Kremlin to replenish National Welfare Fund by RUB1.3tn in June, enough to cover the budget deficit, despite oil revenue pressures

The Kremlin has replenished the National Welfare Fund (NWF) with a new RUB1.3tn ($14.9bn) injection in June, as the Ministry of Finance credited long-delayed foreign exchange proceeds and gold reserves purchased last year, despite ongoing pressure on oil revenues and a growing federal deficit, Vedomosti reported.

The increase is enough to cover all of this year’s forecast budget deficit again and the fund is expected to start growing again over the rest of this year, depending on oil price dynamics, according to the Ministry of Finance (MinFin).

According to Ministry data published on July 1, the liquid portion of the NWF rose from RUB2.84 trillion (1.3% of GDP) at the beginning of June to RUB4.13tn (1.9% of GDP) by the start of July. The increase was driven by the transfer of CNY61.1bn and 74 tonnes of gold acquired in 2023 from additional oil and gas revenues (OGR), the ministry said.

The NWF is a key backstop for the Russian budget, a rainy day fund that can be tapped in times of budget deficit. The assets in the “liquid part” – trillions of rubles have been used to invest into state projects, mainly run by the Russia Direct Investment Fund (RDIF) sovereign wealth fund – have more than halved from RUB8.8 trillion at the start of the Ukraine war over three years ago. Before the top up the RUB2.84 trillion left in the fund was less than the forecast RUB3.78 trillion budget deficit this year, but now it is more.

Experts cited by Vedomosti noted that the injection was crucial, given that current oil prices remain below the fiscal rule’s cutoff level of $60 per barrel. “The situation with the NWF is now much more tense than it was before,” analysts said, adding that the transfer of prior-year reserves would “eliminate the risks of depleting the liquid part of the NWF in the near future”.

According to Finance Minister Anton Siluanov, the government will consider adjusting the budget rule’s cutoff price. The ministry forecasts the NWF’s liquid assets will reach RUB7.3tn (3.4% of GDP) by end-2025, up from RUB5.25tn (2.7% of GDP) in 2024. This year alone, RUB447bn from the NWF is earmarked for budgetary use.

The NWF continues to serve as a key backstop for fiscal shortfalls. The federal budget deficit for 2025 is now projected at RUB3.79 trillion (1.7% of GDP), more than triple the RUB1.17 trillion originally planned. The Ministry of Economic Development also confirmed that up to RUB1 trillion in NWF assets could be invested this year, including RUB300bn for the Moscow–St. Petersburg high-speed rail line.

Despite the NWF’s replenishment, oil and gas revenues are under pressure. In June, OGR totalled RUB494.8bn, bringing the half-year figure to RUB4.73 trillion —still RUB2.62 trillion short of the earlier annual forecast of RUB10.94 trillion. For July, the ministry expects an NGD shortfall of RUB25.8bn.

To stabilise the budget, the Finance Ministry will sell foreign currency worth RUB18.8bn between July 7 and August 6. Including Bank of Russia’s “mirroring” operations, daily forex sales will reach RUB9.7 trillion, according to economist Yegor Susin.

VTB Chief Economist Rodion Latypov estimated that if Urals crude prices drop to $50 per barrel, the NWF’s liquid assets—factoring in the latest top-up—would be sufficient for 2.5 years without changes to the fiscal rule. “If the cutoff price is reduced to $50 and oil prices remain stable, NWF usage could be avoided altogether,” Latypov added.

News

US suspends strategic dialogue with Kosovo amid political deadlock

Washington singles out Kosovo's caretaker PM, leftwing nationalist Albin Kurti, who has a strained relationship with the Trump administration.

Lukewarm support for Polish UN vote condemning Russian drone incursion

Only 46 out of 193 UN member states signed a joint UN declaration on September 12, denouncing Russia’s alleged involvement in a drone incursion into Polish airspace two days earlier.

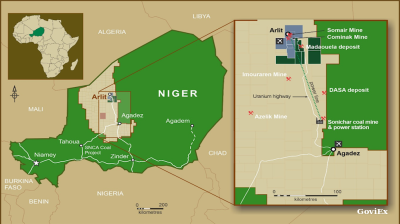

GoviEx, Niger extend arbitration pause on Madaouela uranium project valued at $376mn

Madaouela is among the world’s largest uranium resources, with measured and indicated resources of 100mn pounds of U₃O₈ and a post-tax net present value of $376mn at a uranium price of $80 per pound.

Brazil’s Supreme Court jails Bolsonaro for 27 years over coup plot

Brazil’s Supreme Court has sentenced former president Jair Bolsonaro to 27 years and three months in prison after convicting him of attempting to overturn the result of the country’s 2022 election.