The European Bank for Reconstruction and Development (EBRD) invested a record €11bn in 411 projects in 2020, a 10% year-on-year increase, stepping up investments as the 38 economies where it invests were struck by the coronavirus (COVID-19) pandemic.

As COVID-19 cases rose across Europe in March, the EBRD adopted emergency measures to address the economic impact of the pandemic, becoming the first of the international financial institutions to do so. Its focus was on helping existing clients, for example by providing short-term liquidity and working capital to viable companies.

As well as its own investments, the development bank also directly mobilised €1.2bn from co-investors during the year. The private sector received 72% of total EBRD investment during the year.

“The bank put in an impressive performance and delivered on its promise to help our countries and clients deal with the economic impact of the COVID-19 pandemic. Our investments were sharply higher than the year before and we also provided policy support to help the private sector through the crisis,” said EBRD president Odile Renaud-Basso in a statement.

The bank also supported a record 2,090 trade finance transactions worth €3.3 billion under its Trade Facilitation Programme, that includes 90 issuing and 140 confirming banks across 40 countries, to help keep trade flows going as supply chains were disrupted by the pandemic. Among the transactions supported by the bank were imports of medicines from Spain, Turkey and Switzerland into Lebanon, Georgia and Jordan. In addition, it continued to support the development of local currency and capital markets with 113 projects.

The pandemic’s impact has not been uniform, and has added to existing inequalities, coming down especially hard on women, young people and other groups, according to the EBRD, which prompted the bank to increase inclusion projects by 24% to reach a total investment volume of €4bn.

There were some casualties as attention shifted to the pandemic; last year the share of green investment fell to 29% after reaching a high of 46% in 2019. However, in October the EBRD adopted its new five-year Strategic and Capital Framework, which aims to make it a majority green bank by 2025. The bank also launched its Just Transition Initiative to help protect communities, sectors and workers who stand to lose out economically as a result of policies associated with decarbonisation.

The Green Cities urban sustainability programme continues to expand. The EBRD doubled funding for the proogramme, and it has been extended to 44 municipalities across the bank’s area of operations by the end of 2020, with new entrants including the Polsh capital Warsaw. Also in coal-dependent Poland, which is struggling to embark on a green transition, the EBRD launched five major new renewables projects.

In 2020, the EBRD and other donors within the Western Balkans Investment Framework approved an additional €77.6mn in investment grants and technical cooperation for projects in the EU-aspiring region, which will be supported by a further €204mn in EBRD finance.

Also in the Western Balkans, the EBRD boosted support for small and medium-sized enterprises (SMEs) and the private sector, providing €729mn in loans to commercial banks for on-lending to local businesses to finance investments that will support the recovery and strengthen their competitiveness.

The development bank has been supporting regional connectivity and infrastructure, including through a €30mn loan to Kosovo to ensure the continuation of vital services, a €50mn senior loan to EPCG to support the stability of energy provision in Montenegro and an €85mn loan for Serbia to finance the construction of a new section of the “Peace Highway” to Kosovo.

Further east, major EBRD investments included a €450mn loan to Ukrainian state road agency Ukravtodor, supporting the government in the development of national road infrastructure and the fight against corruption.

It funded over $400mn worth of investments in the energy sector in the South Caucasus, including Armenia’s first renewable project Masrik Solar.

Its biggest infrastructure project outside the oil and gas sector in Central Asia was the Almaty ring road, for which the EBRD arranged a $585mn syndicated loan. In neighbouring Uzbekistan, the EBRD financed one of the first privately owned renewable energy projects, a 100 MW solar photovoltaic plant in the Navoi region.

The priority for the bank in Turkey was the provision of support to the real economy through engagement with local partner banks, to which it channelled a record €893mn, supporting thousands of businesses. It also provided both infrastructure support and funds for renewables in the energy sector.

The newer EBRD members in the southern and eastern Mediterranean (SEMED) region were badly hit by the pandemic. The bank’s response included the provision of €784mn in liquidity lines to local banks for on-lending to businesses in Egypt.

News

_1758059076.jpg)

Trump brands Colombia a narcotics pariah as cocaine production hits record highs

Colombia has been branded a narcotics pariah by the Trump administration, receiving its first "failing to cooperate" designation since 1997 as record cocaine production and deteriorating US-Colombia relations reach a breaking point.

Fuel prices in Kyrgyzstan rocket as Ukraine steps up drone strikes on Russian refineries

Central Asian country relies on Russia for nine-tenths of its fuel.

El Salvador leads Latin America's democratic decline, global watchdog warns

The latest IDEA report warns El Salvador faces the fastest democratic erosion in Latin America, with security policies under Bukele raising concerns over freedoms, judicial independence, and long-term institutional damage.

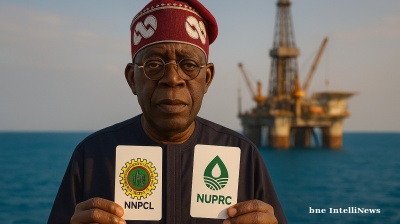

Nigerian president advances oil bill placing NNPCL under control of Finance Ministry, upstream regulator

President Bola Tinubu has endorsed a bill that would undermine the "independence" of NNPCL, shifting ownership to the Finance Ministry and handing new powers to upstream regulator NUPRC.

,_London,_United_Kingdom_02-2_Cropped.jpg)