There is a cost saving to issuing Green. It varies according to circumstances, but the baseline assumption now is for green yields to be below vanilla ones; not by much, but it's persistent enough. It's between 1 basis point to 10bp, with EURs drifting lower while the $version is a tad more elevated. It reflects ESG scarcity, but also longevity.

The market for sustainable financing features a premium on ESG bonds; a reflection of long term aspirational change

Environment, Social & Governance (ESG) as a concept has been elevated in importance on both sides of the financing fence – the issuer and the investor. It's reflected in the deployment of product by issuers that prefer to pursue an ESG objective, alongside investors that want to be seen embracing the same. Green issuance trades at a premium; that's a clear measure of tilt towards greenness.

As a consequence of an excess of demand over supply of ESG bonds, a so-called "greenium" is in play, where ESG bonds trade at a higher price than vanilla ones (thus commanding a lower yield). In consequence, issuance in ESG bonds is cheaper for the issuer, and the buyer accepts a lower running yield.

Why? It's not just because embracing ESG is seen to be the right thing to do, it is also seen as a sensible long-term investment practice; to be in things that are seen to be sustainable. The ultra buy-and-hold strategy must embrace this, as holding on for the long term requires sustainability, by definition. At the extreme, sustainability reduces existential risk (the ultimate default).

Changing times

The lower yield on Green issuance has not always been the norm. A number of years back it was the reverse, where Green issuance meant higher funding costs for issuers. Back then, issuing in the Green space meant making a statement that issuers were willing to pay a bit more to be more Green. Now it's investors making the statement that they are willing to sacrifice (a bit of) yield to help build their Green credentials (both for the investor, and the intermediary).

And this has occurred alongside a dramatic build in ESG issuance. It is clear though that there is demand for more.

Our calculations show a Greenium of some 1bp to 3bp in EUR versus a higher greenium of 5bp to 8bp in $

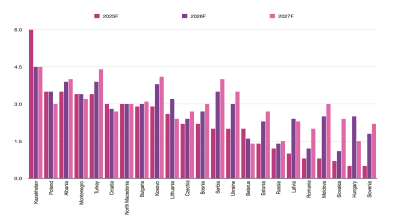

We’ve done an updated holistic analysis of where the greenium is. We base it off EUR and $issuance completed in 2020 and 2021 to date, from mostly European - and US-based corporates. For EUR issues we find a median greenium of 2bp, but can be much higher depending on circumstances. Our credit strategy team has looked at the greenium specifically in EUR investment-grade corporates and has concluded that it is now in the 1bp area, and has fallen in the past number of quarters, mostly on account of more Green issuance. This illustrates considerable variability in the size of the greenium, but also some evidence that is not as large as it was (some 6bp a year ago).

When we look at the $numbers we find evidence that the greenium is currently larger (versus EUR). Our $debt capital markets team spends its days looking at new issues and identifies a spread of anywhere between 1bp to 10bp as the greenium currently for the bulk of bonds that have been issued so far in 2021. We’ve done a separate exercise looking at secondary market levels and have found that the average greenium is in the area of 5bp to 8bp, and in some extreme cases, the greenium can be in excess of 20bp (albeit callable/coupon size impacted). There has been a clear build in issuance from US corporates, and the greenium on $issuance commands a demand for more.

There are various ways to do this exercise, depending on whether we fit a curve or simply look at comparison versus immediate adjacents, and we provide a summary of the detailed outcomes in the illustrations below.

Lets take a middle ground, say a 5bp greenium. For a $1bn bond, that comes to a cost saving of $500,000. Or for a $10bn bond portfolio that is then a $5m cost saving. Maybe not determinative, but also not nothing.

Driving towards a sustainable future

Does this make a difference to the overall drive for a more sustainable future? As a stand-alone, probably not. Even the brownest of operators can identify green aspects to what they do and look then to embrace them by highlighting and ring-fencing them from a financing perspective. The financing decision is part of a bespoke set of processes that as a collective characterises where any corporate is on the spectrum of greenness.

The bigger lifting in terms of making a real difference comes from how businesses are run, what they produce, how they produce, where it's done and what efforts are made to actually make a difference. That still likely requires some carrot and stick. But the pleasing aspect is that Green finance is increasingly positioned to partake in this, and indeed as an aid to lubricating the bigger effort, and that’s important in itself.

This article first appeared in ING THINK here. Padhraic Garvey is ING’s Regional Head of Research in New York and Benjamin Schroeder is a senior rates strategist at ING in Amsterdam

bneGREEN

Malaysia–Vietnam offshore wind project to deliver 2,000 MW by 2034, strengthening regional green energy links

Malaysia’s upcoming offshore wind project connecting Vietnam to Peninsular Malaysia is expected to generate up to 2,000 megawatts (MW) of clean energy by 2034, marking a major step in the nation’s renewable energy expansion

EBRD invests €16.8mn in Croatia’s first large-scale battery storage and virtual power plant

Development bank to take its first equity stake in a standalone merchant storage project.

Kyrgyzstan says neighbours “upset” by country’s lack of water

“This year we were supposed to overcome shortages, but instead, they have intensified,” deputy head of cabinet tells Uzbekistan and Kazakhstan.

EXPLAINER: What is the EU’s CBAM and how will it affect global trade from 2026?

The European Union’s Carbon Border Adjustment Mechanism (CBAM) will enter its full operational phase on January 1, 2026, marking a major shift in global climate and trade policy.