More than 250 companies have registered an interest in listing on the Tehran Stock Exchange (TSE), a market that has tripled in size over three years, IBENA reported on September 7.

Despite the hammering the Iranian economy has taken in the past two years from heavy US sanctions and more lately from the coronavirus (COVID-19) crisis, many Iranians have sought refuge in the country’s stock market—high inflation and a collapsing local currency cause those who hold cash to lose money at a rapid pace, thus wagering on the TSE is seen as offering a hedge against this risk with assets that remain liquid, partly thanks to the government’s commitment to back the bourse via its privatisation programme. Nevertheless, there are those who say the exchange’s benchmark index, the TEDPIX, is a bubble that has gone much too far and threatens to explode over the heads of somewhat desperate investors with a juddering correction.

The TEDPIX for the first time climbed above two million points on August 2—widely seen as an astonishing milestone to hit given that it had only broken through the 1.5mn points barrier on June 30 and the one million threshold in early May, soaring from around 500,000 in March—but by the end of August 18 showed 1.825mn points. By the end of September 9, it stood at 1.607mn points, having lost 40,586 points or 2.46% on the day.

‘W-shape’ rebound?

However, despite the substantial retreat, some investors believe the TSE might ascend once more on the last part of a ‘W-shape’ rebound in the next few months as more cheap shares enter the market.

Iranian Deputy Industry Minister Saeed Zarandi informed media of the 250 companies in the queue for a potential initial public offering (IPO).

The banking system, he said, had announced that IRR3.25qn ($77.4bn at the free market rate) would be available in financing for companies during the current Persian year (ends March 20, 2021) but the corporate sector would probably need towards double that, meaning raising money on the bourse was an appealing option for many companies, he noted.

In early June, Zarandi said that 100 industrial firms were expected to list on the TSE by the end of the calendar year, but more are now apparently looking to get a piece of the action.

News

Fuel prices in Kyrgyzstan rocket as Ukraine steps up drone strikes on Russian refineries

Central Asian country relies on Russia for nine-tenths of its fuel.

El Salvador leads Latin America's democratic decline, global watchdog warns

The latest IDEA report warns El Salvador faces the fastest democratic erosion in Latin America, with security policies under Bukele raising concerns over freedoms, judicial independence, and long-term institutional damage.

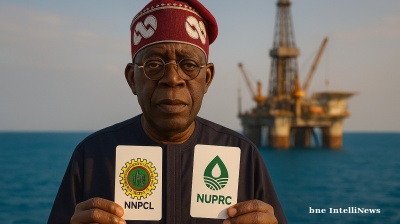

Nigerian president advances oil bill placing NNPCL under control of Finance Ministry, upstream regulator

President Bola Tinubu has endorsed a bill that would undermine the "independence" of NNPCL, shifting ownership to the Finance Ministry and handing new powers to upstream regulator NUPRC.

‘Tinder Swindler’ Simon Leviev detained in Georgia on Interpol red notice

Shimon Yehuda Hayut gained worldwide notoriety thanks to the 2022 Netflix documentary 'The Tinder Swindler', which detailed how he allegedly posed as the son of billionaire diamond tycoon to scam women he met on Tinder.

_1758026150.jpg)