By the end of 2023, the government of Moldova will apply for sovereign ratings from international agencies, in preparation for the placement of FX bonds on international markets, Prime Minister Natalia Gavriliţa said on January 17 in a show broadcast by TV8.

The high cost of debt nowadays, however, makes this an option of last resort, as the government said in the public debt management strategy recently published. It is not an impossible scenario, but only if the country fails to get concessionary lending for large infrastructure projects.

The country mulled the idea of tapping the market with a €500mn FX bond in 2019-2020 when the yields expected by investors would have reportedly been 3.0-3.3%.

According to Gavrilita, Moldova should first have draft infrastructure projects, and only afterwards seek to finance them with FX bonds. But such projects are highly likely to get financing from international financial institutions (IFIs) at much lower costs compared to what the country would have to pay on the market. The main benefit of such FX bonds would be building up a history and a market for Moldovan bonds.

"We now have [feasibility] studies in various sectors of the economy that identify such important infrastructure projects for the country. For example, we will start building a bridge in Ungheni, for which we have already found financing in the European Union,” mentioned Gavriliţa.

Regarding the launch of Moldovan FX bonds, the prime minister mentioned three important issues that the government must tackle first.

"Firstly, we should get a sovereign rating. After that, several important projects for Moldova will have to be selected, which can be implemented using the money raised from the placement of Eurobonds. And finally, the third task is to issue Eurobonds,” she said.

She admitted, however, that the current market circumstances are not great. She also mentioned that the bonds should be “green”.

"We must think and prepare for the placement of the so-called ‘green bonds’, which are attractive and applicable for our country," concluded the prime minister.

Such issues could, for instance, finance green energy projects, which Moldova particularly needs. However, such projects need prior revision of the regulatory framework, as the investors who developed such generation capacities are complaining.

News

Fuel prices in Kyrgyzstan rocket as Ukraine steps up drone strikes on Russian refineries

Central Asian country relies on Russia for nine-tenths of its fuel.

El Salvador leads Latin America's democratic decline, global watchdog warns

The latest IDEA report warns El Salvador faces the fastest democratic erosion in Latin America, with security policies under Bukele raising concerns over freedoms, judicial independence, and long-term institutional damage.

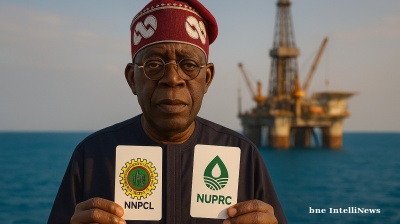

Nigerian president advances oil bill placing NNPCL under control of Finance Ministry, upstream regulator

President Bola Tinubu has endorsed a bill that would undermine the "independence" of NNPCL, shifting ownership to the Finance Ministry and handing new powers to upstream regulator NUPRC.

‘Tinder Swindler’ Simon Leviev detained in Georgia on Interpol red notice

Shimon Yehuda Hayut gained worldwide notoriety thanks to the 2022 Netflix documentary 'The Tinder Swindler', which detailed how he allegedly posed as the son of billionaire diamond tycoon to scam women he met on Tinder.

_1758026150.jpg)