Aggregated net transfers of money to Georgia in the 12-month period ending May increased to $1.89bn. That's 31%, or over $450mn more, compared to the previous 12-month period.

The comparison is skewed by the lockdown period in April last year when the volume of transfers plunged amid mobility constraints. Comparing the transfers in Q1 this year with the same period a year ago avoids that issue - and the robust 33% y/y advance confirms a genuine upward trend in the volume of money transfers.

In May alone, net transfers increased by 39% y/y to $164mn. Some 17% of this came from the Russian Federation and Italy (shares are calculated for gross transfers), with the US accounting for nearly 13% and Greece for nearly 11%. Israel is another significant contributor to money transfers to Georgia, with nearly 8% of total gross transfers in May originating there.

By any metric, the transfers to Georgia therefore increased significantly in the post-lockdown period and they represent a factor that played a key role in the foreign exchange market.

The money transfers have remained, since last July, at around $160mn per month - compared to the $130mn recorded on average in 2019.

The supplementary $450mn in money transfers entering Georgia in the 12-month period ending May can be placed on top of another $460mn - the decrease in the trade deficit over the same period of time.

This $910mn “currency cushion” accounts, however, for only one-third of the $2.7bn plunge in tourism revenues that Georgia incurred in 2020 as the coronavirus pandemic devastated international travel. But it was enough to provide a certain stability to the local currency, the Georgian lari (GEL), while the central bank used foreign loans to maintain the exchange rate close to what it should be in balance with the post-crisis economic recovery trajectory.

Data

Chobani yoghurt king Hamdi Ulukaya becomes richest Turk

Knocks Murat Ulker into second place in Forbes ranking as his company's valuation leaps to $20bn.

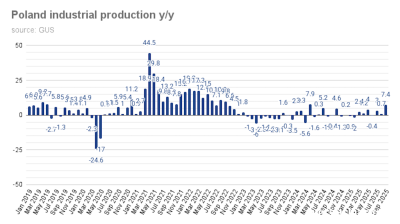

Poland’s industrial production jumps 7.4% y/y in September

September saw an unexpectedly sharp increase in industrial production after the surprise gain of 0.7% y/y in August.

Ukrainian M&A market grows 22% despite war, driven by local investors

Two large acquisitions by agriculture holding MHP and mobile operator Kyivstar accounted for more than half of the total deal value.

Ukraine’s credibility crisis: corruption perception still haunts economic recovery

Despite an active reform narrative and growing international engagement, corruption remains the biggest drag on Ukraine’s economic credibility, according to a survey by the Kyiv International Institute of Sociology.