One of the most closely watched sessions at the annual St Petersburg International Economic Forum (SPIEF), which is underway now, is the economic panel with the heavy hitters from the Kremlin’s economic team. This year the discussion was: is Russia’s economy in recession or just cooling?

Led once again by Andrei Makarov, the wryly acerbic head of the State Duma Budget Committee, the panel featured Central Bank Governor Elvira Nabiullina, Finance Minister Anton Siluanov, and Economy Minister Maxim Reshetnikov. Russian President Vladimir Putin’s economic advisor Maxim Oreshkin, Deputy Chief of Staff to the Presidential Executive Office, who had long been a fixture in these discussions, was not present this year.

The discussion was lively. It was already clear last summer that the economy would slow this year. As reported by bne IntelliNews, the Central Bank of Russia (CBR) issued a pessimistic medium-term macroeconomic outlook at the start of August that said growth would slow sharply in the first half of this year.

Indeed, unable to curb the Kremlin’s massive military spending, Nabiullina tied up with the Ministry of Finance (MinFin) to artificially cool the economy by adopting non-traditional non-monetary policy methods to crush spending in an effort to bring down persistent inflation.

And it worked. Maybe too much. The economy has been slowing and inflation has been coming down, but after OPEC decided to increase production in April, to punish Kazakhstan, which has routinely been ignoring its agreed production quota, oil prices collapsed, falling to a low of $58, chopping Russia’s oil revenues by a third. At the same time interest rates remain very high even after a symbolic cut of 100bp to 20% last month. Russia’s economy contracted in the first quarter of this year in real terms, even though it put in a nominal 1.4% of growth. It seems that Nabiullina has overdone the slowdown.

“Based on current business sentiment and leading indicators, we are on the verge of slipping into a recession,” Economy Minister Reshetnikov told the delegates in St Petersburg during a heated exchange with the other officials. “The numbers suggest a cooling, but all data is essentially a rear-view mirror,” he said. “Based on the current feelings of business [...] we are, in general, well, it seems to me, on the verge of going into recession.”

In an interview just days earlier, Oreshkin declared that Russia’s current growth model is exhausted and needs more investment and reforms to go back to growth. Makarov seized on the opportunity to press the panel: what, then, should come next?

Nabiullina was more sanguine. The economy may be slowing more than expected, but the plan is working as after almost two years of no progress inflation has begun to fall and fall faster than expected. Characteristically cautious, she explained: “Our demand economy was growing, but the supply economy was lagging, and that’s where the overheating and inflation came from.”

The weekly Rosstat calculation of Russia's annualised inflation rate slowed to from over 10% to 9.6% as of June 16 after falling from 9.73% on June 9 and 9.88% at the end of May. However, the rate still remains well above the CBR’s target rate of 4%.

The 2025 budget assumes inflation at 7.6%, but Reshetnikov said the forecast will be revised downward in August.

Amongst the measures take, a generous mortgage subsidy programme was ended last July, state guaranteed loans to state-owned enterprises (SOEs) have been slashed, and for the first time ever Russians paid off more consumer loans than they took out over the first half of this year after the CBR hiked the macro prudential restrictions on retail borrowing. Among the knock on effects from these measures is the real estate market has been rocked and construction is one of Russia’s three big economic drivers.

"The inflation forecast is a calculation backed by our determination to achieve the target,” Nabiullina said. “Some might call this stubbornness <…>, but 'persistence' is a more accurate term. We have been striving and will continue to strive to bring inflation down to the target level of 4%," she said.

Nabiullina emphasized that reducing inflation is crucial both for individuals and for businesses, as high inflation erodes income and savings. "Low inflation is the foundation for the growth of real household incomes," she concluded.

Siluanov was also upbeat, suggesting that while the current slowdown was sharper than intended, the economy would start to recover in the second half of this year as the falling inflation and lower interest rates kick in.

“We’re going through a cold spell now,” Siluanov said during the forum session. “But after every cold spell comes summer.”

Siluanov has proven to be a prescient forecaster. In 2023 after the West imposed its twin oil sanctions, the economy received a major shock with the budget deficit in just January soaring to 1.7% of GDP. Analysts predicted a major slow down and an end of year deficit soaring to as much as 12% of GDP, with a consensus closer to 3-4%. However, Siluanov stuck to his official forecast of 2% of GDP, arguing that a deep study of the budget and projected revenue flows told him things were not as bad as they seemed. Russia's budget ended that year with a deficit of 1.9% of GDP.

