MARINS: Europe’s “fake it till you make it” war approach cannot hold off Russia’s trillion dollar war machine

In their speeches on the war in Ukraine, European leaders appear like a video clip looped on repeat. Standing before the cameras they declare new packages of support for Kyiv and threaten new measures to pressure Russia as if it were still 2022. Yet much has changed in 2025.

European leaders now spend most of their energies lobbying for the continued support of President Donald Trump. Despite these efforts, America is passing the burden of sustaining the war in Ukraine onto Europe. It is unclear if Europe’s leaders grasp what is required to contain Russia’s well-armed and supplied war machine. There are only limited and infrequent references to Russian military production gains over the last three years. Yet, the serious discrepancy in military spending cannot be ignored; it is likely to force Europe to finally alter its approach to the war in Ukraine.

Despite this, there is much optimistic talk about Europe’s capacity to sustain Ukraine against Russia. It is often stated that the combined GDP of European economies is ten times higher than Russia. Surely European technical, industrial, economic and human resources can – given time – develop a far more formidable military machine than Russia. Others argue the existing conventional forces of Europe can be quickly concentrated into a mobile fighting force capable of deterring Russia. It is hoped that, as Russia has sustained serious losses, Europe has a comfortable window within which to rearm. Fundamentally misunderstanding Moscow’s war of attrition approach, others take heart in Russia’s inability to wage rapid and largescale offensive manoeuvre warfare. Some continue to talk up Ukraine’s chances of not only resisting for years to come but also – with European help – finding new ways to hurt Russia on its own territory.

Focusing on such talking points reinforces longstanding European complacency, ignores the altered balance of military power and implies serious diplomacy with Moscow can be postponed. While commentators talk up Europe’s chances of cobbling together a deterrence force at some future juncture, Russia has, through various means, spent a trillion dollars to resurrect its own military machine. Between 2022 and 2025 Russia’s defence budgets have spent over $500bn dollars, more than double what the West has allocated to Ukraine. So far in 2025 Russia is easily outspending the West with a record $94bn on military needs. Most of this has gone on replacing lost equipment ($20-30bn) and producing various forms of ammunition ($15-20bn). Special family and injury payments reached around $7.8-9bn.

It is in this context we must consider the announcements of Norway’s $8.5bn or Sweden’s $3.38bn of military aid to Ukraine. The piecemeal donations of various European states must be processed through Nato and US procurement mechanisms that are less efficient than that of Russia’s single, if flawed, centralised system. The funds sent by European tax-payers buy Western-produced equipment that costs three times higher than equivalents in Russia. Europe may have to find $2 trillion dollars over 7-10 years just to match Russian military spending.

Russia’s outlay since 2022 also includes around $250bn to rebuild military production facilities and infrastructure. In contrast to the West, Russia has moved quickly to activate its heavy industrial capacities in a systematic and wide-ranging manner. Russia’s chemical industries – central to the production of munitions – received $30-40bn of investment. UralChem, Kazanorgsintez, EuroChem, UGMK, Lukoil, and Evraz are now able to supply 75% of the chemicals needed for domestic munition production of 3mn artillery shells annually. In contrast, it transpired Europe could only deliver 400,000-600,000 of the 1.5mn shells they promised to produce for Ukraine in 2024. Europe is suffering major destabilisations in its supply chains from Asia to Africa. There are shortages in nitrocellulose due to China’s 2024 export bans, TNT and antimony is in short supply, delaying mining and the production of munitions, primers and tanks.

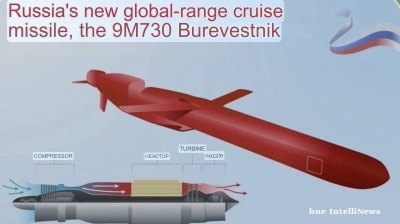

Russia has also ramped up drone and missile production – two key weapons in the war. The Alabuga Special Economic Zone is considered to be the world’s largest drone factory and aims to produce 60,000 long range drones a month by the end of 2025. Russia’s growing drone production capacity, in which $7.5bn has been invested, is predicted to employ 333,000 people in 900 companies by 2026. Meanwhile, over 2023 and 2024 Russia invested in five complexes for solid-fuel, engines and other missile components. Ukrainian intelligence has estimated as of 2025 Russia’s annual production of strategic and tactical missiles is around 3000. Europe’s drone and missile production capacities remain in their infancy. France and the UK are only now restarting production of SCALP/Storm Shadow cruise missiles after a 15-year hiatus. European access to semiconductors and neon, vital for missiles and drones, has been unstable since 2022. China controls 70% of the rare earth minerals needed to produce radars and sonars, guidance systems and crucial electronic components.

When it comes to drones, Ukrainian production led to a degree of battlefield dominance in the first years of the war. Even today its drone strikes on Russian oil facilities inflict some discomfort on Moscow. However, after a second wave of Chinese restrictions in 2024, the Ukrainian drone industry had to switch to domestic suppliers of motors, machine views and other components. This slowed the production and accuracy of much-needed fibre-optic drones. Ukraine is now hoping new partnerships with western companies will supply what is needed to compensate for the gap. Russia will aim to seek and destroy any new production centres that come online.

