Hungarian policymakers have conceded that the economy stagnated in Q2 and that full-year growth, even in the base case scenario, could only reach 1%, in line with market consensus.

In an analysis published on the financial portal Portfolio.hu, experts of the National Economy Ministry (NGM) revised their quarterly forecasts ahead of the July 30 release of preliminary Q2 GDP data.

Experts now expect flat growth in the April-June period, revising down their earlier March forecast of 1.5% year-on-year expansion. The downgrade is attributed to weak agricultural performance caused by drought conditions and a broader industrial slowdown. Although services, retail sales and construction remained relatively resilient, officials noted that this was insufficient to offset the overall economic weakness.

The growth target for Q3 and Q4 was revised to 1-2%, from 3.5-4% respectively, an open acknowledgement that the government's targets have become untenable. During the presentation of the main figures of the 2026 budget draft in March, the government had anticipated that the economy would bounce back to annualised growth rates of 3.5-4% by the second half. The official growth target was revised then from 3.4% to 2.5%.

That estimate, crucially, was published before the onset of a trade conflict triggered by the US administration's tariff moves, a development that Hungarian officials had not accounted for in earlier models, further questioning the viability of the prognosis, analysts noted.

An analyst of Portfolio.hu notes that the updated forecast implies that full-year growth may end up closer to 1%, or even lower at 0.5%, if downside risks, the impact of trade war or weak agricultural output materialise.

While the ministry has so far avoided publishing a new forecast, the latest analysis is an open admission that the government's spring projections were overly optimistic, not to mention the bold outlook at the start of the year.

Prime Minister Viktor Orban, bolstered by the election victory of Donald Trump and the possibility of a ceasefire in the Ukraine war and an impending economic deal with the new administration, went as far as to predict a 3-6% GDP growth, which even analysts aligned with Fidesz had labelled as overly ambitious.

Just four months into the year, the government was forced to revise its main 2025 macro projections, and the prime minister had since neglected economic issues. Instead, he launched an aggressive anti-Ukrainian campaign with a "referendum drive" on the country's EU accession to divert attention from the cost-of-living crisis.

As Portfolio.hu notes, the subdued growth outlook for 2025 raises questions about the sustainability of the government's fiscal targets.

The analysis, co-authored by four officials from the ministry, including the deputy state secretary for budget affairs and former senior analyst of MBH Bank Gergely Suppan struck a notably optimistic tone regarding the fiscal outlook. The authors argued that although this year's GDP growth is expected to be more subdued than earlier forecasts, it does not threaten the budget targets. They pointed to the recovery in domestic demand as a key source of revenue stability, with VAT receipts outperforming expectations, while increased reserves offer a substantial fiscal buffer.

The government has pinned its hope on a consumption-led economic recovery in 2025 as the external environment remains unfavourable and there is still no turnaround in investments, falling by double digits. Retail sales expanded by 4.4% y/y in the April-May period, up from 1.2% in Q1, and according to the latest data from online cash registers, retail expansion continued in June as well, according to the forecast by NGM.

Portfolio.hu assumes that the government's revised 4.1% deficit target may be difficult to reach in the case of weaker growth. They concur that the budget shortfall could rise to 4.8% in case of a 1% growth, and a 0.5% rise in GDP would push the deficit closer to the 5% level in 2025.

At a press briefing last week, head of the Prime Minister's Office Gergely Gulyas said that the government would revise the growth estimate after the release of the first half fiscal data, published on Tuesday, July 22.

Hungary's economy has struggled to regain momentum since mid-2022, alternating between marginal gains and contractions. Seven of the past 11 quarters have recorded negative growth, including four of the last six. The country exited a technical recession late last year, only to slip back into decline.

The government has consequently failed to meet deficit targets since 2020, when it reached 7.5%, which only moderated slightly to 6.8% of GDP due to the pre-election spending splurge. Austerity measures and windfall taxes introduced in mid-2022 helped reduce the deficit to just under 5% that year. The 2023 budget was approved with a target of 3.5%, but the final figure came in at 5.9%. For 2024, the government initially aimed for a 2.9% deficit, which swelled to 4.9% of GDP.

News

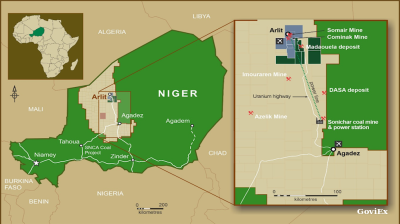

GoviEx, Niger extend arbitration pause on Madaouela uranium project valued at $376mn

Madaouela is among the world’s largest uranium resources, with measured and indicated resources of 100mn pounds of U₃O₈ and a post-tax net present value of $376mn at a uranium price of $80 per pound.

Brazil’s Supreme Court jails Bolsonaro for 27 years over coup plot

Brazil’s Supreme Court has sentenced former president Jair Bolsonaro to 27 years and three months in prison after convicting him of attempting to overturn the result of the country’s 2022 election.

Iran cleric says disputed islands belong to Tehran, not UAE

Iran's Friday prayer leader reaffirms claim to disputed UAE islands whilst warning against Hezbollah disarmament as threat to Islamic world security.

Kremlin puts Russia-Ukraine ceasefire talks on hold

\Negotiation channels between Russia and Ukraine remain formally open but the Kremlin has put talks on hold, as prospects for renewed diplomatic engagement appear remote. Presidential spokesman Dmitry Peskov said on September 12, Vedomosti reports.