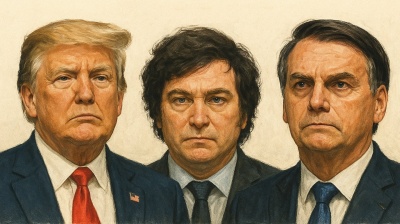

Argentine President Javier Milei has secured a commanding mandate to pursue his radical economic overhaul after his party, La Libertad Avanza (LLA), scored an impressive victory in the make-or-break October 26 midterm elections. LLA obtained almost 41% of the national vote, surpassing the rosiest projections and defeating the Peronist opposition by nine percentage points.

The result vindicates the self-styled “anarcho-libertarian” economist, who came to power in 2023 as a political upstart with minimal legislative support. His party held just 40 of 257 seats in the Chamber of Deputies and six of 72 in the Senate, severely constraining his ability to implement his ambitious reform agenda.

The midterms, widely deemed the real litmus test for Milei, redistributed half the seats in the lower house and a third in the upper house, with LLA increasing its representation to 101 and 19 respectively.

Such a decisive outcome appeared unlikely just weeks before polling day. Argentina had endured months of political turbulence during the summer. Karina Milei, the president's sister and close adviser, faced corruption charges linked to leaked audio recordings, which she vehemently rejects.

More damagingly, LLA suffered defeat to the Peronists in September's Buenos Aires provincial election, led by Governor Axel Kicillof, an erstwhile finance minister for former president Cristina Fernandez de Kirchner who is betting on a fresh start as a leftist rising star despite his dismal economic track record. That loss triggered a sell-off in Argentine government bonds and a sharp depreciation of the peso. Mistrust of Milei personally climbed to its highest level since his inauguration, with polling showing just 34% of Argentines believing in a better future, down from 48% the previous year.

Critics from the left had long denounced the social costs of Milei's stabilisation programme: whilst inflation had been tamed – it has fallen from triple digits to around 30% annually, while the economy has posted two consecutive quarters of growth for the first time since 2022 – real wages had fallen 20%, and Buenos Aires has become more expensive than New York for many goods and services.

Yet most pollsters had consistently predicted an LLA victory, if not the eventual margin. The opposition's failure stemmed partly from its inability to offer voters a coherent alternative beyond reversing Milei's reforms. The spectre of Peronism in its free-spending form, associated with currency devaluation and financial unpredictability, proved more alarming than criticisms of the incumbent.

Turnout stood at just 68%, the lowest since democracy was restored in 1983, suggesting that committed ideological supporters rather than swing voters determined the outcome. And Milei commanded more of them.

The $20bn swap agreement with the Trump administration and the US Treasury's commitment to source an additional $20bn from private creditors appear to have been decisive in convincing voters that Milei would have the resources to deliver his reforms. The libertarian leader, a darling of US President Donald Trump, has been given a clear mandate for a new round of radical reforms, though his next steps will likely involve some difficult compromises.

The extraordinary US support, which sparked controversy at home, extended beyond financial commitments. Washington intervened to prop up the falling peso with $1bn in purchases, helping Milei avoid the political fallout from a currency collapse in the campaign's final stretch.

The libertarian win also offers crucial assurance to the International Monetary Fund, which backs the government's commitment to austerity under a $44bn programme, bolstered by a further $20bn after a successful renegotiation earlier this year. Milei's continued adherence to fiscal discipline is vital for Argentina, whose total exposure to the fund is estimated at $55bn, to secure expected disbursements. In a veiled endorsement for Milei, IMF Director Kristalina Georgieva had urged Argentines to "stay the course" to ensure the will for change was not derailed by political headwinds.

The decisive result was naturally welcomed by financial markets, as it reduces the risk of Argentina abandoning its commitment to fiscal discipline. Investors, who had previously priced Argentine sovereign bonds at distressed levels, now expect risk assets to benefit from renewed political stability and the strong potential for pro-market structural changes.

