Russia's consumer price index (CPI) posted a growth of 0.2% month-on-month in July, with year-on-year inflation slowing to 4.6%, according to the data of the Rosstat agency. The m/m inflation was below the consensus expectations of 0.2%. In y/y terms inflation was in line with expectations and on the way to converge to the Central Bank of Russia (CBR) target of 4%.

The current CBR target is 4.2%-4.7% for 2019. A Reuters analyst survey at the end of July had an inflation forecast of 4.2% for 2019 and 3.9% for 2020. Previously the Ministry of Economic Development argued that inflation could overshoot below 4% already in 2019.

Commenting on July 2019 data, Sberbank CIB wrote that "core inflation (which does not include seasonally volatile prices for fruits and vegetables, regulated tariffs and fuel), a proxy for monetary inflation, remained at 0.2% m-o-m for the second month in a row."

"This means that annualized inflation... was down to only 2.9%," Sberbank argues, expecting the y/y inflation to end the year 2019 in the range of 3.8-4.2%.

As reported by bne IntelliNews, in the end of July inflation-minded CBR cut the key interest rate for the second time this year to 7.25%. The regulator is expected to make at least one more cut by the end of the year, and the recent update of US sanctions against Russia does not seem to pose risks to CBR's plans to transit to moderately loose monetary policy.

"Russia's low inflation and sluggish economic growth serve as arguments for the CBR to cut the key rate in September despite the ruble's depreciation in early August due to geopolitical tensions," Sberbank CIB argues.

The bank does not think that, "the weaker ruble would have a significant effect on the inflationary trends in the coming months, as household demand remains very weak."

Data

Chobani yoghurt king Hamdi Ulukaya becomes richest Turk

Knocks Murat Ulker into second place in Forbes ranking as his company's valuation leaps to $20bn.

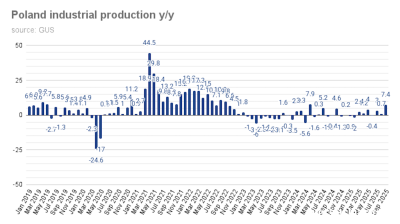

Poland’s industrial production jumps 7.4% y/y in September

September saw an unexpectedly sharp increase in industrial production after the surprise gain of 0.7% y/y in August.

Ukrainian M&A market grows 22% despite war, driven by local investors

Two large acquisitions by agriculture holding MHP and mobile operator Kyivstar accounted for more than half of the total deal value.

Ukraine’s credibility crisis: corruption perception still haunts economic recovery

Despite an active reform narrative and growing international engagement, corruption remains the biggest drag on Ukraine’s economic credibility, according to a survey by the Kyiv International Institute of Sociology.

_2_1761012864.jpg)