Progress has finally been made in bringing down inflation, but Nabiullina was cagey on the topic of when the CBR can start cutting rates again. She said she will reduce the key rate “as inflation slows in Russia,” but was upbeat on the prospects for another cut without saying anything specific.

"We will cut rates as inflation declines. It is currently slowing down, even faster than we expected, and inflation expectations will decrease accordingly - this is how it should work," Nabiullina said.

Nevertheless, this will be a painful year for Russian business. According to bne IntelliNews sources in Moscow, all the major firms are suffering from the sky-high interest rates and debt servicing is eating into profits.

“No one has any cash,” one board member of a major conglomerate told bne IntelliNews recently. “Every spare ruble is being eaten up by debt repayments. Everyone is cancelling all non-essential investment projects and some of the oligarchs are running out of cash.”

So far the Kremlin has avoided bailouts or debt relief, but on the flip side it has also avoided hiking taxes, which remains an option to cover budget shortfalls.

MinFin has been tapping its other resources to close the circle. It is tapping the domestic bond market, which has some RUB20bn of liquidity via banking sector liquidity with more than RUB2.7 trillion ($35bn) of new Russian Finance Ministry’s OFZ treasury bill issues, or 56% of its annual borrowing plan.

And this is expensive borrowing. MinFin is paying steep yields of 15.2% on six-year bonds and 15.5% on 11-year debt, thanks to the high prime interest rates.

It is also planning to tap the National Welfare Fund (NWF) again, drawing down just under RUB500bn this year to fund the deficit. That is actually a relatively modest amount as Siluanov wants to preserve as much cash in the fund as he can for emergencies. The liquid part of the fund has fallen from around RUB8.8 trillion pre-war to only RUB2.8 trillion now, against a projected total budget deficit this year of just under RUB3.9 trillion.

What next?

So, what is the outlook for this year? In its last macroeconomic survey the CBR anticipated growth slowing for 2025 and 2026, with real GDP growth projected to be between 0.5-1.5% in 2025 and 1.0-2.0% in 2026 and inflation is expected to be around 5.3% in 2025.

Siluanov has been working hard to prune the tax code and expenditures to produce as lean a budget as he can. “What have we been doing in recent years?” he asked rhetorically. “And it is yielding results! Because some companies are leaving, some are appearing. And that means our model is working... Indeed, this year we have a planned cooling. But everything will depend on our own actions. The goal-setting is absolutely correct.”

Reshetnikov suggested incrementalism. He called for addressing long standing structural issues “without revolutions,” citing stagnant labour productivity, which is a major problem, and unpassed bills on bankruptcy and the digital platform economy.

Oreshkin’s call for a new technological and organisational leap was echoed abstractly by Siluanov, who spoke of achieving “technological sovereignty” — though specifics were lacking.

Business are unhappy with Nabiullina’s go-slow policies and want the central bank to cut rates, even if that means higher inflation. Deputy Prime Minister Alexander Novak summed up the sentiment, saying that current indicators indicate the need to reduce the Central Bank's key rate and abandon the cooling policy. He reported this at a Sberbank business breakfast as part of the St. Petersburg International Economic Forum. According to him, it is necessary to move from controlled cooling to, on the contrary, heating of the economy. “To do this, you need to not miss the moment when it needs to be done,” Novak said.

But tellingly, the panel avoided any mention of the elephant in the room: the strain of enormous and growing military spending on the war, which is not going to change.

Features

South Korea, the US come together on nuclear deals

South Korean and US companies have signed agreements to advance nuclear energy projects, aiming to meet rising data centre power demands, support AI growth, and strengthen the US nuclear fuel supply chain.

World Bank seems to be having second thoughts about Tajikistan’s Rogun Dam

Ball now in Dushanbe’s court to justify high cost.

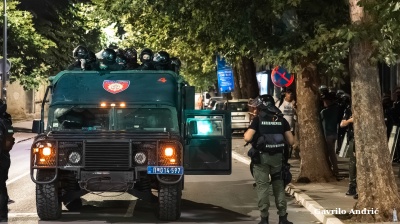

INTERVIEW: From cinema to Serbian police cell in one unlucky “take”

An Italian software engineer caught in Belgrade’s August protests recounts a night of mistaken arrest and police violence in the city’s tense political climate.

_Cropped_1756210594.jpg)

Turkey breaks ground on its section of the TRIPP rail corridor

Turkish project would help make TRIPP the go-to route for Middle Corridor freight.

_1756222537.jpg)