The Czech National Bank's (CNB) board at its last meeting under Governor Jiri Rusnok raised key interest rates by 1.25 percentage points (pp), bringing the base interest rate to the highest level since 1999 at 7 percent. At the same time, the CNB increased the discount rate to 6% and the Lombard rate to 8%.

The last meeting of the old bank board before a new governor takes over next month may have provided an additional incentive for outgoing Governor Jiri Rusnok and the other hawkish board members to opt for a large 1.25pp hike to curb inflation, which reached 16% in May, far above the CNB’s forecast of 14.9% year-on-year.

The CNB was, along with Hungary's central bank, the first in the EU to start raising interest rates last year. At the beginning of May it increased rates again by 0.75pp to 5.75%.

Today's hike is expected to be the last significant rate hike this year, according to analysts. The new CNB board will start its work on July 1 under new governor Ales Michl, who is known to be an opponent of the current rate hikes.

"The bank board assessed the risks and uncertainties of the spring forecast as being markedly inflationary and acting towards a need for further significant tightening of monetary policy. In particular, higher price growth at home and abroad is having an inflationary effect," the bank statement read.

Five of the seven central bankers again voted in favour of today's decision. Two, including the new governor, voted to leave rates unchanged. The Czech koruna did not react significantly immediately after the board's decision and stabilised against the euro at around CZK24.68 per euro.

"This large hike has been well telegraphed, but what happens next will be intriguing. A new and perceived dovish CNB board takes over on 1 July and holds its first policy meeting on 4 August. It seems far too early for this new board to soften monetary conditions in the face of inflation, which is peaking higher and later than the CNB had originally expected," said Frantisek Taborsky, FX & FI Strategist at ING Bank.

"However, the focus will be on whether the new board wants to let the Czech koruna do the talking and whether – through FX intervention – the CNB wants to guide EUR/CZK lower to the 24.50 area, somewhat closer to where CNB models had been forecasting EUR/CZK to be trading (closer to 24.00 actually)," Taborsky noted.

The Union of Industry and Transport of the Czech Republic criticised the CNB's decision to increase the interest rate. "Further interest rate hikes by the CNB mean additional financing costs for companies and certainly do not help them," said Bohuslav Cizek, chief economist of the Union of Industry and Transport of the Czech Republic.

According to Cizek, interest rates on new loans to non-financial companies already reached 7 percent in April, the highest in the CNB's statistics since 2004, and will rise further as a result of the current decision of the bank board.

"Given the shift in the board towards a more dovish formation, we expect the June increase to be the last one in the current cycle. We believe that this will be followed by rate stability until the end of the year," said David Vagenknecht, Raiffeisenbank analyst.

"Although inflation will, in my view, point to a further need to tighten monetary policy, I expect the new board members to try to 'sit out' inflation and not raise rates for at least a few months," said Vit Hradil, Chief Economist at Cyrrus.

"Later in the summer, we suspect interest in CNB rate cuts next year will return. We think a cut could come as early as the first quarter," Taborsky added.

On the contrary, Joseph Marlow of Capital Economics believes the CNB will opt for at least one more hike in the cycle. "We then expect the policy rate to be left unchanged until mid-2023, which is a more hawkish view than is currently priced into financial markets," he said.

"While the CNB may have been in a hawkish mood today, the tightening cycle in Czechia is nearing its end. We think that inflation may be nearing its peak, and the appointment of three new board members also means that the board will probably have a more dovish makeup from July," Marlow said.

"As a result, we think it’s most likely that the CNB will end its tightening cycle with a 50bp hike at its August meeting, taking the policy rate to 7.50%. That said, as we expect inflation to remain above 10% until early next year, we think that the policy rate will remain at a high level for longer than most currently expect," Marlow added.

News

US strikes on drug vessels kill 14 in deadliest day of Trump's narcotics campaign

The US military killed 14 people in strikes on four vessels allegedly transporting narcotics in the eastern Pacific Ocean, marking the deadliest single day since President Donald Trump began his controversial campaign against drug trafficking.

Russia withdraws from Cold War plutonium disposal pact with US

Russian President Vladimir Putin has formally withdrawn from a key arms control agreement with the United States governing the disposal of weapons-grade plutonium, as the few remaining nuclear security accords between the two powers vanish.

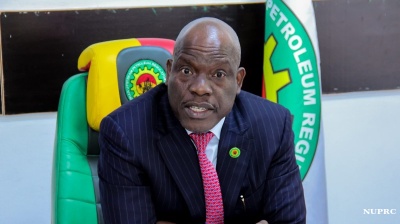

Nigeria’s NUPRC holds exploratory talks with Bank of America on upstream financing

Nigeria's upstream regulator, NUPRC, has held exploratory talks with Bank of America as the country looks to attract new capital and revive crude output, after falling short of its OPEC+ quota.

European diplomacy should have stopped war, Orban tells Italian broadcaster

The job of European diplomacy would have been stopping the war in Ukraine, but Brussels has become "irrelevant" by deciding not to negotiate, Prime Minister Viktor Orban told an Italian TV channel on October 28.