Environmental, social and governance (ESG) considerations are becoming increasingly prominent across Southeast Asia, a region once thought to lag behind in sustainability priorities.

Across the archipelagos and peninsulas of the wider ASEAN region, ESG is no longer confined to idealistic investor presentations. It is beginning to shape investment flows, boardroom decisions and national policy frameworks everywhere. And at the heart of this shift, Environmentally and Socially Driven (ESD) stocks are drawing considerable attention.

Much of the impetus stems from global financial markets, where ESG is now seen not merely as a reputational risk mitigator, but as a performance driver. Institutional investors, from large-scale sovereign wealth funds to pension boards, are increasingly screening portfolios for ESG metrics, and Southeast Asian firms are adapting quickly to retain access to this global capital. Companies in Malaysia, Singapore, Thailand and the Philippines in particular are making significant efforts to align their operations with ESG principles, albeit not always voluntarily, but increasingly out of necessity.

Singapore, often regarded as a regional financial bellwether in Asia, is in many ways leading the way. The city-state’s bourse has mandated climate reporting for issuers in key sectors, prompting a marked improvement in disclosures.

Companies such as Keppel Corporation and Sembcorp Industries, both with historically carbon-heavy operations, are now positioning themselves as green transition leaders. Their pivot toward renewable energy and circular economy practices has been welcomed by ESG-conscious investors. Because of this, such firms are now increasingly referred to as ESD stocks – those combining genuine environmental responsibility with strong social and governance credentials, rather than simply by ticking boxes.

Elsewhere in the region, Indonesia to the south of Singapore is witnessing an ESG evolution of its own. Historically reliant on coal use – and export – the country has begun to recognise the economic and environmental costs of continued fossil fuel dependence. The launch of its carbon exchange in early 2025, and plans to scale up geothermal and hydroelectric capacity signal a more strategic embrace of sustainability. Market players such as Barito Renewables and Pertamina Geothermal Energy, both now on the radar of ESG-aligned funds, exemplify the growth of ESD-oriented enterprises in the country.

Thailand, too, is making headway. State-backed efforts to develop a bio-circular-green economy are encouraging corporates to adopt more sustainable business models. Energy giants like Gulf Energy and CP Group are investing heavily in renewables, while local banks have started integrating ESG risk into their lending frameworks.

Notably, ESG-labelled bond issuances are rising, suggesting a broader base of support for sustainability across sectors. As in other parts of Southeast Asia, this has supported the emergence of a number of listed companies that are not only compliant with ESG expectations, but actively reshaping their business models around them.

Vietnam, though often more cautious in regulatory terms, is not being left behind. The country’s stock exchanges have begun requiring ESG disclosures from listed firms, and both domestic and foreign investors are pushing for greater transparency. Vietnamese companies with strong governance and proactive environmental commitments such as those involved in renewable energy or sustainable agriculture are fast becoming the region’s next generation of ESD stocks. Their appeal lies in the combination of high growth potential and alignment with global capital’s sustainability benchmarks.

One important development underpinning all of this is the rise in ESG data providers and ratings services tailored to the Southeast Asian context.

Where global metrics often failed to capture local nuance, regional players are now filling the gap, offering more accurate reflections of company-level performance. This is helping investors to identify genuinely sustainable firms, separating them from those engaging in mere ‘greenwashing’. It also reinforces the value of ESD stocks, not only for their ethics but for their demonstrable long-term value.

There remain problems in the sector, however. Regulatory consistency is lacking in some areas and across borders, data availability is patchy, and enforcement mechanisms are weak in several jurisdictions. Moreover, many small and medium-sized enterprises, which form the backbone of Southeast Asian economies, still view ESG as a cost to be avoided rather than an opportunity.

Yet the tide is turning, particularly as consumer awareness rises and regional governments see alignment with ESG standards as a way to access international funding for infrastructure and greener transitions.

Importantly, the growth of ESD stocks reflects a deeper cultural shift. In contrast to earlier years, when ESG commitments were often externally imposed or donor-driven, today's sustainability momentum in the region is increasingly internal. It is being led by local entrepreneurs, regional investors and policymakers who understand that sustainable practices are integral to future competitiveness.

Southeast Asia is now a geographic and business entity entering a new phase – one in which ESG is not only an external requirement, but a source of local and global differentiation. ESG, by way of ESD stocks may well become the backbone of Southeast Asia’s future economic success.

Features

South Korea, the US come together on nuclear deals

South Korean and US companies have signed agreements to advance nuclear energy projects, aiming to meet rising data centre power demands, support AI growth, and strengthen the US nuclear fuel supply chain.

World Bank seems to be having second thoughts about Tajikistan’s Rogun Dam

Ball now in Dushanbe’s court to justify high cost.

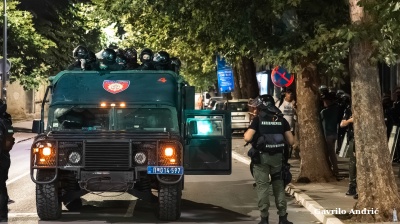

INTERVIEW: From cinema to Serbian police cell in one unlucky “take”

An Italian software engineer caught in Belgrade’s August protests recounts a night of mistaken arrest and police violence in the city’s tense political climate.

_Cropped_1756210594.jpg)

Turkey breaks ground on its section of the TRIPP rail corridor

Turkish project would help make TRIPP the go-to route for Middle Corridor freight.