is an emerging markets sovereign debt strategist for ING in the UK. This note first appeared on ING’s THINK.ING portal here.

Content Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Opinion

IMF: Global economic outlook shows modest change amid policy shifts and complex forces

Dialing down uncertainty, reducing vulnerabilities, and investing in innovation can help deliver durable economic gains.

COMMENT: China’s new export controls are narrower than first appears

A closer inspection suggests that the scope of China’s new controls on rare earths is narrower than many had initially feared. But they still give officials plenty of leverage over global supply chains, according to Capital Economics.

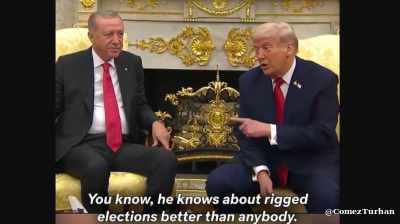

BEYOND THE BOSPORUS: Consumed by the Donald Trump Gaza Show? You’d do well to remember the Erdogan Episode

Nature of Turkey-US relations have become transparent under an American president who doesn’t deign to care what people think.

COMMENT: ANO’s election win to see looser Czech fiscal policy, firmer monetary stance

The victory of the populist, eurosceptic ANO party in Czechia’s parliamentary election on October 6 will likely usher in a looser fiscal stance that supports growth and reinforces the Czech National Bank’s recent hawkish shift.