Iran's handwoven carpet industry, once a cornerstone of the nation's cultural and economic identity, has experienced a precipitous decline that mirrors broader challenges facing the country's export economy. Export figures reveal a catastrophic contraction from $427.4mn in 2011 to a mere $41.7mn in 2024, representing an 90% reduction that extends far beyond typical cyclical downturns to suggest structural damage to one of Iran's most traditional industries.

The trajectory of this decline follows a predictable pattern aligned with geopolitical developments. Between 2012 and 2014, as international sanctions tightened, exports fluctuated between $250-300mn, demonstrating the industry's initial resilience. The implementation of the Joint Comprehensive Plan of Action in 2015 provided temporary respite, with exports recovering to approximately $400mn by 2017. However, the reimposition of comprehensive sanctions in 2018 marked the beginning of an accelerating collapse, with exports plummeting below $50mn in 2019 and remaining stubbornly low thereafter.

This dramatic contraction reflects multiple interconnected factors that have fundamentally altered the industry's operating environment. Sanctions represent the primary constraint, effectively severing access to traditional markets in Europe, East Asia and Arab countries where Persian carpets historically commanded premium prices. The resulting market fragmentation has forced producers to pivot towards domestic sales, a strategy that proves insufficient given the limited domestic purchasing power and preference shifts towards machine-made alternatives.

The industry's structural vulnerabilities have been exposed by external pressures. Government support mechanisms, never robust, have deteriorated further during the sanctions period. Insurance coverage for weavers remains woefully inadequate, with only 273,000 individuals covered against a target population of 2mn. This represents a fundamental failure of social protection that undermines the industry's human capital base. The demographic profile of the workforce has shifted dramatically, with average ages increasing as younger generations abandon the profession due to poor economic prospects and lack of career security.

Raw material costs present another significant challenge, with silk prices increasing from IRR1bn per kilogram to IRR1.4bn within three months. This inflationary pressure occurs whilst producers cannot proportionally increase carpet prices due to constrained demand, creating a classic cost-price squeeze that erodes profitability across the value chain. The situation is exacerbated by currency volatility, as producers must purchase materials at dollar-linked prices whilst selling predominantly in the domestic market for rials.

Competition from international producers has intensified during Iran's period of market isolation. China, Afghanistan and Pakistan have developed manufacturing capabilities that produce carpets with Iranian designs at substantially lower costs. Whilst these products lack the authenticity and long-term durability of genuine Persian carpets, they have captured market share in price-sensitive segments. The proliferation of counterfeit products sold as authentic Persian carpets has further damaged brand recognition and consumer confidence.

The decline has created a vicious cycle of disinvestment and skill erosion. Towns that supported 2,000 weavers in the 1990s now sustain only 500, representing a 75% reduction in local capacity. University graduates in carpet-related disciplines face unemployment, leading to brain drain as skilled individuals seek opportunities in other sectors. This human capital flight threatens the industry's long-term recovery prospects, as traditional weaving techniques require years of training and cultural transmission.

Market dynamics have shifted fundamentally as producers concentrate on survival rather than growth. Many accept low-margin orders simply to maintain market presence, whilst others have abandoned export activities entirely. International trade exhibitions, once vital for market development, now attract primarily Chinese manufacturers and peripheral Gulf state buyers, reflecting the industry's reduced global profile.

The broader economic implications extend beyond immediate employment and export revenues. The carpet industry represents a significant component of Iran's cultural soft power, with genuine Persian carpets serving as ambassadors of Iranian craftsmanship and artistic heritage. The industry's decline therefore represents both economic and cultural losses that may prove difficult to recover even under improved political conditions.

However, underlying demand fundamentals remain intact. Persian carpets continue to command respect for their quality, authenticity and artistic value in international markets. Industry experts suggest that sanctions relief could enable recovery within six months, indicating that market access rather than product competitiveness represents the primary constraint. This assessment implies that the current crisis reflects policy-induced rather than structural economic factors.

The Iranian carpet industry's decline illustrates how geopolitical tensions can devastate traditional export sectors, particularly those dependent on international market access and cultural authenticity. Recovery will require not only sanctions relief but also comprehensive policy support addressing insurance provision, raw material supply chains, and international marketing capabilities. Without such intervention, one of Iran's most iconic industries risks permanent marginalisation in global markets.

Features

South Korea, the US come together on nuclear deals

South Korean and US companies have signed agreements to advance nuclear energy projects, aiming to meet rising data centre power demands, support AI growth, and strengthen the US nuclear fuel supply chain.

World Bank seems to be having second thoughts about Tajikistan’s Rogun Dam

Ball now in Dushanbe’s court to justify high cost.

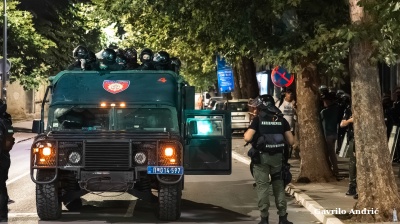

INTERVIEW: From cinema to Serbian police cell in one unlucky “take”

An Italian software engineer caught in Belgrade’s August protests recounts a night of mistaken arrest and police violence in the city’s tense political climate.

_Cropped_1756210594.jpg)

Turkey breaks ground on its section of the TRIPP rail corridor

Turkish project would help make TRIPP the go-to route for Middle Corridor freight.