Azerbaijan's revised 2020 budget highlights the hit to its public finances from lower oil prices and the pandemic, Fitch Ratings said on August 26 in a non-rating action commentary.

The government’s planned deficit has been raised to 12.4% of GDP from 2.3% in the original budget, the ratings agency noted. An increase in the planned transfer from the country’s sovereign wealth fund (Sofaz) to the budget should support the Azerbaijani manat (AZN) 1.7 to USD exchange rate, which has faced less pressure in recent months, it also observed.

“The key change in the revised consolidated budget, approved by the president in mid-August, is a lower oil price assumption,” Fitch said. “Fiscal projections are now based on an average of USD35/b (consistent with Fitch's forecast for Brent crude), compared with USD55/b in the original 2020 budget. Spending has been revised up by 1.2pp of GDP. This incorporates a rise of 0.4pp of GDP in health expenditure compared with the original budget, additional capital investments to stimulate the economy amounting to 0.3pp of GDP, and 0.5pp of GDP in additional unspecified measures.”

As with many other sovereigns, countering the economic impact of the coronavirus (COVID-19) pandemic has necessitated a temporary suspension of the government's fiscal rule, Fitch also said.

Fitch rates oil and gas-rich Azerbaijan at ‘BB+’, with a ‘Negative’ outlook (revised from ‘Stable’ in April).

"Large savings"

“Despite the severe adverse impact on the fiscal deficit, large savings provide Azerbaijan with a significant degree of financing flexibility. The consolidated budget deficit will be primarily financed by a drawdown of Sofaz assets and the large cash deposits in the government's single treasury account,” Fitch also said in its commentary.

It added: “Sofaz assets were broadly flat over the first six months of 2020, ending June at USD43.2 billion, with changes in the value of its portfolio offsetting lower oil revenues and transfers to the budget. With nominal GDP falling in US dollar terms and its portfolio primarily in foreign currency-denominated assets, Sofaz assets will remain in excess of 85% of GDP. Consequently, while most sovereigns are projected to post large rises in debt/GDP in 2020, we forecast Azerbaijan's general government debt to increase by just 4.0pp to 23.0% of GDP, with much of that resulting from a sharp fall in the denominator.”

Sofaz transfers to the state budget were increased to the equivalent of $7.2bn from $6.7bn, supporting the AZN/USD de facto fixed exchange rate of 1.7, Fitch said. Sofaz sales of FX for manats to transfer to the budget are a key source of foreign currency and helped preserve exchange rate stability, notably in March, it added.

The 2020 economic growth assumption in Azerbaijan’s revised budget has been cut to -5.0% from 2.4%. Fitch forecasts -4.2%. The cut reflects coronavirus containment measures and Azerbaijan's participation in OPEC+ oil supply cuts.

“A renewed lockdown in July highlights the lingering risk of coronavirus in Azerbaijan and downside risks from further waves of infections and renewed lockdown measures, which could further pressure real GDP growth,” Fitch concluded.

News

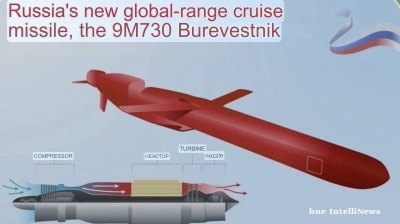

Russia test fires its Burevestnik nuclear-powered cruise missile

Russia’s Burevestnik nuclear-powered cruise missile has no analogues in the world, Russian President Vladimir Putin said, as the Kremlin escalates the unfolding missile arms race with Ukraine another notch.

Russia claims to surround Pokrovsk

Russia’s chief of the general staff Valery Gerasimov triumphantly reported to Putin that 31 Ukrainian battalions have been encircled in Pokrovsk and 18 battalions in Kupyansk, the hottest spot in the war.

.jpg)

Brazil and US to start urgent tariff negotiations after Trump-Lula meeting

Brazilian President Luiz Inácio Lula da Silva and US President Donald Trump have agreed to start immediate negotiations on tariffs and sanctions imposed by Washington, following a meeting in Malaysia that sought to ease trade tensions.

Cambodia and Thailand agree peace deal

Thailand and Cambodia have agreed a peace deal to mark the end of a conflict earlier in the year as Cambodian Prime Minister Hun Manet and Thai Prime Minister Anutin Charnvirakul attended a signing ceremony overseen by US President Donald Trump.

.jpeg)

_seen_here_meeting_with_Congressman_Jimmy_Panetta_201025_Cropped_1760946356.jpg)