As the war in Ukraine enters its third year, Kyiv and its partners are pithing international investors to get involved the infrastructure projects.

“Act now, not after the war ends,” is the pitch in a white paper released in July by Amber Infrastructure and Dragon Capital, in time for the Ukraine Recovery Conference (UKR2025), in what they argue is a once-in-a-generation opportunity.

The two firms, a major engineering group and Ukraine’s biggest investment bank, argue that Ukraine’s economic resilience during the war and its proximity to the EU make it an attractive proposition for private capital to shape a new European infrastructure market from the ground up.

“Ukraine’s reconstruction is not simply about replacing what was lost – it is about building the infrastructure of a 21st-century European economy,” the paper says. Ukraine’s investment case is rooted in Ukraine’s convergence with EU standards as part of its accession process, untapped logistics potential and rapid reform momentum. The message is clear: reconstruction is already under way, and those who delay will miss out.

The country’s infrastructure needs are immense. War damage is estimated to be $568bn by the World Bank and Dragon Capital estimate there is a need to raise some $150bn in private sector capital participation to fund the reconstruction.

And there is a lot to do. The war has left Ukraine operating with just 15 GW of power generation capacity – less than half of its pre-war level – against peak winter demand of up to 19 GW. Ukraine’s transport sector requires €75bn in investment, while energy and extractive industries need around €66bn, according to World Bank estimates cited in the paper.

Yet despite an economic contraction of nearly 29% in 2022, the country has posted consecutive years of recovery and maintained functioning institutions and is forecast to grow by 2% this year.

Foreign direct investment remains below pre-war levels – $55.6bn compared to nearly $66bn – but early signs of investor re-engagement are emerging. Dragon Capital’s M10 Lviv Industrial Park, located just 60 km from the Polish border, secured $10mn in equity and $9.2mn in war-risk insurance, becoming a showcase for wartime logistics investment.

The white paper presents Ukraine as an evolving laboratory for infrastructure-led growth. “The window for securing strategic positioning is narrowing rapidly,” it warns, noting that post-war competition for flagship projects will be fierce. Key themes include decentralised renewable energy, supply chain hubs, and cross-border infrastructure aligned with EU corridors such as Via Carpatia and the Trans-European Transport Network.

The paper acknowledges investor hesitancy due to security and legal risks, but argues these are being addressed through institutional reforms, bilateral investment treaties, and evolving insurance products. Amber and Dragon Capital suggest that private equity and infrastructure funds – not just governments – must lead Ukraine’s reconstruction if the country is to unlock its full potential.

“The time to act is not after the war – but now,” the report concludes.

As the war in Ukraine enters its third year, Kyiv and its partners are pitching international investors to get involved in the infrastructure projects.

“Act now, not after the war ends,” is the pitch in a white paper released in July by Amber Infrastructure and Dragon Capital, in time for the Ukraine Recovery Conference (UKR2025), in what they argue is a once-in-a-generation opportunity.

The two firms, a major engineering group and Ukraine’s biggest investment bank, argue that Ukraine’s economic resilience during the war and its proximity to the EU make it an attractive proposition for private capital to shape a new European infrastructure market from the ground up.

“Ukraine’s reconstruction is not simply about replacing what was lost – it is about building the infrastructure of a 21st-century European economy,” the paper says. Ukraine’s investment case is rooted in Ukraine’s convergence with EU standards as part of its accession process, untapped logistics potential, and rapid reform momentum. The message is clear: reconstruction is already under way, and those who delay will miss out.

The country’s infrastructure needs are immense. War damage is estimated to be $568bn by the World Bank and Dragon Capital estimates there is a need to raise some $150bn in private sector capital participation to fund the reconstruction.

And there is a lot to do. The war has left Ukraine operating with just 15 GW of power generation capacity – less than half of its pre-war level – against peak winter demand of up to 19 GW. Ukraine’s transport sector requires €75bn in investment, while energy and extractive industries need around €66bn, according to World Bank estimates cited in the paper.

Yet despite an economic contraction of nearly 29% in 2022, the country has posted consecutive years of recovery and maintained functioning institutions and is forecast to grow by 2% this year.

Foreign direct investment remains below pre-war levels – $55.6bn compared to nearly $66bn – but early signs of investor re-engagement are emerging. Dragon Capital’s M10 Lviv Industrial Park, located just 60 km from the Polish border, secured $10mn in equity and $9.2mn in war-risk insurance, becoming a showcase for wartime logistics investment.

The white paper presents Ukraine as an evolving laboratory for infrastructure-led growth. “The window for securing strategic positioning is narrowing rapidly,” it warns, noting that post-war competition for flagship projects will be fierce. Key themes include decentralised renewable energy, supply chain hubs, and cross-border infrastructure aligned with EU corridors such as Via Carpatia and the Trans-European Transport Network.

The paper acknowledges investor hesitancy due to security and legal risks, but argues these are being addressed through institutional reforms, bilateral investment treaties, and evolving insurance products. Amber and Dragon Capital suggest that private equity and infrastructure funds – not just governments – must lead Ukraine’s reconstruction if the country is to unlock its full potential.

“The time to act is not after the war – but now,” the report concludes.

Features

South Korea, the US come together on nuclear deals

South Korean and US companies have signed agreements to advance nuclear energy projects, aiming to meet rising data centre power demands, support AI growth, and strengthen the US nuclear fuel supply chain.

World Bank seems to be having second thoughts about Tajikistan’s Rogun Dam

Ball now in Dushanbe’s court to justify high cost.

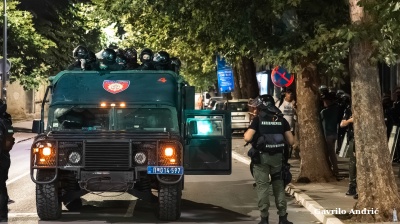

INTERVIEW: From cinema to Serbian police cell in one unlucky “take”

An Italian software engineer caught in Belgrade’s August protests recounts a night of mistaken arrest and police violence in the city’s tense political climate.

_Cropped_1756210594.jpg)

Turkey breaks ground on its section of the TRIPP rail corridor

Turkish project would help make TRIPP the go-to route for Middle Corridor freight.

_1_1756172090.jpg)