Argentine stocks traded offshore surged immediately, including shares in Banco Galicia, BBVA, and the national oil company YPF. The peso appreciated almost 5% against the dollar, whilst bonds maturing in 2035 jumped 13 cents to a record 70.34 cents. This momentum is expected to move strongly in Argentina's favour, aiding foreign exchange reserve accumulation and leading to a marked decline in interest rates. Investors seem to believe the government now has the leverage needed to break Argentina's notorious cycle of policy reversal.

Yet confidence remains tied to the prospect of sweeping reforms – including reduced pension costs, simplified tax systems, and more flexible labour laws – that could unlock much-needed foreign direct investment. Whilst Milei took some encouraging steps, like the Incentive Regime for Large Investments (RIGI) approved last year, for the country to emerge as a true destination for long-term investments, legislative consensus remains paramount.

According to government insiders quoted by La Nación, the economic programme includes a clear timetable for what officials call the "reform triangle". The privatisation agenda for state-owned companies such as Aysa, Enarsa, and Trenes Argentinos was stipulated for implementation by mid-November. A proposal for comprehensive structural tax reform, aimed at improving efficiency and streamlining the tax system, is scheduled to be developed and shared with IMF staff by the end of December. The reform proposal for promoting labour formalisation is scheduled for presentation to Congress in 2026, whilst a review and proposal for pension system reform, intended to simplify the fragmented system and improve sustainability, is scheduled for submission to Congress in December 2026.

But despite the electoral triumph, Milei now faces the immediate challenge of proving he can weave durable political alliances. His party still lacks an outright majority in both legislative chambers, meaning he must secure allies to push through significant policy changes. While LLA is now powerful enough to fend off presidential vetoes against any attempted overrides by the Peronist opposition, the path to passing laws will have to go through deals with the political centre.

LLA and its closest allies, the centre-right PRO party led by former president Mauricio Macri, together hold 104 seats in the Lower House, narrowly short of the 129 seats required for a simple majority. Analysts cited by Reuters suggest this collaboration could form a "workable but fragile vehicle for reform," potentially susceptible to disruption by regional negotiations or personal rivalries.

To achieve a quorum and pass legislation, though, the government must secure support from additional legislators. The ruling party needs at least 25 deputies to complement their bloc of 104 seats, likely drawing from the 50 legislators comprising the centre bloc, which includes members of the Radical Party and governors of the United Provinces. In the Senate, LLA and its allies are expected to hold 24 seats, but will need to compete for the votes of 20 unaligned senators, requiring support from "at least two radicals" to approve the key structural reforms before the end of 2027.

Milei has dovishly signalled willingness to negotiate, proposing new talks with provincial governors and expressing a desire to collaborate with any party holding "points of agreement". However, these overtures have been met with caution by political opponents.

This scepticism is fuelled by the libertarian leader's unwavering adherence to his ideologically driven “core policies.” Some officials question Milei's capacity for consensus, believing he is unlikely to compromise on core principles such as fiscal austerity, state reform, and deregulation.

Structural reforms, particularly labour market changes, present a tough challenge because they may prove unpopular with the wider public. The opposition also argues that Milei's “open customs” policies hinder domestic production, as reflected by factory closures caused by cheaper imports.

Despite the post-election rally in risk assets, currency stability remains a significant hurdle. Many economists view the peso as overvalued relative to economic fundamentals – and according to macroeconomic textbooks, it certainly is. The currency's post-election appreciation, whilst welcomed by markets, intensifies concerns about competitiveness.

Milei will likely need to make room for further depreciation to restore the export potential of Argentine goods, a growing concern given the decline in industrial production, one of the principal complaints against his government. Sticking to the current managed-float exchange rate regime could leave the peso severely misaligned, complicating efforts by the central bank to rack up the necessary foreign reserves needed to service debt obligations, including at least $18bn due in 2026. Analysts caution that the government's commitment to accumulate $4bn in international reserves by year-end is "quite optimistic" under present conditions.

The real challenge for Milei now is to engineer a currency adjustment without triggering the political backlash that nearly derailed his campaign just weeks ago. How quickly he escapes this bind will determine whether his mandate delivers the lasting economic transformation Argentina sorely needs.