Last year was a rough recession-hit ride for the Turkish shopper and not surprisingly retailers found themselves dealing with far more cautious consumers. It’s a fact of boom-to-bust life that’s been brought home by a Nielsen survey that has shown some 74% of Turkish consumers now prefer private labels at supermarkets.

Strong demand for private labels—generally cheaper than other brands on the shelves—is another indicator that Turks have been struggling to make ends meet and will hope Turkey this year makes a strong recovery from the economic turmoil that has beset the country since the summer 2018 currency crisis.

The survey also showed that 87% of consumers make a point of comparing prices at different supermarkets to find the most affordable items before heading out to shop. That percentage is up from 72% a year ago.

Some 74% of respondents said that they compared private labels’ prices with the prices of other brands.

The market size in Turkey of private label products presently amounts to Turkish lira (TRY) 60bn ($10.2bn), the researchers found.

The share of private labels in total products sold at supermarkets grew by 30% in 2019, according to Imer Ozer, head of the Private Label Association of Turkey.

People are increasingly buying private label nappies, dairy products, margarine and vegetable oils, Ozer added.

Ozer also noted that private labels accounted for 50% to 70% of all products sold at discount stores whereas the corresponding figure for other regular large supermarkets was 5% to 12%.

As inflation rocketed amid Turkey's economic woes, officials regularly sounded warnings to shops not to exploit the situation by over-pricing, and in some areas even set up state-run fruit and vegetable stalls with prices that were guaranteed as low. Some critics dismissed the move as a pre-election ploy in advance of the March local elections. In those elections, the ruling AKP party did particularly badly in the cities as Turks protested about the state of the economy.

Turkish households’ consumption increased 1.5% on an annual basis in the third quarter of 2019 after contracting in the previous three quarters, according to the latest GDP data.

Households’ spending plunged nearly 8% y/y in Q4 of 2018 following the currency crisis, while the contraction was 4.9% y/y in Q1 and 1% y/y in Q2 last year.

News

_1758059076.jpg)

Trump brands Colombia a narcotics pariah as cocaine production hits record highs

Colombia has been branded a narcotics pariah by the Trump administration, receiving its first "failing to cooperate" designation since 1997 as record cocaine production and deteriorating US-Colombia relations reach a breaking point.

Fuel prices in Kyrgyzstan rocket as Ukraine steps up drone strikes on Russian refineries

Central Asian country relies on Russia for nine-tenths of its fuel.

El Salvador leads Latin America's democratic decline, global watchdog warns

The latest IDEA report warns El Salvador faces the fastest democratic erosion in Latin America, with security policies under Bukele raising concerns over freedoms, judicial independence, and long-term institutional damage.

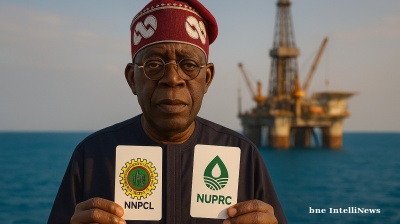

Nigerian president advances oil bill placing NNPCL under control of Finance Ministry, upstream regulator

President Bola Tinubu has endorsed a bill that would undermine the "independence" of NNPCL, shifting ownership to the Finance Ministry and handing new powers to upstream regulator NUPRC.