Ukraine is in urgent need of additional financing from partners as the continuation of the war drives up defence spending and reconstruction needs, jeopardizes budget financing, weighs on the balance of payments, and slows economic growth.

The budget gap for 2025-28 is assessed at around $53bn, nearly double the July projection, largely reflecting higher expenditures on defence and social protection during the war and thereafter, according to the latest Ukraine Macroeconomic Handbook by KSE Institute.

This is broadly consistent with the IMF’s $65bn number for 2026-29. To preserve macro-financial stability, Ukraine urgently needs a new IMF program and the adoption of the proposed €140bn Reparation Loans from the EU and other G7 partners. Importantly, the loan would be non-interest bearing and repaid only after reparations from Russia are received, thereby supporting debt sustainability. Rising defence and social spending remain the main drivers of the deficit.

Ukraine’s near-term growth outlook has weakened due to intensified defence and energy sector repair needs. Weak performance in the first half of the year, with GDP growing only 0.8% y/y, and renewed Russian attacks on energy infrastructure weigh on economic activity, offsetting recent positive signs in the manufacturing and construction sectors.

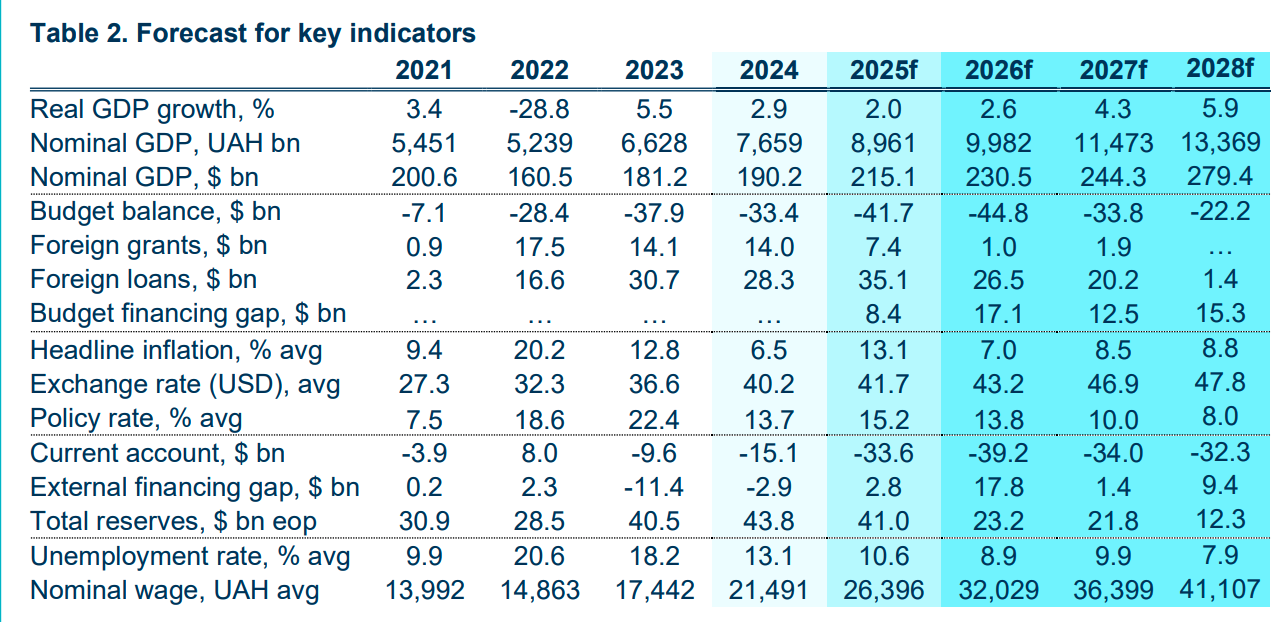

KSE Institute forecasts 2025-26 GDP growth in the 2-2.5% range, followed by a post-war rebound of 4.3% and 5.9% growth in 2027 and 2028, respectively. The post-war recovery will require sufficient investment, however, as growth will primarily be driven by capital formation. An investment-driven expansion, infrastructure reconstruction, and industrial renewal all require more effective attraction of both foreign and domestic capital to unlock the Ukrainian economy’s full potential.

