Russia’s Finance Ministry has projected a federal budget deficit of RUB5.7tn ($63.6bn) in 2025, or 2.6% of GDP, based on expected expenditures of RUB42.8tn and revenues of RUB37.1tn. But according to budget execution data and historical trends, that forecast is highly optimistic, says Janis Kluge, a fellow at the Stiftung Wissenschaft und Politik (SWP) in Berlin.

In January-October 2025, Russian budget spending was RUB34.1 trillion rubles, while revenues amounted to RUB29.9 trillion rubles, according to the latest data from Russia’s Finance Ministry. For the full year, the ministry expects expenditures of RUB42.8 trillion rubles and revenues of RUB37.1 trillion rubles. This results in a deficit of RUB5.7 trillion rubles, said Kluge in a substack post.

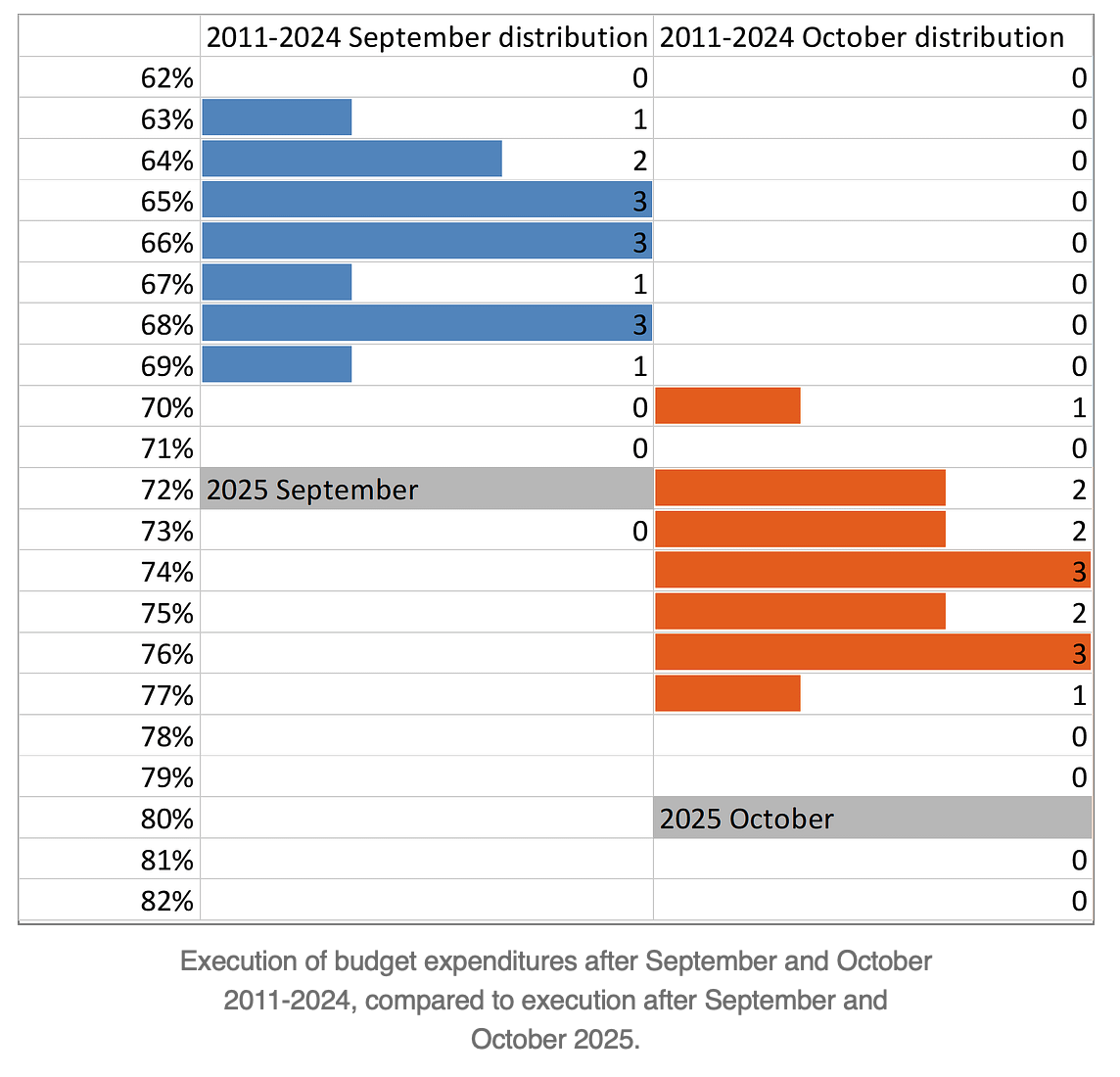

"By the end of October, Russia had already spent 80% of the annual budget. That’s unusually high," Kluge observes. "If they stick to the planned RUB42.8tn for the year, then September and October spending would fall well outside any historical pattern."

From 2011 to 2024, the average execution rates for those months were 66% in September and 74% in October. But in 2025, Russia had already surpassed those benchmarks by several percentage points.

Kluge adds that historical data suggests actual spending is likely to reach at least RUB45.2–RUB45.3tn, overshooting the target by up to RUB2.5tn.

Spending is running hot, driven up by expanding military costs, but the performance of revenues coming in is the same as normal.

There was a slight 0.3% deviation in October, according to Ministry of Finance (MinFin) data, but Kluge argues that the mushrooming spending trajectory will push the deficit to 3.5% of GDP, nearly a full percentage point higher than the official estimate. The risk, he says, lies not just in the overspend but in the political and fiscal implications of quietly exceeding the government’s stated targets.

Still, with just over a month to go, there are still some uncertainties both on the upside and downside. December is traditionally the big spending month for the Russian budget as several annual payments are made. At the same time, it is a big month for end-of-year tax collections – typically 20% of the entire year’s spend happens in December alone.

After the disastrous budget deficits at the end of 2022, which blew out to record levels, MinFin has tried to smooth the curve somewhat by spreading some payments across the year. There are some new tax payments to collect, so the end result is still not clear.

