Polish food and beverage group Maspex secured commitments for 21.1% of shares in Moldovan winery Purcari on the first day of its buy-out offer, Profit.ro reported on July 17. The offer targets a 98.4% stake in the Bucharest-listed winery, one of the region’s leading wine producers.

Maspex seeks to get a controlling stake through the takeover bid. The acquisition, if successful, would broaden Maspex’s product portfolio beyond its core soft drinks and food businesses. Purcari operates vineyards and production facilities in Moldova and Romania, exporting to more than 40 markets worldwide.

Shareholders offered to sell 8.53mn out of a total of 40.4mn shares at the price of RON21 per share set by Maspex, valuing the committed stake at RON179mn (€35mn). The subscription period for the offer, brokered by BRD – Groupe Société Générale, is open until July 30.

At the offered price, Purcari’s full market capitalisation stands at RON849mn (€167mn), slightly above its current market value. However, the offer represents a nearly 50% premium over the company’s share price earlier this year, before Maspex disclosed its acquisition plan.

Maspex, which operates in Romania through brands such as Tymbark, Tedi, Bucovina and La Festa, is seeking to expand into the alcoholic beverages market with the Purcari acquisition. The Polish group said it aims to build a significant stake in the winemaker, while confirming that it does not plan to delist the company from the Bucharest Stock Exchange.

When Maspex announced the takeover bid on May 21, it also disclosed that it had reached an agreement to purchase a 13.04% stake from Purcari's founder Victor Bostan and an unnamed institutional investor. Bostan will sell a 5% stake held indirectly through Amboselt Universal, while the remaining 15% (also held indirectly through Amboselt Universal) will be subject to a lock-up agreement and a put/call option exercisable in the first half of 2028. The future exercise price will match the takeover bid price plus 12% annual interest.

News

_1758059076.jpg)

Trump brands Colombia a narcotics pariah as cocaine production hits record highs

Colombia has been branded a narcotics pariah by the Trump administration, receiving its first "failing to cooperate" designation since 1997 as record cocaine production and deteriorating US-Colombia relations reach a breaking point.

Fuel prices in Kyrgyzstan rocket as Ukraine steps up drone strikes on Russian refineries

Central Asian country relies on Russia for nine-tenths of its fuel.

El Salvador leads Latin America's democratic decline, global watchdog warns

The latest IDEA report warns El Salvador faces the fastest democratic erosion in Latin America, with security policies under Bukele raising concerns over freedoms, judicial independence, and long-term institutional damage.

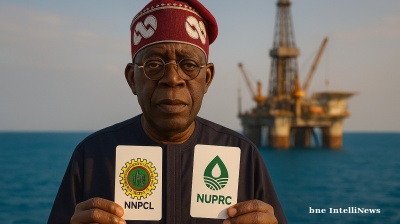

Nigerian president advances oil bill placing NNPCL under control of Finance Ministry, upstream regulator

President Bola Tinubu has endorsed a bill that would undermine the "independence" of NNPCL, shifting ownership to the Finance Ministry and handing new powers to upstream regulator NUPRC.