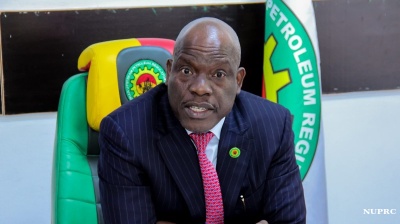

Interview with Heirs Energies Executive Director and Chief Financial Officer Samuel Nwanze

Heirs Energies is one of Africa’s fastest-growing indigenous integrated energy companies and a subsidiary of Nigeria's privately held Heirs Holdings Group, which has diversified investments across key sectors including energy, finance, and healthcare. The company says it is dedicated to powering Africa’s growth through sustainable investments and responsible resource development. Its flagship asset, Oil Mining Licence 17 (OML 17) - among Nigeria’s largest onshore oil and gas fields - is operated as a joint venture (JV) with the Nigerian National Petroleum Company Limited (NNPCL).

NewsBase spoke exclusively to Samuel O. Nwanze, Executive Director and Chief Financial Officer of Heirs Energies and Chief Investment Officer of Heirs Holdings Group. With extensive experience in finance, investments, and corporate leadership, he spearheaded the landmark acquisition of a 45% interest in OML 17. Nwanze previously held senior roles at Heirs Holdings, HH Capital, Tenoil Energy, and Bank PHB, with his career spanning multiple sectors, including oil and gas, power, agriculture, and financial services across Africa and internationally.

NewsBase: You were at the helm of structuring the OML 17 acquisition. What strategies did you deploy, and what challenges did you encounter, to secure financing for one of the largest indigenous-led deals in Nigeria?

Samuel Nwanze: The acquisition of a 45% operating interest in OML 17 was indeed a landmark transaction, and securing the financing required a multifaceted strategy built on credibility, a compelling value proposition, and robust risk mitigation.

Our approach was fundamentally about telling a compelling story that went beyond the immediate asset. We positioned OML 17 not just as a collection of oil wells, but as a strategic national asset with immense untapped potential. Our pitch to financiers focused on the significant scope for production growth through our “Brownfield Excellence” model and, crucially, the underutilised gas resources that aligned perfectly with Nigeria's domestic energy needs. This narrative of enabling national energy security and economic development greatly expanded the deal's appeal beyond a simple commodity play.

A cornerstone of our strategy was demonstrating the strength and stability of our partnership with the NNPCL. The 55/45 JV provided a legitimate framework that gave international lenders confidence. We complemented this by proving that Heirs Energies was a committed, long-term operator, not just a financial sponsor. We presented a detailed operational plan and a seasoned leadership team, which was crucial in assuring lenders that their capital was backed by both technical expertise and strong governance.

Of course, a transaction of this scale is never without its challenges. We were navigating a complex macroeconomic and regulatory environment. The true test of our financial structure came with its ability to adapt. While we secured an initial $2.5bn facility, demonstrating strong market confidence, we later proactively optimised it to a $1.1bn package to fit with the complement of assets we secured approvals for. Whilst this was a setback, it was a strategic demonstration of our fiscal discipline and our commitment to de-risking the investment for the long term, ensuring the capital structure was perfectly aligned with the asset's cash flow profile and our phased development plan.

NewsBase: How did Heirs Energies achieve such rapid growth at OML 17, doubling production to 50,000 bpd within 100 days?

Samuel Nwanze: That rapid turnaround was a powerful demonstration of our operational philosophy in action. It wasn't about magic; it was about a disciplined focus on unlocking the inherent value that was already within the asset. When we took over, we saw significant potential that was lying dormant, and we moved with speed and precision to activate it.

The first thing we did was deploy our entirely Nigerian technical team to conduct a swift and thorough assessment. We prioritised low-risk, high-impact activities, primarily focusing on reactivating wells that had been shut-in but were otherwise viable. This required a meticulous approach to well integrity and production system optimisation. We also implemented a relentless focus on production efficiency and maintenance, ensuring that once we brought barrels online, they stayed online.

Critically, this success was rooted in our people and our approach. We empowered our local team, who have an intimate understanding of the terrain, to make decisions quickly. We also worked diligently from day one to build trust with the host communities, ensuring a stable operating environment. By combining this social licence with our technical execution, we were able to achieve what many thought was impossible in that timeframe. It was a clear proof of concept that our Brownfield Excellence strategy - applying disciplined management and local expertise to existing assets - can deliver transformative results.

NewsBase: What lessons from the OML 17 acquisition would be particularly relevant for other African energy independents aiming to execute similar deals?

