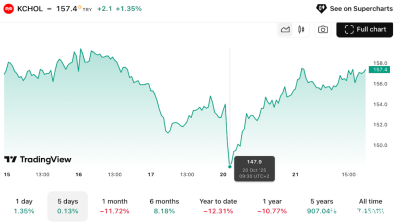

The monetary policy committee (MPC) of Turkey’s central bank on October 23 cut its main policy rate (one-week repo) by 100 bp to 39.5%. The move indicated that a cautious stance prevails. The median expectation was for a 150-bp cut, while the finance industry was clear that it wanted to see no easing at all in the face of sticky inflation.

The authority also cut its overnight lending rate by 100bp to 42.5%, without fixing the symmetry of its so-called interest rate corridor as the overnight borrowing rate was also cut by 100bp to 38%.

The central bank occasionally scraps or limits one-week repo auctions to push local lenders to the overnight window for the sake of additional tightening within the interest rate corridor.

Risks more pronounced

The underlying trend of inflation increased in September, the MPC said in its accompanying statement, adding that recent data suggested that demand conditions are at disinflationary levels but also pointed to a slowdown in the disinflation process.

The risks posed by recent price developments, particularly in food, to the disinflation process through inflation expectations and pricing behaviour have become more pronounced, it also noted.

Deceleration in easing

On July 24, the MPC revived its monetary easing cycle by delivering a 300-bp rate cut. On September 11, it delivered a 250-bp cut.

December 11 expected to bring final cut of year

On December 11, the authority will hold its last rate-setting meeting of the year. Another rate cut is almost certainly in prospect. The size of the expected cut, though, is not.

The "step" size is reviewed prudently on a meeting-by-meeting basis with a focus on the inflation outlook, the MPC reiterated in its October 23 statement.

As things stand, any decision within the wide range between no cut and up to 500 bp would be no surprise. Developments in the upcoming one and half month period will be determinative.

Official annual inflation of 33% in September

On October 3, the Turkish Statistical Institute (TUIK, or TurkStat) said that Turkey’s consumer price index (CPI) inflation officially crept up to 33.29% y/y in September from 32.95% y/y in August.

It is not advisable to plan, price or draw inferences based on TUIK data. There is widespread concern about the reliability of Turkey’s official data series.

Goal is below 30%-level at end-2025

On August 14, Turkey’s central bank raised its end-2025 official inflation "forecast" range to 25-29% in its latest quarterly inflation report.

TUIK looks set to release end-2025 official inflation at around 30%. The goal is to provide a figure that stands below the 30%-level. Getting there will depend on developments in the last quarter of the year.

On November 7, the central bank will release its next and last quarterly inflation report for this year, which will include updated forecasts.

October 24 brings CHP hearing

On October 24, the next hearing in the trial concerning the main opposition Republican People’s Party (CHP) national party congress held in November 2023, which is being conducted by the Ankara 42nd (Asliye Hukuk) civil court of first instance, is to be held.

A surprise decision in which trustees are appointed to manage the party is on the cards.

The USD/TRY pair remains under control and Turkey's eurobond auctions continue undeterred despite the political stress.

Data

Polish retail sales return to solid growth in September

Polish retail sales grew 6.4% year on year in constant prices in September, picking up from a 3.1% y/y rise in August, the statistics office GUS said.

Uzbekistan’s nine-month foreign trade nears $60bn

Export growth of 33% and import expansion of 16% y/y produce $6.4bn deficit.

Hungary’s central bank leaves rates unchanged

National Bank of Hungary expects inflation to fall back into the tolerance band by early 2026, with the 3% target sustainably achievable in early 2027 under the current strict policy settings.

Germany slowdown weighs on Lithuania’s export-driven manufacturing sector

Lithuania’s economy remains highly sensitive to the industrial cycle in Germany, its third largest trade partner.