Finally, there is the question of attracting and sustaining investment for future military production up to and beyond 2030. Russia’s technocrats in the ministries and the Central Bank of Russia have created special exemptions for companies engaged in war production, leading to a further $250bn investment in the war economy. Six of Russia’s largest companies – Gazprom, Rosatom, Rosneft, Surgutneftegas, Novatek and Lukoil – invested a combined $300bn on military research and weapons production. Meanwhile, Russia’s energy giants are awash with revenue ($235bn in 2024) and readily invest in sustaining future production. Gazprom Neft and Surgutneftegas are preparing large investments to tap the Arctic’s 90bn barrel reserves for military fuel, while the recently agreed “Power of Siberia 2” with China is now the world’s largest gas deal. While Russia can be confident of funding its trillion-dollar war machine, Europe faces soaring energy costs and electorates less than enthusiastic about cutting social spending to pay for weapons. Europe will have its hands full trying to match Russia’s estimated annual production of 60,000 long range drones,1,500 tanks; 3,000 Armoured Fighting Vehicles and 3,000 long range missiles.

While Ursula Von der Leyen calls for Europe to turn Ukraine into a “steel porcupine”, Russia has already built its own iron monster stationed firmly within Ukraine and poised to advance further. Recent devastating air strikes on Kyiv send a clear message: Russia has the firepower to smash any military production facility or concentration of forces across Ukraine, including any Nato or EU delegations or Western “volunteers”. At the start of the month, 26 countries of the “Coalition of the Willing” declared a readiness to deploy forces as a “security guarantee” to post-war Ukraine. Yet, given Europe’s deficient air defences and Russia’s superior weapons stocks, it is clear any deployment would be extremely vulnerable. The mismatch in military spending and production acts as a constraint on what Europe’s Coalition of the Willing can do in practice.

Many continue to hope Russia’s military spending and losses will somehow exhaust its political system or economy. Others will claim Russian spending statistics cannot be relied upon or raise questions about Moscow’s dependency on China. Yet, this year, Russian gold reserves are projected to reach 2,800 tonnes, 500 more than in 2022. With Russia’s Sovereign Wealth Fund still holding approximately $170bn and compound economic growth forecast between 3.5-5.5% over the next three years, Russia is unlikely to face any significant difficulties in sustaining its war efforts during this period. Meanwhile, Europe is struggling to raise the funds not only to pay for weapons but also to cover even half the cost of running the Ukrainian state, which is estimated at around $40-50bn annually. As many European states teeter on the brink of a serious debt crisis, discussions continue on how to use frozen Russian assets as the means to pay for support to Ukraine. That such actions are being considered only underlines the serious problems facing the Europeans.

Overall, there are strong grounds to conclude Russia’s trillion-dollar war machine can be sustained while it remains to be seen how Europe will find the resources to sustain Ukraine. Russia’s military machine applies increasingly unbearable pressure on Kyiv across a long front and acts as a hard power veto on Western goals in Ukraine. To prologue the war and forestall Putin’s victory, European taxpayers will have to cough up exorbitant sums. The call for Europe to sustain Ukraine through buying US weapons shipments while simultaneously initiating a costly long-term rearmament programme does not appear realistic in political or economic terms. European leaders most likely realise following Trump’s call for third-party sanctions on China and India and a complete halt of Russian energy imports to the EU, that it would only result in even more economic self-harm and dependency on the USA.

It is possible that, behind closed doors, European leaders note the unfavourable situation and acknowledge the war cannot be won. Their maintenance of a united front is to deter Russian belligerence while they try to broker a peace in which Ukraine may cede territory but somehow retain its sovereignty. Whatever is said in public, the starting point of future European engagement with Russia must accept an essential fact: Moscow responded quicker to scale up production, forked out the cash and has increased its military capacities. With America disengaging, Europe is in no position to force Russia’s hand. If anything, Russia has leverage to increase the pressure on Ukraine and increase its demands. The endless optimism of those talking up Europe’s military capacities tomorrow must not obscure the fundamental truths of today. It is time for European leaders to integrate this reality into their approach to ending this war. If the Europeans continue blowing hot air while Russia grinds toward military victory, the resultant damage to its credibility and security will be all the worse.

Matthew Blackburn @MJMBlackburn81 is a Senior Researcher at the Norwegian Institute of International Affairs who studies the politics of contemporary Russia and Eurasia, including both domestic politics and interstate relations.

Patricia Marins @pati_marins64 is an independent analyst focusing on defence and security in Europe and Eurasia.

Opinion

A year after the Novi Sad disaster, Belgrade faces one crisis after another

Serbia’s government is grappling with a convergence of crises which threaten to erode President Aleksandar Vucic’s once-dominant position.

Don’t be fooled, Northern Cyprus’ new president is no opponent of Erdogan, says academic

Turkey’s powers-that-be said to have anticipated that Tufan Erhurman will pose no major threat.

COMMENT: Hungary’s investment slump shows signs of bottoming, but EU tensions still cast a long shadow

Hungary’s economy has fallen behind its Central European peers in recent years, and the root of this underperformance lies in a sharp and protracted collapse in investment. But a possible change of government next year could change things.

IMF: Global economic outlook shows modest change amid policy shifts and complex forces

Dialing down uncertainty, reducing vulnerabilities, and investing in innovation can help deliver durable economic gains.