The decision to delay a swathe of steep new tariffs on a wide range of global imports until August 1 by Donald Trump has prompted a cautious response from East and Southeast Asia, where governments and exporters are seeking clarity amid a shifting trade environment shaped by the ever unpredictable president’s latest protectionist policies.

While the pause in implementation has offered short-term breathing room, many in the region remain wary of Washington’s intentions, particularly as some countries now face prospective duties as high as 40%. The delay has not dispelled anxieties around the broader direction of US trade policy, which continues to unsettle longstanding economic relationships.

According the The Guardian, among the nations most directly affected in the region are Indonesia (32%), Thailand (36%), Cambodia (36%), Laos (40%), and Myanmar (40%). Japan, South Korea and Malaysia - three of the region’s most developed export economies - also face proposed blanket tariffs of 25%.

As a result, across the region, governments are attempting to interpret the significance of Trump’s latest manoeuvre: is the delay a gesture of goodwill to spur last-minute negotiations, or simply a tactical extension as part of a hard-line strategy aimed at forcing supply chains back to US soil?

Cynics are even claiming the US president doesn’t want to push his controversial tariffs into the spotlight as the US reels from devastating flash floods in Texas that claimed over 100 lives in recent days.

Uncertainty intensifies

In the immediate aftermath of the announcement, regional markets showed mixed reactions. Currencies weakened modestly across several ASEAN nations, while exporters, particularly in the electronics, textiles and automotive sectors, began revisiting contingency plans laid out since Trump first floated reciprocal tariff measures earlier this year.

For countries such as Vietnam, which had earlier reached a deal with Washington, the delay reaffirms the value of early bilateral engagement. By contrast, for Indonesia and Thailand, both of which have seen strong growth in US-bound exports in recent years, the proposed tariff levels have raised alarms within trade and industry ministries.

In Bangkok, concerns are mounting over the effect of a potential 36% tariff on Thai automotive components, which form a significant share of its exports to the US. Similarly, Jakarta is closely watching developments as it considers its own strategic options, including deeper trade engagement with non-Western blocs and the acceleration of domestic industrial policy to shield critical sectors from global headwinds.

Japan, South Korea treading carefully

Japan and South Korea, both long-time US allies meanwhile have responded with caution. While neither country welcomed the 25% tariff threat, their broader interests in maintaining strong defence and diplomatic ties with Washington make public confrontation unlikely.

Tokyo, in particular, faces a delicate balancing act. It has not yet secured an exemption deal, and US pressure over auto exports remains a persistent sticking point. South Korean officials have indicated they are hopeful of reaching a compromise before the August 1 deadline but are aware of the political calculus Trump may be employing as he seeks to appeal to domestic manufacturing interests ahead of the US election cycle.

Both governments are now considering whether fresh rounds of bilateral talks can produce concessions palatable to the White House without appearing to capitulate to unilateral economic coercion.

Calculated gamble or more Trump recklessness?

The delay, framed as part of a “reciprocal tariff” strategy, is likely a calculated gamble designed to maximise leverage in a compressed time frame. Yet, by tying tariff relief to the requirement that countries shift manufacturing to the United States, Trump risks alienating key partners at a time when many in Asia are already expanding intra-regional cooperation through frameworks such as the Association od South East Asian Nations (ASEAN) and the Regional Comprehensive Economic Partnership (RCEP).

To this end, Trump’s additional threat of a 10% tariff on countries working closely with BRICS nations - a group that initially included China and India with others in Asia now also on the periphery such as Vietnam and Indonesia - has further muddied the waters, particularly for Southeast Asian nations that are increasingly engaging with emerging multilateral structures beyond Western influence.

Realignments underway

Because of this, for ASEAN countries, the announcement may accelerate strategic realignments that were already in motion. The push for “de-risking” from the US market but not full decoupling, has been on the agenda for several years, particularly following trade tensions during Trump’s first administration.

Now, countries like Malaysia, Indonesia and Thailand are expected to deepen efforts to develop alternative export markets, boost intra-Asian trade, and attract supply chain investment diverted from more vulnerable economies.

With just weeks until the revised deadline, trade officials across Asia are entering a critical phase. While some governments may pursue fast-track deals to stave off immediate disruption, others may conclude that Trump’s tariff threats reflect a broader shift in US economic posture; one that requires longer-term structural adaptation rather than short-term accommodation.

Features

South Korea, the US come together on nuclear deals

South Korean and US companies have signed agreements to advance nuclear energy projects, aiming to meet rising data centre power demands, support AI growth, and strengthen the US nuclear fuel supply chain.

World Bank seems to be having second thoughts about Tajikistan’s Rogun Dam

Ball now in Dushanbe’s court to justify high cost.

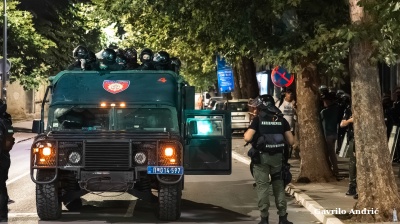

INTERVIEW: From cinema to Serbian police cell in one unlucky “take”

An Italian software engineer caught in Belgrade’s August protests recounts a night of mistaken arrest and police violence in the city’s tense political climate.

_Cropped_1756210594.jpg)

Turkey breaks ground on its section of the TRIPP rail corridor

Turkish project would help make TRIPP the go-to route for Middle Corridor freight.

.jpg)