As a country Bangladesh is at an energy crossroads. Following decades of natural‑gas dominance, its energy planners are charting a course towards a diversified portfolio, including nuclear power-use, LNG, coal-fired generation, and a nascent but ambitious renewable sector.

This multifaceted approach reflects both opportunity and challenge, fuelled by surging power demand, dwindling domestic gas reserves and pressing environmental concerns.

Nuclear: Rooppur’s promise

The jewel in Bangladesh’s emerging energy crown is the Rooppur Nuclear Power Plant. Under construction since 2017 with support from Russia’s Rosatom, it comprises two VVER‑1200 reactors totalling 2.4 GW. Unit 1 is expected online in late 2025, followed by Unit 2 in mid‑2025.

The project, financed via an $11.38bn loan, is projected to meet around 10% of the nation’s electricity needs when complete.

While concerns over foreign debt and geopolitical leverage are voiced, especially in Western commentary on Russia’s overseas nuclear diplomacy, Bangladesh sees Rooppur as a scientific and crucial domesic leap, signalling entry into the atomic age. To this end, there is already talk of extending the site with further reactor units and perhaps a research reactor sources in the region indicate.

LNG: the expensive bridge fuel

Once the country’s lynchpin, natural gas has in recent years been drawn down from domestic fields and supplanted by costly LNG imports. As such, Bangladesh has plunged into the global LNG market, increasing its spot cargoes from 23 to 48 in 2024, with projections to spend around $50bn on LNG infrastructure and plants alone news agencies such as Reuters have reported.

The nation forged a non‑binding deal with Louisiana’s Argent LNG for up to 5mn tonnes per year (tpy) in a bid to diversify suppliers and assuage import issues. Yet this reliance hits hard. LNG prices have spiked 300% since 2021, triggering fiscal stress, underutilised capacity – an example being the Payra plant operating at only 40% or so of its potential, and environmental indignation

Critics of Dhaka’s LNG policy and use argue thay the country is entrapped by “LNG addiction” and the local Dhaka Tribune has indicated these voices highlight that the $36bn spent on LNG plants could have instead powered up renewable capacity to 62 GW.

Coal: the double edged sword

In addition to nuclear power, Bangladesh is rapidly constructing coal-fired capacity to anchor baseload generation. Payra at 1.32 GW and Matarbari at 1.2 GW are the flagship mega‑plants, built with Chinese and Japanese aid respectively.

Meanwhile, Rampal, a 1.32-GW Indo‑Bangladeshi venture, also helps underpin domestic energy security even as concerns flood environmental circles due to its proximity to the environmentally important Sundarbans – an area of mangrove forest home to around 100 Bengali tigers.

Japan’s climate‑finance intervention at Matarbari, and advanced pollution controls at Payra, however, are seen as attempts to green‑wash what is fundamentally a fossil-based project. However, analysts question whether more coal is wise. A 2025 Daily Star editorial warned that yet another coal unit would exacerbate overcapacity as baseload margin already hovers at ~61%. At the same time it would contradict environmental aims .

Renewables

Bangladesh is also making inroads into solar, wind, and off‑grid renewable models. Surprisingly, the country runs the world’s largest off‑grid solar system, serving around 20mn people. Yet utility‑scale utility growth lags: by 2021, renewables made up just 3% of generation, falling short of government targets local media reports. Much of this is attributed to land scarcity and grid constraints which have throttled expansion.

Some progress is being made though: Feni solar park (50 MW), rooftop PV mandates on schools, hospitals, and public buildings, and solar tenders totalling 5.2 GW are underway. The government has also refreshed its Renewable Energy Policy, raising targets to 20% by 2030 and 30% by 2041. Even the interim administration under Nobel laureate Muhammad Yunus has mandated rooftop panels on public institutions, both to help ease monthly bills and unlock private investment.

Balancing act

Bangladesh’s Integrated Energy and Power Master Plan, whether idealistically or otherwise, envisions a future comprising nuclear, gas / LNG, coal, renewables, hydrogen, bioenergy, regional imports from India to the west and Nepal and Bhutan to the north.

But ambition often meets stark realism in Bangladesh. Domestic gas production is expected to run dry by 2033 without fresh discoveries according to reports, and LNG’s volatility pressures finances and environment in a country still lacking in funds and political stability. Coal expansion might lock in high carbon emissions while at the same time stranding assets and renewables need policy consistency, grid investment, and land‑use innovation. Even nuclear, for all its promise, is locked into large foreign‑currency debt and complex regulatory regimes.

Nevertheless, Dhaka’s diversification strategy is pragmatic. Rooppur offers a high‑intensity, carbon‑light backbone. LNG and coal sustain base‑load power while renewables scale and grid resilience improves. Regional imports help buffer against drought or monsoon-induced supply drops. Cross-border energy trading with Bhutan, India and Nepal also helps.

Charting a sustainable future

To this end, even as Bangladesh’s energy narrative may appear disordered and marked by competing priorities and financial risk, it reflects the complex realities that fast-growing economies face.

If Bangladesh can sustain its renewable momentum, claw down LNG and coal’s share, and make Rooppur a safe and financially viable success, it could truly reimagine its energy future. The nation that once burned through daily blackouts now stands at the cusp of an energy transformation - resilient, cleaner and ready for the challenges ahead.

Features

South Korea, the US come together on nuclear deals

South Korean and US companies have signed agreements to advance nuclear energy projects, aiming to meet rising data centre power demands, support AI growth, and strengthen the US nuclear fuel supply chain.

World Bank seems to be having second thoughts about Tajikistan’s Rogun Dam

Ball now in Dushanbe’s court to justify high cost.

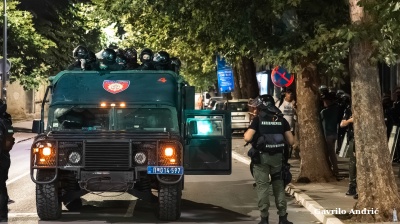

INTERVIEW: From cinema to Serbian police cell in one unlucky “take”

An Italian software engineer caught in Belgrade’s August protests recounts a night of mistaken arrest and police violence in the city’s tense political climate.

_Cropped_1756210594.jpg)

Turkey breaks ground on its section of the TRIPP rail corridor

Turkish project would help make TRIPP the go-to route for Middle Corridor freight.

.jpg)