Brazil's economy is expected to moderate in the near term as inflation converges to target, before strengthening to 2.5% over the medium term, the International Monetary Fund said in a statement on July 17 after completing its annual review of the country.

The IMF Executive Board concluded its 2025 Article IV consultation with Brazil on July 14, praising the economy's strong growth performance over the past three years whilst noting downside risks from global policy uncertainty.

Growth is projected to slow from 3.4% in 2024 to 2.3% in 2025, amid tight monetary and financial conditions and a scaling back of fiscal support, the Washington-based lender said. Over the medium term, growth is forecast to recover to 2.5%, supported by monetary policy normalisation and structural factors including VAT reform and accelerated hydrocarbon production.

Inflation is expected to reach 5.2% by end-2025 before gradually converging to the 3% target by end-2027, the IMF said.

The fund commended Brazil's monetary policy tightening cycle undertaken by the Lula administration in September 2024 as "appropriate and consistent with bringing inflation and inflation expectations back to the 3% target."

Brazil's economy has grown strongly over the past three years, surprising on the upside, with expansion reflecting strong consumption supported by fiscal stimulus and supply-side factors. However, inflation rebounded in 2024 amid strong demand, rising food prices, and currency depreciation, exceeding the target tolerance interval.

Fiscal sustainability urged

Executive Directors welcomed Brazil's strong growth performance and falling unemployment and poverty in recent years, whilst encouraging authorities to ensure continued inflation convergence and secure fiscal sustainability.

The IMF recommended further steps to put public debt on a firm downward path, facilitate lower interest rates, and create space for priority investments. Directors suggested measures to mobilise revenues, including rationalising inefficient tax expenditures and tackling budget rigidities.

The ongoing VAT reform would simplify the tax system and boost productivity, whilst personal income tax reforms could enhance progressivity and domestic revenue mobilisation, the fund said.

Resilient financial system

The IMF welcomed that Brazil's financial system remains resilient, with banks highly liquid and adequately capitalised. Directors encouraged close monitoring of household credit risks, including in light of the recently enhanced private payroll loan programme.

The fund also praised Brazil's leadership in financial innovation, which has promoted financial inclusion, efficiency, and competition, whilst suggesting greater administrative and financial autonomy for the Central Bank of Brazil would support continued technological progress.

Environmental progress

The IMF heaped praise on Brazil's leadership in multilateral cooperation, including implementation of the country's Ecological Transformation Plan and progress in reducing deforestation. Brazil is on track to meet its Nationally Determined Contribution targets, the lender noted.

The balance of risks to the growth outlook is tilted to the downside amid heightened global policy uncertainty, whilst risks to the inflation outlook are broadly balanced, the fund said.

Downside risks stem externally from slower growth in major economies amid heightened global trade tensions, and domestically from larger-than-expected effects from monetary policy tightening and the possibility of lower-than-envisaged fiscal effort.

News

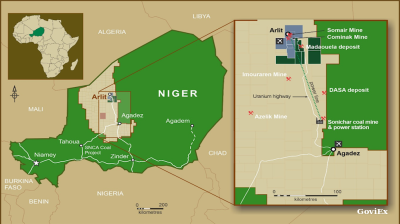

GoviEx, Niger extend arbitration pause on Madaouela uranium project valued at $376mn

Madaouela is among the world’s largest uranium resources, with measured and indicated resources of 100mn pounds of U₃O₈ and a post-tax net present value of $376mn at a uranium price of $80 per pound.

Brazil’s Supreme Court jails Bolsonaro for 27 years over coup plot

Brazil’s Supreme Court has sentenced former president Jair Bolsonaro to 27 years and three months in prison after convicting him of attempting to overturn the result of the country’s 2022 election.

Iran cleric says disputed islands belong to Tehran, not UAE

Iran's Friday prayer leader reaffirms claim to disputed UAE islands whilst warning against Hezbollah disarmament as threat to Islamic world security.

Kremlin puts Russia-Ukraine ceasefire talks on hold

\Negotiation channels between Russia and Ukraine remain formally open but the Kremlin has put talks on hold, as prospects for renewed diplomatic engagement appear remote. Presidential spokesman Dmitry Peskov said on September 12, Vedomosti reports.

.jpg)