Hungary’s radical right-wing leader Viktor Orban is struggling to cope with the country’s unfolding cost of living crisis, a task made much harder because of his pre-election spending spree and his isolation inside the European Union.

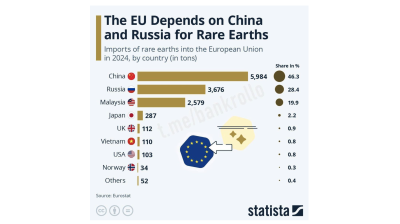

Surging energy prices and a bulging budget deficit have already forced the government to cut back regulated gas and electricity subsidies as energy imports rose to more than 10% of GDP.

Hungary’s strongman is trying to shift the blame for the country’s looming recession and record inflation on to the EU’s sanctions on Russia, a risky political strategy at a time when Budapest is fighting to secure access to vital EU funds and allay concerns about its violations of the rule of law and its cosy relationship with Vladimir Putin’s dictatorship.

Fidesz, bracing for a tight election against a united opposition last spring after three successive supermajority victories, embarked on an unprecedented pre-election spending spree, dishing out 3-4% of GDP in tax rebates, bonus payments for the armed forces and an extra month of pensions. This drove up consumption and GDP, but the public finances are in disarray as a result.

The government claimed that the country’s strong economy – bouncing back quickly from the recession caused by the coronavirus (COVID-19) pandemic in 2020 – would cover the fiscal handouts and public investments. But analysts raised the red flag and warned of the negative impacts on inflation and the budget balance.

Headline inflation was already running at close to 8% before the war, climbed to over 15%, and is set to peak at 20% or above, according to the latest forecast by the Hungarian National Bank (MNB).

Even before Putin’s invasion of Ukraine, the budget gap had already reached 40% of the full-year target of 4.9% of GDP. At the end of August, it widened to 91%.

Gaping budget hole

At an international press conference two days after his party’s landslide election victory in April, Orban categorically denied that he would carry out a fiscal consolidation. The word austerity has been cancelled by Fidesz, which only uses it to refer to the IMF-imposed consolidation of public finances carried out by the last non-Fidesz government after the Global Financial Crisis.

To fix the gaping hole in the budget, the government dug out its playbook from 2010, when it took power. It levied extra profit taxes on the finance sector, retail and energy companies and airlines, targeting an estimated HUF800bn in extra revenue for 2022 and 2023. Spending at ministries and state bodies was frozen and some HUF2 trillion in public investments were postponed.

The markets were unimpressed by Orban’s first steps to consolidate the budget, reflected in the slide of the Hungarian currency, even as the MNB kept raising rates. The HUF/€ rate slid to 417 in July, a 10% decline since the start of 2022, making the forint the weakest currency in the V4 group.

The MNB lifted the base rate from 0.75% in June 2021 to 13% on September 27, when it called an end to the monetary tightening policy, a risky move according to analysts as inflation continues to gallop ever higher. The markets were also not impressed by the central bank's decision and the forint plunged to 424 against the euro in intra-day trading on September 29, and to 437 against the dollar.

The sell-off came as geopolitical tensions over Ukraine are on the rise and there are beginning to be fears over the central bank's foreign currency reserves as the country's current account is deteriorating at a rapid pace due to higher energy import bills.

The government’s measures have also failed to stem the cost of living crisis. The 4% windfall tax on retailers and a price cap on half a dozen food samples seemed popular at first but came at a heavy price. Retailers, as expected, passed on the extra burdens to consumers. The falling forint has also pushed up the price of imported goods.

By August, food prices on average rose at the fastest clip among EU states in Hungary, close to 31% year on year. The price of basic food staples not regulated by the government rose by many times the average CPI. The statistics office registered extraordinary price increases: 67% for margarine, 64% for bread, 61% for cheese, 59% for pasta products, 55% for milk products and 54% for butter.

Economists estimate that those earning the median wage of around HUF250,000 now spend half of their salaries on food and utility bills. This is expected to climb further as the winter kicks in and Hungarian households will face the impact of higher utility bills due to the partial phase-out of energy subsidies.

Felling the totem pole

By July it had become evident that windfall taxes alone would not be enough to fix the budget and more drastic measures were needed. The government was therefore forced to cut back regulated gas and electricity subsidies.

The government had frozen retail electricity and gas prices before the 2014 election. Keeping energy prices low has been a totemic issue for Fidesz and one that was seen as key to winning elections.

After their talks in the Kremlin on the first of February, Putin had assured the Hungarian premier that Budapest would receive gas five times below the market price.

Russia has become a key political and economic ally of Orban since his first election landslide in 2010. The government has defended its pragmatic stance of putting economic interests ahead of value-based foreign policy when criticised for cosying up to Eastern autocrats such as Putin and China’s Xi Jinping. The argument was that without "cheap Russian energy", the regulated retail utility prices could not be maintained.

But the notion of cheap Russian gas turned out to be a myth, as shown by the monthly foreign trade data. Hungary’s export-oriented economy, generally posting hefty surpluses, has run a deficit for the 13th straight month, posting a record €1.15bn gap in July.

Although the price formula of the 15-year gas agreement with Gazprom signed in September 2021 remains secret, Hungary appears to be paying above the market price, according to these trade statistics. Analysts believe that contract prices are tied to Dutch TFF gas exchange rates with a three-month lag, unlike in the previous contract, when the price was linked to movements in the oil market.

