Commercial real estate investment dropped by 55% in Central Europe in 2023, says Cushman & Wakefield

Commercial real estate investment in Central Europe dropped by 55% year on year in 2023 to €5.02bn because of the continuing economic uncertainty, according to a report by commercial real estate agency Cushman & Wakefield released on February 26.

“Evidently, prices have not bounced back enough to satisfy sellers, and buyers have not adjusted to the new pricing. Hence the low investment activity,” said Jeff Alson, Head of Capital Markets CEE at Cushman & Wakefield.

The real estate agency said the market in Central Europe (Bulgaria, the Czech Republic, Hungary, Poland, Romania and Slovakia) is unlikely to see a quick recovery in pricing that satisfies both sellers and buyers. Additionally, potential de-leveraging requirements could lead to a scarcity of new equity for existing deals or reinvestments, resulting in more forced sales, adding to the market's challenges.

Nevertheless, Cushman & Wakefield predicts investment volumes over the next few years to gradually increase by 10% to 15% annually.

Poland experienced the most significant investment downturn of 68%, leading its share of overall volume to fall from around half or more in preceding years to roughly a third. The Czech Republic was in second place, with around a quarter.

The highest proportion of the capital went into the office sector, although its share dropped from 41% in 2022 to 32% in 2023 because of the increasing trend towards remote work.

The industrial and retail sectors remained at nearly equal levels, both slightly exceeding 27%, and basically the same as the year before (26%).

The logistics and industrial sectors performed well, though despite an e-commerce surge, demand from its tenants decreased. The retail sector also demonstrated resilience, showing robust sales across CEE and also attracting significant investment volumes.

Prime yields exhibited a mixed pattern: while some markets saw a slight increase, reflecting investor demand for premium, risk-averse assets, others remained stable, underscoring the underlying resilience and ongoing appeal of prime commercial real estate in Central Europe.

Sector-wise, prime yields have been increasing since the beginning of 2022 across all asset classes. The sharpest outward movement has been recorded in offices, while yields of industrial properties grow with the lowest speed in CEE.

Local investors and those from CEE accounted for the majority (65%) of investment transactions in the region in 2023, which is significantly higher share than in the previous years (42% in 2022 and 37% in 2021). Investors originating from the Czech Republic were behind 37% of the investment volume, and there were almost no acquisitions by Asian or German investors. Nevertheless, it is anticipated that international capital will ultimately resume its inflow

“Despite a traditionally stable investment environment in the CEE region, there is currently a gap of three to five billion euros in the gross investment volume compared to the historical averages. This deficit is projected to be offset by a steady return of international capital and a consistent increase in local investment, supplemented by a healthy but more selective debt market. Over the coming years, this is expected to recover and eventually increase long-term averages,” said Alson.

Investment into sectors (% share of total). Source: Cushman & Wakefield

Data

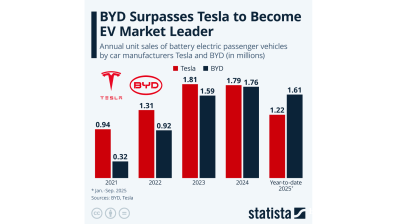

BYD surpasses Tesla to become EV market leader – Statista

While Chinese manufacturer BYD already pulled ahead of Tesla in production volume last year, with 1,777,965 battery electric vehicles (BEV) produced in 2024 (4,500 more than Tesla), the American manufacturer remained ahead in sales.

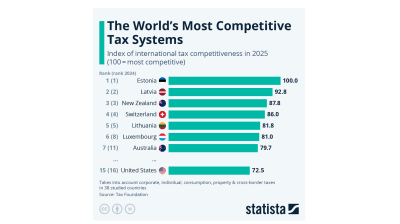

Estonia has the world’s most competitive tax systems for the 11th year in a row – STATISTA

The Tax Foundation has released its International Tax Competitiveness Index which highlights the most competitive tax rates in different countries around the world. For the 11th consecutive year, Estonia had the highest score in the index.

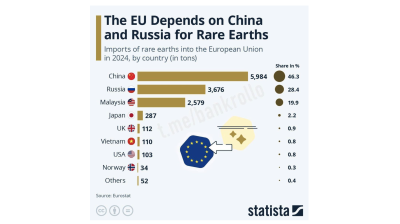

EU rare earth supply dominated by China and Russia - Eurostat

The European Union remains heavily dependent on China and Russia for rare earth imports, with nearly three-quarters of its supply sourced from the two countries in 2024, according to data published by Eurostat and reported by Statista.

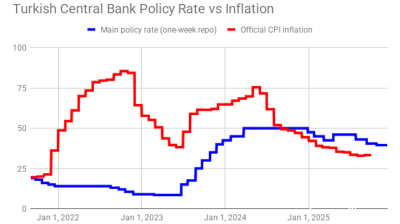

Turkey's central bank remains cautious, delivers 100bp rate cut

Decision comes on eve of next hearing in trial that could dislodge leadership of opposition CHP party.

_0_1691414451.jpg)