Samuel Nwanze: The journey with OML 17 offered several profound lessons that I believe are essential for any African independent looking to step into this space. Beyond the technical and financial specifics, it really comes down to a fundamental shift in mindset.

One critical lesson is the absolute necessity of operational readiness long before the deal is even closed. You cannot wait for the ink to dry to start planning how you will run the asset. We had our full management and technical team embedded in the planning process, with a clear, 100-day plan drafted and ready for execution from day one. This meant we could hit the ground running, avoiding the value erosion that so often happens during a prolonged transition period. The new operator must be ready to perform from sunrise on the first day.

Another key takeaway is the importance of financial foresight. It’s not enough to secure capital for the acquisition alone. You must structure your financing with the future in mind - accounting for the essential capital expenditure required to grow the asset, meet decommissioning liabilities, and navigate inevitable market cycles. Your financial partners need to share this long-term vision, providing a flexible structure that allows you to adapt and invest through different phases of the asset’s life, rather than constraining you.

Finally, and perhaps most importantly, is to view local content and community engagement not as a regulatory hurdle, but as the very foundation of your social licence to operate and a direct source of competitive advantage. By building a 95% indigenous contractor base and investing in trust with host communities, we created a stable operating environment that enabled our rapid production growth. This locally rooted model builds resilience, fosters goodwill, and ultimately de-risks the investment in a way that is incredibly attractive to international partners and financiers who are increasingly focused on ESG principles. It transforms a potential challenge into your greatest strength.

NewsBase: With 100% of the gas produced from OML-17 going into the domestic market, what role does domestic gas distribution play in the company’s growth and sustainability plans?

Samuel Nwanze: The decision to dedicate 100% of our gas to the domestic market is a strategic pillar that sits at the very heart of our identity and our long-term vision. It is far more than a revenue stream; it is the foundation of our integrated business model and our tangible commitment to the philosophy of Africapitalism - the belief that the private sector’s most powerful role is to drive Africa’s economic and social transformation.

For our growth, domestic gas provides a stable and predictable financial foundation. Unlike the volatile international oil markets, gas supplied under long-term domestic agreements offers revenue visibility, which is crucial for prudent financial planning and reinvestment. This stability allows us to de-risk our operations and fund future exploration and production activities with greater confidence. It transforms a by-product into a strategic economic engine.

Crucially, this strategy is our operational embodiment of both sustainability and the core tenets of Africapitalism. We are actively contributing to a lower-carbon future for Nigeria by providing a cleaner alternative to diesel and other fuels for industries and power generation. This aligns with the “environmental stewardship” principle of Africapitalism. More fundamentally, by fuelling the plants that power the national grid, we are directly tackling energy poverty - the most critical barrier to entrepreneurship and economic diversification on the continent.

This is where our strategy becomes a direct expression of our Chairman, Tony O. Elumelu’s investment philosophy. We are not just extracting resources; we are “powering” Africapitalism itself. Reliable gas supply empowers the small and medium-sized enterprises (SMEs), the “Tony Elumelu Foundation Entrepreneurs,” and the large-scale industries that create jobs and build social wealth. We are enabling the ecosystem for entrepreneurship to thrive, thereby embedding our business within the sustainable and prosperity-creating development of the nation.

This aligns perfectly with Nigeria’s “Decade of Gas” initiative, and our plans to ramp up gas production to 200 mmcf (5.66 mcm) per day in the next five years underscore our commitment. We see ourselves as a key partner in building the infrastructure and capacity that will allow Africa to harness its own gas resources for its own prosperity. In this way, our corporate growth is intrinsically linked to the continent's growth, fulfilling the core Africapitalism mandate that “what is good for Africa, is good for business.”

NewsBase: Could you describe the investment strategy that guides Heirs Energies' approach to African energy markets in upstream, gas, and power sectors?

Samuel Nwanze: Beginning upstream, we strategically target assets with foundational potential, like OML 17. We see these not merely as oil fields, but as integrated energy hubs. Our focus is on applying our operational expertise to unlock immediate value, which in turn generates the capital and provides the critical resource base - especially gas - to fuel broader economic growth.

This brings me to the core of our strategy: gas. We have made a deliberate and strategic commitment to the domestic market. While we do supply gas to our sister companies like Transcorp Power and TransAfam Power, ensuring reliability and efficiency within our ecosystem, a significant portion of our gas also powers other major plants, such as First Independent Power Limited and Geometric Power, which are key players in the Eastern Domestic Network. This allows us to create a stable, predictable revenue stream while simultaneously fulfilling a larger social mandate: to be a cornerstone of Nigeria's industrialisation and energy security. We are not just a supplier; we are a partner in national development.

