Mergers and acquisitions (M&A) in CEE (excluding Russia and Turkey) in the first quarter hit €8.5bn, up by 50% year on year, according to data from Mergermarket released on April 15. The number of deals in Q1 was 115, just above the 109 in 1Q20.

The M&A value is the highest Q1 figure since 2013, the data and intelligence company said, and was boosted by several large transactions by foreign investors. Foreign investments represented 86% of deal-making by value, accounting for €7.3bn across 60 deals. The region’s top deals were both in Poland, with Allianz's €2.5bn acquisition of Aviva Poland, followed by Cellnex Telecom’s €1.6bn purchase of Polkomtel Infrastruktura.

Fund transactions soared to €1.5bn across 18 deals, compared to €65mn and eight deals a year ago. The biggest fund transaction was Partners Group’s €800m buyout of Fortum Oyj, a Baltics-based district heating business. There were only 17 fund exits, worth €148 mn, compared with eight exits worth a much higher €1.9bn in 1Q20.

Mergermarket's annual 2020 survey with Wolf Theiss had also shown surprisingly strong deal flow despite the coronavirus (COVID-19) pandemic, with trends towards bigger deals and a higher proportion of private equity deals.

Mergermarket said intra-CEE M&A remained stable, with 62 transactions worth €1.2bn, compared with 58 deals worth €1.2bn in 1Q20.

It said financial services was the busiest sector by value, with 11 deals totalling €3bn representing 36% of the overall total. Technology was the most active sector by deal count, with 26 deals totalling €551mn.

News

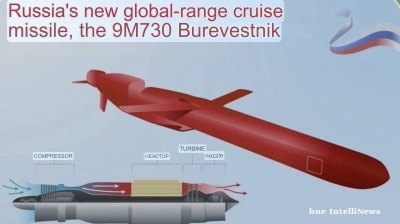

Russia test fires its Burevestnik nuclear-powered cruise missile

Russia’s Burevestnik nuclear-powered cruise missile has no analogues in the world, Russian President Vladimir Putin said, as the Kremlin escalates the unfolding missile arms race with Ukraine another notch.

Russia claims to surround Pokrovsk

Russia’s chief of the general staff Valery Gerasimov triumphantly reported to Putin that 31 Ukrainian battalions have been encircled in Pokrovsk and 18 battalions in Kupyansk, the hottest spot in the war.

.jpg)

Brazil and US to start urgent tariff negotiations after Trump-Lula meeting

Brazilian President Luiz Inácio Lula da Silva and US President Donald Trump have agreed to start immediate negotiations on tariffs and sanctions imposed by Washington, following a meeting in Malaysia that sought to ease trade tensions.

Cambodia and Thailand agree peace deal

Thailand and Cambodia have agreed a peace deal to mark the end of a conflict earlier in the year as Cambodian Prime Minister Hun Manet and Thai Prime Minister Anutin Charnvirakul attended a signing ceremony overseen by US President Donald Trump.