Orban defended the tenability of the subsidy scheme right until the end, when it became clear that the budget could no longer bear the burden. The day of reckoning came on July 12, when the government declared an energy state of emergency, which included the revision of the energy subsidy scheme.

The blanket cap on household electricity and gas prices is simply unaffordable in the current "wartime energy crisis", government officials said at the time, with the sinking forint added to the woes.

Based on Hungary’s gas imports of 80mn MWh, the increase of gas prices from €20/MWh in 2021 to over €200/MWh would boost the country’s energy bill to €16bn, or one-tenth of the country’s GDP, Concorde brokerage said in a recent report.

Finance Minister Mihaly Varga unveiled shocking data on Hungary’s energy import balance at a conference last month. The price tag paid by Hungary for gas, oil and electricity would reach HUF8 trillion (€20bn) in 2022, against just HUF1.8 trillion in 2019. The €15bn-16bn increase in energy bills in a couple of years accounts for 10-11% of Hungary’s GDP and is three to four times the amount of money Hungary is eligible for from the 2021-2027 EU budget each year.

Varga also noted that the economy will sink into recession from Q4 until the third quarter of 2023, meaning that for that year it will contract 1-2%. The 2023 budget, approved in July, which targeted a 4% growth and a 5% inflation, will have to be amended.

Soft landing, hard landing

The jury is out on whether Hungary will face a soft or a hard landing. Former MNB deputy governor Akos Peter Bod, an advisor to opposition parties in the 2022 campaign, expects a hard landing, as the country’s exposure to the energy shock is higher than its neighbours, due to strong dependence on Russian energy sources and the lack of investments in energy efficiency due to distorting price caps.

The energy use of Hungary’s industry remains one of the highest in Europe, while the share of insulated homes is one of the lowest. In 2016 the EU gave Hungary some HUF500bn for insulating homes but the government decided to use the money for similar projects in the public sector, with mixed results.

Low retail energy prices due to price caps did not provide incentives for households and businesses to carry out energy-efficient investments over the years, for which Hungary is paying a big price now.

Economists are drawing parallels to the 1970s oil shock, which led Hungary to join the IMF in 1982. Eventually, this was seen as the start of the demise of the Communist government. By the time Hungary held its first free elections in 1990, Hungary had become the most indebted country in the region, racking up an eye-watering $20bn in state debt.

According to recent press reports, an IMF delegation visited Hungary in July, which was not part of the annual Article IV mission. Officials of the Washington-based group said Hungary had not asked for financial assistance.

The widening current account gap, which could rise to €13bn-14bn this year, has dented the central bank's currency reserves, falling below the key level of the equivalent of three months of imports. This, according to Concorde brokerage chairman Gyogy Jaksity, is a prelude to calling in the IMF.

Others opine that the IMF could only be an option if Hungary fails to agree with the EU on the payment of frozen funds, and if borrowing costs on the international markets are too high. Independent media 24.hu reported that Hungary is looking for alternative financing sources in China and that a Green Panda bond could be on the table.

Hungary has pledged to co-operate with the European Commission in 17 areas in an attempt to gain access to some €7.5bn in Cohesion Funds from the 2021-2027 budget suspended under the EU’s new Conditionality Mechanism, as well as €5.8bn of Recovery and Resilience Funds that were suspended earlier over the government’s violation of the rule of law and rampant corruption.

Hungary has received €57bn, or 4.5% of its annual GDP, in transfers from Brussels since it joined the EU in 2004 and is a major beneficiary in the new 2021-2027 budget. OTP chairman-CEO Sandor Csanyi warned that without an agreement, the country's GDP would decline by 0.5%.

Some analysts believed the prime minister’s credibility would be tarnished after breaking his key campaign promise to maintain the energy cap in July, but recent polls show only a slight erosion in Fidesz support and an increase in undecided voters.

Many saw comparisons to 2006 when former Socialist Prime Minister Ferenc Gyurcsany admitted that his government had lied about the state of the economy to win the election.

His speech at Balatonoszod at a closed-caucus meeting was leaked in September 2006, triggering the worst political crisis in Hungary’s history, helping Orban to make a comeback. After two lost elections, there were calls for his removal from the party.

But Hungary’s opposition, still reeling from the election fiasco in the spring, has yet to capitalise on Fidesz breaking its election promises. It has failed to win over disillusioned Fidesz voters, according to analysts. But Orban might not be so lucky if the cost of living crisis continues to deepen.

Features

INTERVIEW: Can Albania’s tourism miracle last?

As social media brings in the crowds, the head of the Albanian Tour Operators Association tells bne IntelliNews Albania should turn away from mass-market tourism and focus on higher-value offerings.

COMMENT: Taiwan’s equality paradox - when “progressive” doesn’t mean equal

Taiwan’s insistence that women should have access to every privilege of citizenship - from political office to professional advancement - but not its responsibilities, undermines the moral foundation of its democracy.

Russian e-commerce giant Wildberries goes on a mysterious M&A spree

Russian e-commerce giant goes on M&A spree Almost a year after the controversial merger with a leading outdoor advertising firm, Russia’s leading e-commerce site Wildberries is indulging in a fresh bout of eyebrow raising deals.

US expands oil sanctions on Russia

US President Donald Trump imposed his first sanctions on Russia’s two largest oil companies on October 22, the state-owned Rosneft and the privately-owned Lukoil in the latest flip flop by the US president.