The aggregated net profit of Georgia's banks more than doubled in June compared to the same month last year, to Georgian lari (GEL) 295mn ($92mn) - it amounted to the biggest profit ever recorded by the banks in the country’s history.

In the second quarter of the year, the profit was GEL648mn (over $200mn), 140% up y/y, and in the ytd period of January-June the aggregated profits exceeded GEL1bn (over $300mn) - compared to GEL477bn losses in the first half of last year when the Georgian banks set aside GEL1.2bn in provisions for potential asset losses as a result of the crisis that was emerging.

The gross profit plus provisioning cost - a metric that indicates the operational profit of banks not impacted by the cost of provisioning - increased by 27% y/y to GEL450mn ($140mn) in Q1 this year and by 115% to GEL590mn ($180mn) in Q2.

The banks' profits are also in line with the forecast of the National Bank of Georgia (NBG), as Papuna Lezhava, NBG vice president said in June that the Georgian banking system was expected to make a “pretty solid profit" this year.

The banking system remains adequately capitalised and liquid, the International Monetary Fund (IMF) said in its Concluding Remarks after Article IV Consultations with the country.

Stress tests conducted in the recent Financial Sector Assessment Program (FSAP) mission confirmed that banks have sufficient capital to absorb credit losses stemming from the pandemic under a conservative baseline scenario over the next three years. Under the stress scenario of an extended pandemic and an adverse external financial environment, capital shortfalls are not deemed substantial and are assessed to be manageable from a systemic perspective.

Nevertheless, the IMF recommends that financial sector policies should now aim to maintain adequate buffers and provisions in the banking sector, amidst signs of recovery.

The NBG should ask banks to preserve sufficient retained earnings until significant downside risks to the economy recede and identifying effective ways to resolve non-performing loans (NPLs) remains important - even though they appear to be falling from a peak of 8.5% in March 2021 and have been significantly provisioned.

News

El Salvador leads Latin America's democratic decline, global watchdog warns

The latest IDEA report warns El Salvador faces the fastest democratic erosion in Latin America, with security policies under Bukele raising concerns over freedoms, judicial independence, and long-term institutional damage.

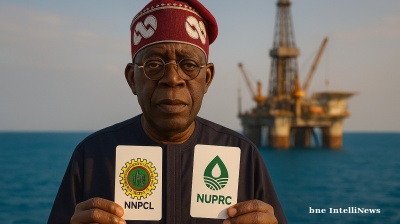

Nigerian president advances oil bill placing NNPCL under control of Finance Ministry, upstream regulator

President Bola Tinubu has endorsed a bill that would undermine the "independence" of NNPCL, shifting ownership to the Finance Ministry and handing new powers to upstream regulator NUPRC.

‘Tinder Swindler’ Simon Leviev detained in Georgia on Interpol red notice

Shimon Yehuda Hayut gained worldwide notoriety thanks to the 2022 Netflix documentary 'The Tinder Swindler', which detailed how he allegedly posed as the son of billionaire diamond tycoon to scam women he met on Tinder.

_1758026150.jpg)

Bolivia sells $1bn of gold reserves in forward contracts to shore up finances

In recent months, the Central Bank of Bolivia (BCB) has executed forward contracts on gold worth nearly $1bn, raising questions about the legal framework, transparency of operations and long-term implications for the economy.