Ukraine’s widening trade deficit poses a growing challenge. Higher-than-anticipated imports—partially due to weapons purchases, electric vehicles, and untaxed small parcels—contribute to an increasing trade deficit. The deficit is now projected to reach $42bn in 2025 and is expected to remain seriously elevated over 2026-28.

Closing the deficit will be quite challenging as imports are now effectively twice the size of exports, which means that the latter must grow at twice the rate of the former just to maintain the gap in absolute terms. Together with the war’s impact on capital flows and a projected sharp drop in committed foreign support, the trade deficit will dramatically reduce reserves to $12.4bn at the end of 2028.

Budget pressures remain substantial amid elevated defence and security spending, with the fiscal financing gap projected to reach $53.3bn over 2025-28. The cumulative budget deficit is forecast to be $142.5bn during the period, with currently committed financing significantly lower at $89.4bn—largely under the EU’s Ukraine Facility and the ERA mechanism—opening up a significant financing gap that must be addressed by Ukraine and its international partners. Spending on defence is projected to rise to $83bn in 2025. Although the defence spending is expected to gradually decline after the assumed end of the war in 2026, its share in total public expenditure will remain substantial, as Ukraine will need to maintain deterrence against future Russian aggression and rebuild depleted weapons stocks.

Inflation continues to ease, supported by prudent monetary policy, and the exchange rate remains broadly stable with gradual depreciation expected in 2026. Headline inflation fell from its peak of 15.9% in May 2025 to 11.9% in September, driven by stable food and energy prices and the NBU’s tight monetary stance. It is expected to continue its downward trajectory through 2026, before increasing in 2027 as the recovery gains steam. The NBU maintained its key rate at 15.5%, which has anchored expectations, with significant easing anticipated only once inflation drops below 10%. Meanwhile, the Hryvnia remained broadly stable around 41-42 UAH/$, aided by sustained NBU interventions and foreign assistance inflows; however, it is projected to devalue to ~45 UAH/$by the end of 2026 amid foreign support concerns.

Government-identified priority recovery funding vs. actual financing

|

Sector |

Requested ($bn) |

Funded ($bn) |

|---|---|---|

|

Energy |

3.4 |

1.1 |

|

Housing |

2.3 |

0.2 |

|

Critical and social infrastructure |

2.1 |

0.3 |

|

Humanitarian demining |

0.9 |

0.1 |

|

Economic recovery |

1.5 |

0.5 |

|

Other |

5.3 |

2.2 |

|

Total |

15.5 |

4.4 |

Disbursement of international recovery funding by source (2023–2025)

|

Donor / Institution |

Pledged ($bn) |

Disbursed ($bn) |

|---|---|---|

|

EU |

6.0 |

2.4 |

|

USA |

3.2 |

1.1 |

|

World Bank |

2.5 |

1.6 |

|

Japan |

1.5 |

0.4 |

|

EBRD / EIB |

1.0 |

0.3 |

|

Other bilateral donors |

1.3 |

0.6 |

|

Total |

15.5 |

6.4 |

Read the full report here.

The Kyiv School of Economics (KSE) is a bne IntelliNews media partner and a leading source of economic analysis and information on Ukraine. This content originally appeared on the KSE website.

Features

PANNIER: Ruling family’s ‘palace in the sky’ cruel sight for Turkmenistan’s poor souls down below

Photos posted of renovated Boeing by US makeover manager offer further insight into "ultra-luxurious" world enjoyed by Berdimuhamedovs.

Russia tax service targets Russian accounts in UAE

The Russian Federal Tax Service (FTS) has ramped up its scrutiny of Russian nationals holding accounts in the United Arab Emirates, following the effective implementation of automatic tax information exchange between the two countries.

INTERVIEW: Can Albania’s tourism miracle last?

As social media brings in the crowds, the head of the Albanian Tour Operators Association tells bne IntelliNews Albania should turn away from mass-market tourism and focus on higher-value offerings.

COMMENT: Taiwan’s equality paradox - when “progressive” doesn’t mean equal

Taiwan’s insistence that women should have access to every privilege of citizenship - from political office to professional advancement - but not its responsibilities, undermines the moral foundation of its democracy.