Ultimately, this creates a virtuous cycle. A strong upstream funds gas development, and reliable gas supply enables power generation - both within our group and for the wider market. This powers homes, fuels industries, and creates jobs. It's a business model that is commercially sustainable precisely because it is socially impactful, perfectly embodying the Africapitalism vision where our success is intrinsically linked to the prosperity of the communities and economies we serve.

NewsBase: What are the key risk management and capital deployment strategies that Heirs Energies adopts when investing in complex oil and gas projects in Africa?

Samuel Nwanze: Navigating complex energy projects in Africa requires a disciplined and proactive approach to risk, one that is deeply integrated with our capital allocation philosophy. For us, risk management is not a separate function; it is the foundation of our investment strategy.

Our framework begins with a rigorous, pre-emptive identification of risks across the entire spectrum - technical, regulatory, political, and commercial. We conduct exhaustive due diligence, but we go a step further by stress-testing our financial models against a range of scenarios, including downside cases. This allows us to understand the true resilience of an investment before we commit. A key part of this is our deep focus on the operating environment. We view our relationship with host communities not as a peripheral issue, but as a core strategic risk- and opportunity. By investing in trust and shared prosperity, we build a vital social license that secures our operations and de-risks the asset for the long term.

This cautious approach directly informs our capital deployment. We are strong believers in phased investment. Rather than deploying a large lump sum upfront, we allocate capital against clear, measurable milestones. This creates a discipline of performance, ensuring that capital is released only as value is demonstrably unlocked. It effectively contains risk and prevents over-exposure before an asset has proven its potential.

Furthermore, our strong balance sheet and proven access to capital, as demonstrated with the OML 17 financing, provide us with strategic optionality. This financial strength means we can weather volatility and still have the capacity to seize complementary opportunities without compromising our core operational funding. In essence, our strategy is to be both prudent stewards of capital and agile partners, ensuring that every dollar deployed is done with a clear view of both its financial return and its contribution to our long-term, integrated vision for African energy.

NewsBase: Looking ahead, how does Heirs Energies plan to expand across Africa, and what role do impact-driven investments and strategic partnerships play in that vision?

Samuel Nwanze: Our expansion across the continent is a natural evolution of our mission, and it will be guided by the same principles that have shaped our success in Nigeria: discipline, integration, and a deep commitment to Africapitalism.

We are not pursuing growth for growth's sake. Our strategy is to identify and replicate our integrated model in new markets where we can create systemic value. This means seeking assets -particularly in the upstream and gas sectors - that can serve as anchor platforms, similar to OML 17. The goal is to establish new strategic hubs where we can apply our operational expertise to unlock value and then build out the domestic gas and power linkages that are so critical for local economies.

In this expansion, strategic partnerships are absolutely essential. We do not see ourselves as a lone operator. Our approach is to collaborate with national oil companies, host governments, and other established players who share our long-term vision for sustainable development. These partnerships are a powerful risk-mitigation tool, combining local knowledge with our technical and managerial expertise. They allow us to align interests, share capabilities, and collectively undertake the significant investments required to transform a region’s energy landscape.

Ultimately, for us, impact investment is not a separate initiative; it is the very engine of our commercial strategy. An investment that powers industries, creates jobs, and builds local capacity is an investment that creates a stable, prosperous, and growing market for our own products and services. This is the core of Africapitalism - where our success as a company is inextricably linked to the economic prosperity we help generate. This is the blueprint we are excited to share and refine with future partners across the continent, and a central theme of our discussions at African Energy Week in Cape Town.

News

Brazil's Lula "horrified" as Rio police raid death toll reaches at least 130

Brazilian President Luiz Inácio Lula da Silva expressed shock at the fatalities from a massive police operation targeting Rio drug gangs that left scores dead, while residents and rights advocates accused authorities of summary executions.

Nigeria's NNPCL weighs technical equity partnerships to revive idle state-owned refineries

NNPCL is reviewing options to bring the Port Harcourt, Warri and Kaduna refineries back into meaningful operation, possibly by bringing in technical equity partners to upgrade or repurpose units.

Situation critical in Ukraine’s frontline key logistics hub Pokrovsk

Russian infantry units have breached Ukrainian defensive lines and entered the key eastern logistics hub of Pokrovsk, sparking intense street fighting and threatening to encircle Ukrainian forces as the situation becomes "critical."

Viktor Orban facing delicate balancing act to persuade Donald Trump to ease pressure on Hungary over Russian sanctions

The Hungarian prime minister, long admired in MAGA circles and hailed by Donald Trump as a “great leader” now finds himself for the first time at odds with the US president over the latest US sanctions on Russia.