There was an air of disappointment among investors after the September 20 announcement of Turkey’s new medium term economic programme (MTP).

With the country mired in economic turmoil that has brought about a collapse in the value of the Turkish lira (TRY) and facing a possible descent into a banking crisis, there was an expectation among some market participants that Finance Minister Berat Albayrak would announce a ‘bad bank’ vehicle to address non-performing loans (NPLs). None was forthcoming.

Following Albayrak’s presentation on the three-year MTP, there were also some objections that the government was not bringing in enough austerity to get a grip on Turkey’s debt-fuelled economy that some forecasts show might be set to plunge into a deep recession.

Revising the government’s growth targets, Albayrak said ministers now anticipated that the GDP expansion would be 3.8% this year and 2.3% in 2019, compared to the previous forecasts of 5.5% for both years. Last year saw Turkey outstrip China by posting growth of 7.4%, but the economy has overheated and is coming off the rails.

Markets remain anxious that despite the sickly state of Turkey’s economy, strongman President Recep Tayyip Erdogan will interfere with monetary policy to achieve cheaper money and more credit-driven growth that has been popular with voters during his 15 years at the helm. They would like to see a decisive commitment to austerity and economic rebalancing.

“Forecasts too ambitious”

“At the moment, the programme is a disappointment. First, when you look at the growth forecast, the current account deficit forecast, they are too ambitious,” Guillaume Tresca, a senior EM strategist at Credit Agricole, told Reuters.

“We don’t have anything new, regarding a bad bank, regarding the treatment of [NPLs], regarding the foreign-exchange funding of the banking system or the foreign-exchange funding of the corporates. It is lacking details and it is lacking news.”

After Albayrak’s presentation, the chairman of Turkey’s BDDK banking watchdog confirmed that there would not be a transfer of problem loans to another institution.

Assessing the MTP, Timothy Ash at BlueBay Asset Management said in a note: “I think Albayrak gets a pass in the MTP, as at least the macro targets look credible/consistent. Seems deficit targets will be met by cutting public investment by 36% YOY in 2019. But beyond that not much detail, albeit MTP’s never have that much. But I think the market wanted to see more focus on the problems in the banks, and how the government is going to help the work out process there.”

Prior to the presentation, he said in another note: “Important the MTP sets the right tone—front and centre has to be evidence the government gets the challenges in the banks.”

He added: “After the rate hike last week, it’s now all about banks, NPLs and liquidity. And liquidity—think rollover risks there—is all about accepting the NPL problem and being proactive to do something about it—forebearance was fine as an emergency crisis mode response—but now it is about accepting NPLs, and working with banks to help clean up bank balance sheets.

“Remember foreign banks will only roll FX debts to banks and provide liquidity if they trust bank balance sheets, and guess at the moment with the forbearance story they don’t.”

During the MTP presentation in Istanbul, Albayrak, Erdogan’s son-in-law, stated: “We will see a gradual growth increase from now on. Our main goal is to establish 5% growth from 2021 onwards.” He did not take questions.

“We are aware of the economy’s strong and weak points,” Albayrak added.

Turkey is presently beset by annual inflation at a 15-year high of nearly 18%. Albayrak forecast it hit 20.8% this year and 15.9% next year.

Jitters over exposed corporates, banks

The finance minister later told broadcaster CNN Turk that Turkey’s public banks would face no financing problems this year. But the jitters over how the collapse of the TRY—down around 40% against the dollar in the year to date and showing only a small improvement after the MTP announcement—will hit corporates with forex debts but local-currency earnings and the banks. Fitch Ratings has estimated that the banks’ foreign-currency lending stands at around 43% of all loans.

Turkey’s external debt maturing within one year or less regardless of the original maturity was up by 1% m/m as of end-July, latest central bank data shows. It stood at $181.3bn compared to $179.1bn at the end of June.

In the presentation, Albayrak reiterated an earlier announcement from Erdogan on the suspension of new government investments. He said that investment projects for which the tender process has not been finalised will be suspended as part of Ankara’s fiscal tightening.

Albayrak added that Turkey would prioritise investments in pharmaceuticals, energy, and petrochemicals to reduce its current account deficit, now seen as shrinking to 2.6% of GDP by 2021 from 4.7% in 2018.

He also said Turkey would revise its social insurance schemes and restructure its incentive scheme for exports.

Slides shown during Albayrak’s speech outlined other government forecasts, including:

* 2018 budget deficit/GDP ratio seen at 1.9%, unchanged from

previous forecast

* 2019 budget deficit/GDP ratio seen at 1.8% vs previous forecast

of 1.9%

* 2020 budget deficit/GDP ratio seen at 1.9% vs previous forecast

of 1.6%

* Primary budget surplus/GDP ratio seen at 0.1% in 2018, 0.8% in

2019, 1% in 2020

* Unemployment rate seen at 11.3% end-2018, at 12.1% in 2019

* Exports seen at $170bn in 2018 and gradually rising to $204.4bn in 2021

* Imports seen at $236bn in 2018 and rising to $244bn in 2019.

* Foreign trade deficit seen at $66bn by end-2018 and at $62bn in 2019.

News

Fuel prices in Kyrgyzstan rocket as Ukraine steps up drone strikes on Russian refineries

Central Asian country relies on Russia for nine-tenths of its fuel.

El Salvador leads Latin America's democratic decline, global watchdog warns

The latest IDEA report warns El Salvador faces the fastest democratic erosion in Latin America, with security policies under Bukele raising concerns over freedoms, judicial independence, and long-term institutional damage.

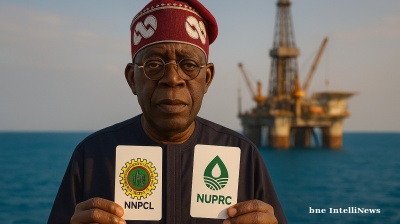

Nigerian president advances oil bill placing NNPCL under control of Finance Ministry, upstream regulator

President Bola Tinubu has endorsed a bill that would undermine the "independence" of NNPCL, shifting ownership to the Finance Ministry and handing new powers to upstream regulator NUPRC.

‘Tinder Swindler’ Simon Leviev detained in Georgia on Interpol red notice

Shimon Yehuda Hayut gained worldwide notoriety thanks to the 2022 Netflix documentary 'The Tinder Swindler', which detailed how he allegedly posed as the son of billionaire diamond tycoon to scam women he met on Tinder.

_1758026150.jpg)