Hungary’s central bank maintained its key policy rate at 6.5% on October 21, with the overnight deposit rate at 5.5% and the overnight collateralised lending rate at 7.5%, in line with market expectations. The key policy rate has been unchanged since September 2024.

The Monetary Council’s decision was unanimous, with no dissenting votes, and the forward guidance was left unchanged, signalling a continued commitment to strict and cautious monetary policy to ensure price stability.

According to the National Bank of Hungary (MNB), inflation is expected to fall back into the tolerance band by early 2026, with the 3% target sustainably achievable in early 2027 under the current strict policy settings.

MNB Governor Mihaly Varga emphasized that maintaining the stability of the Hungarian forint is crucial for curbing inflation and anchoring inflation expectations, well above the headline figure and MNB’s target. The strengthening of the currency, gaining more than 5% versus the euro this year, has already begun to reduce producer prices in the manufacturing sector and import costs, with gradual effects expected to pass through to consumer prices, he added.

September’s headline CPI remained at 4.3% year-on-year, unchanged for the third consecutive month. Key price developments included food rising by 4.7%, household energy costs up 10.6%, services up 5.9%, and durable goods increasing 2.9%, while monthly prices remained stable. Varga said inflationary pressures remain strong and that the fight against inflation is ongoing, despite temporary relief from margin caps and other price-stabilizing measures.

Inflation remains above the central bank’s 4% target band even as government measures, such as the profit margin cap on retailers, shave off 1.5pp of the figure. The MNB, based on the government’s official communication, assumes the measure will be phased out in November; however, analysts say this is unlikely before the April election.

Amundi’s investment director Peter Kiss highlighted that, combined with pre-election fiscal easing, this leaves the MNB with little room for interest rate cuts in the near term. Amundi now expects the first rate cut only around mid-2026, as the high real interest rate continues to support the forint and could even strengthen it if other central banks keep easing.

Varga also noted that Hungary’s macroeconomic picture shows mixed signals. Domestic retail sales continue to expand, supported by strong household consumption, while industrial and construction output have shown some declines. Bank lending exhibits a similar duality, with household loans growing at double-digits, while corporate lending remains moderate. Overall, the banking system retains strong liquidity and capital buffers, capable of meeting increased credit demand, Varga said.

The MNB is closely monitoring moves by global central banks and expects the US FED to continue to cut rates, while the European Central Bank (ECB) is expected to hold rates steady.

Varga reiterated that the MNB’s primary objective remains price stability and that decisions are based on domestic data rather than market expectations. While inflation expectations among households have slightly improved, they remain elevated

The governor also commented on the forint’s regional performance, noting that its relative interest rate advantage over currencies such as the Polish zloty is likely to increase, as neighboring central banks may continue easing. By mid-2026, the Hungarian policy rate could be 250-300 basis points above Czech and Polish rates, further enhancing the forint’s attractiveness, he added.

Overall, the MNB remains committed to a cautious, stability-oriented approach, emphasizing the continued importance of maintaining high real interest rates to anchor inflation expectations and support the eventual achievement of its inflation target, analysts commented.

Responding to a question, the governor said euro adoption is not on the agenda, as Hungary does not yet meet the criteria, and the government has expressed no political intent to join the eurozone.

Data

Germany slowdown weighs on Lithuania’s export-driven manufacturing sector

Lithuania’s economy remains highly sensitive to the industrial cycle in Germany, its third largest trade partner.

Chobani yoghurt king Hamdi Ulukaya becomes richest Turk

Knocks Murat Ulker into second place in Forbes ranking as his company's valuation leaps to $20bn.

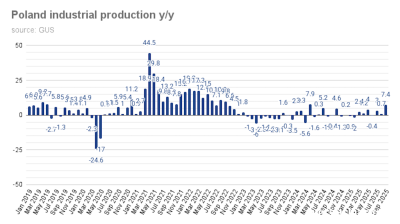

Poland’s industrial production jumps 7.4% y/y in September

September saw an unexpectedly sharp increase in industrial production after the surprise gain of 0.7% y/y in August.

Ukrainian M&A market grows 22% despite war, driven by local investors

Two large acquisitions by agriculture holding MHP and mobile operator Kyivstar accounted for more than half of the total deal value.