Turkish President Recep Tayyip Erdogan on April 12 kept up his attack on conspiratorial outside forces he claims are trying to use exchange rates to knock Turkey off its economic path.

With the Turkish lira (TRY) taking a breather from five straight days of devaluation that on April 11 pushed it to an all-time low of 4.1944 to the dollar—by around 18:30 Istanbul time on April 12 it stood at 4.0981—the populist president lashed out at international investors, saying: “Do not worry, Turkey will stay on its path with determined steps, nobody can discipline us based on exchange rates.”

He added in a speech in Ankara: “The rise in exchange rates has no reasonable, logical or by-the-book explanation.” According to Bloomberg, Erdogan also referred to actors on the business and financial markets waging “economic terror”, adding: “Those playing an active role in the economy, those within the financial system, if you are attempting to wage economic terror against our country by using developments [linked to the conflict] in Syria as a pretext, you’ll be making a mistake. When the time comes, you’ll be held accountable and pay the price.”

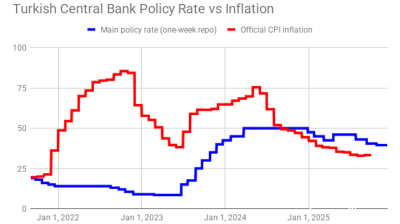

Although Turkey is facing stubborn double-digit inflation, currently at 10.2%, and devaluation that has seen the TRY lose 8% against the dollar so far this year—one of the worst performances of emerging market currencies—Erdogan continues to push for lower interest rates, when the consensus of analysts and economists is that the Turkish economy is overdue for some substantial monetary tightening.

Anxieties have grown that the president’s ‘Erdonomics’ are fatally undermining the independence of the Central Bank of the Republic of Turkey (CBRT) and analysts are having to question whether the Turkish economy could even be on course for a meltdown, especially with reports that debt problems in the corporate sector are likely to keep the lira under pressure over coming weeks.

Hike despite the heat

On April 11, Capital Economics said that despite the political heat it was pencilling in a 100bp hike that it predicts will be introduced in the central bank’s late liquidity lending rate at the April 25 meeting of its monetary policy committee (MPC).

“Admittedly, the government is starting to exert pressure on the central bank not to raise interest rates,” Capital Economics’ senior emerging markets economist William Jackson said in an April 11 note to investors. He added: “The authorities seem to have shifted their focus to maintaining strong rates of growth in the economy. And earlier this week, President Erdogan talked of the need to lower interest rates to boost investment. Nonetheless, this isn’t necessarily a barrier to rate hikes. Indeed, policymakers at the central bank faced similar pressures before they raised interest rates in early 2014 and again in early 2017.”

CBRT governor Murat Cetinkaya on April 12 reassured the markets that the central bank is following developments in inflation and will tighten monetary policy if it is thought necessary. His comments may have helped give the TRY a small shot in the arm.

The lira’s difficulties are partially tied to geopolitical tensions such as the spat between the US and Russia over the alleged chemical attack in Syria and Donald Trump’s threats of missile strikes in response, while the currency is also exposed to Fed rate hikes that seem likely to occur in coming months. But investors say most of Turkey’s problems are home-grown. They are wary of overheating in an economy that is experiencing debt-fuelled ‘warp-speed’ growth.

Economists question how sustainable the pace of growth is given the widening current account deficit at towards 6% of GDP, the double digit inflation, which stands at double the central bank target, and the large external financing gap amounting to $220bn, or 25% of GDP, and double the FX reserves.

News

Bill Gates makes surprise Indian TV debut

In a move set to spark both intrigue and curiosity, Microsoft co-founder and philanthropist Bill Gates has made a cameo appearance on Indian television, entering the iconic drama series Kyunki Saas Bhi Kabhi Bahu Thi 2.

Queen Sirikit of Thailand dies

The death of Queen Sirikit of Thailand has marked the end of an era for the Thai monarchy. According to an official statement from the Bureau of the Royal Household of Thailand, Her Majesty died at 9.21 pm on October 24.

Pakistan, the latest in Asia to see gold prices plummet

In international trading, the precious metal lost $35 per ounce to settle around $4,115, extending a week-long slide triggered by shifting expectations over US monetary policy.

_1761305900.jpg)

Latin America edges up growth forecasts but remains trapped in low gear, ECLAC says

Latin America and the Caribbean will expand 2.4% this year, the Economic Commission for Latin America and the Caribbean said, marking the second upward revision since April but pointing to the region's struggle to escape chronically weak growth.