Stressed markets sent a loud and clear message to the Turkish central bank on May 3 after digesting the latest hard-to-stomach inflation data and pushing the Turkish lira (TRY) to another record low: “You are behind the curve.”

Though not one to betray any doubt in public, even outspoken populist Turkish President Recep Tayyip Erdogan, having called snap elections for June 24, may be unsettled at how quickly the reaction to the announced higher-than-expected April annual inflation of 10.85% weakened the TRY to 4.2487 against the dollar, from May 2’s close of 4.1785. With Core “C” CPI inflation recorded at 12.24% y/y, Turkish assets amid the overheating economy continued to take a battering. The day also saw the yield on Turkey’s 10-year local-currency bonds move up 31 basis points to 13.24%, nearing the record 13.56%.

On April 25, the Central Bank of the Republic of Turkey finally responded to market pressure for some tightening amid the stubborn double-digit inflation, surging current account deficit and signs of corporate debt difficulties in the credit-fuelled economy. The initial response to its move was that it had exceeded expectations by making a 75 basis point (bp) hike when the consensus was that it would go for 50bp. However, even on the day of the rate increase, the lira bears came stomping back into the picture and, with the May 3 response to the disappointing inflation figures, they appear to be rapidly gaining more ground.

Timothy Ash, a strategist at BlueBay Asset Management, who has long contended that, against the backdrop of strong political pressure from Erdogan for loosening, the CBRT has been a worry at the wheel, tweeted: “Turkey - clear from inflation data today with headline and core rising that the CBRT is still behind the curve despite the 75bps hike last week. Given subsequent FX move it is pretty clear the CBRT needs to tighten further. FX level could determine election.”

Jason Tuvey, an emerging markets economist at Capital Economics, said Capital had only expected Turkish annual inflation to rise to 10.5%.

He said in a note: “High and rising core inflation will add to concerns that rapid growth is causing the Turkish economy to overheat. We expect headline inflation to rise a little further over the coming months. Despite the central bank hiking its late liquidity window rate by 75bp last week, there has been little relief for the lira… All of this strengthens the case for the Turkish MPC [monetary policy committee] to take further steps to tighten monetary policy over the coming months.”

"50bp more likely in July"

Given the upcoming presidential and parliamentary elections, and the possibility of political pressure for lower interest rates, the MPC may be hesitant to raise interest rates at its next meeting in June, Tuvey also noted. “Accordingly, our central scenario is that another rate hike, probably in the order of 50bp, is most likely in July. But if the sell-off in the lira gathers pace, the chances of an earlier rate hike will increase.”

Inflation in April increased in seven of the 12 main categories of the CPI basket, with the weakening of the TRY and the rise in oil prices partly to blame. “An increase in petrol price inflation contributed 0.2%-pts to the overall rise in the headline inflation rate. Furnishings inflation hit a fresh record high. Meanwhile, core inflation rose to 12.2% y/y last month, the second-highest reading on the current series which began in 2004,” Tuvey added.

At 17:05 Istanbul time, the lira stood at 4.2030 to the dollar, a weaker level than its previous all-time low of 4.1944 recorded on April 11 prior to the rate hike. The currency was slightly over 3% down in the first three days of May alone and nearly 10% lower since the start of the year.

Lorenzo Gallenga, a money manager at Quaestio Capital Management in Milan, was another analyst referring to the CBRT’s failure to beat the curve. He told Bloomberg: “The inflation data continues to show the inability of the central bank to get ahead of the curve. The risk is now of inflation expectations moving higher, making tackling persistently high inflation that much harder.”

On May 1, S&P Global Ratings, in an unsolicited and unscheduled update on Turkey, cut the country’s credit rating deeper into junk as it responded to the growing risk of its overheating economy experiencing a hard landing. S&P highlighted the country’s deteriorating inflation outlook and the long-term depreciation and volatility of the Turkish lira (TRY) as well as signs of corporate debt distress.

"There is a risk of a hard landing for Turkey’s overheating, credit-fuelled economy," S&P said in the statement. "This is reflected in the rising imbalances in Turkey’s economy, most notably in its widening debt-financed current account deficit and high inflation."

News

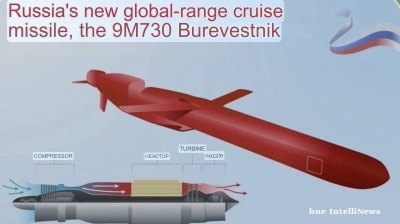

Russia test fires its Burevestnik nuclear-powered cruise missile

Russia’s Burevestnik nuclear-powered cruise missile has no analogues in the world, Russian President Vladimir Putin said, as the Kremlin escalates the unfolding missile arms race with Ukraine another notch.

Russia claims to surround Pokrovsk

Russia’s chief of the general staff Valery Gerasimov triumphantly reported to Putin that 31 Ukrainian battalions have been encircled in Pokrovsk and 18 battalions in Kupyansk, the hottest spot in the war.

.jpg)

Brazil and US to start urgent tariff negotiations after Trump-Lula meeting

Brazilian President Luiz Inácio Lula da Silva and US President Donald Trump have agreed to start immediate negotiations on tariffs and sanctions imposed by Washington, following a meeting in Malaysia that sought to ease trade tensions.

Cambodia and Thailand agree peace deal

Thailand and Cambodia have agreed a peace deal to mark the end of a conflict earlier in the year as Cambodian Prime Minister Hun Manet and Thai Prime Minister Anutin Charnvirakul attended a signing ceremony overseen by US President Donald Trump.