Certain taxes—like the utilisation fee and personal income tax—were raised and are typically settled in the final quarter. These may lift year-end revenues. Conversely, mineral extraction tax and VAT on imports have underperformed, offsetting gains.On the expenditure side, Russia may attempt to limit defence outlays.

"There are signals of a slowdown in sectors related to the arms industry," Kluge notes, but he cautions against reading too much into it. "The appearance of reduced output is likely a result of shrinking civilian production, not a pullback in weapons manufacturing."

Officials in Moscow have previously claimed to have pre-paid for weapons contracts, theoretically dampening year-end spikes. But similar claims were made in 2023, only for November and December to account for over 25% of the full-year spend. In 2025, for the Finance Ministry’s projection to hold, those two months would need to deliver no more than 20%, a threshold Kluge calls "highly unusual".

One remaining lever is to defer expenditures into 2026, effectively shifting part of the fiscal burden forward. Still, the overall picture points to overspending.

"Despite all the disclaimers, the most likely scenario is a significant budget overrun. It will be interesting to see how and when the Finance Ministry begins to communicate this," Kluge says.

Opinion

Corruption and lack of competitiveness threaten fast-track EU enlargement

wiiw study says candidate countries must accelerate deep economic and institutional reforms if they hope to meet ambitious timelines for EU accession.

UBN: Energoatom scandal hurts Ukraine, benefits the Kremlin

The $100bn Energoatom corruption scandal that broken on November 10 has caused outrage in Ukraine. It has hurt Ukraine's reputation and benefited the Kremlin, says UBN's editorial team.

COMMENT: Finland’s President Stubb lists the three obstacles to a Ukraine ceasefire

Finland’s President Alexander Stubb has warned that a ceasefire in Russia’s war against Ukraine is unlikely to materialise before spring, and urged Western allies to sustain support for Kyiv despite recent corruption scandals.

COMMENT: Trump was “sent by heaven”, Russia is a “God-given” neighbour, says Kazakhstan’s president. What's cooking?

With White House and Kremlin visits in the space of six days, pressure was on Kassym-Jomart Tokayev to pull off a masterclass in multi-vector foreign policy.