In July Rosstat declared it will withhold data on monthly retail, wholesale trade, income, and salary data from its June release. Analysts say the reason is those numbers paint an increasingly bleak picture the government is trying to hide from the public.

Reconciled data between Rosstat and Sberbank shows that real wage growth is, for all intents and purposes, stagnant, Kommersant reports.

Growth in demand of individuals for goods and services in June was just 1.4% y/y according to Sberindex and statisticians increased their estimate of annual growth of real disposable income in the first quarter of 2025 by 0.3 percentage points to 8.7%, down modestly from last year’s record levels.

Real wages growth is also slowing. In annual terms it increased by 4.2% in May against growth of 4.6% in April, 0.1% in March, 3.2% in February and 6.5% in January 2025 in nominal terms, Kommersant reports. But removing seasonality and all these numbers become negative: growth in May compared to April was -0.4%, in April compared to March -1.5%, in March -0.2%, in February -1.2%, in January -2.2%, according to Centre for Macroeconomic Analysis and Short-Term Forecasting (CMASF).

Banks are expecting the government to scale back subsidy support as budgetary pressures intensify as Russia’s economic problems grow, says Nicholas Trickett, a political economy analyst writing in Riddle.

Inflation is falling faster than expected allowing the Central Bank of Russia (CBR) to put in 300bp of rate cuts in the last two months to help boost growth and could put in another 300bp of cuts before the end of the year. But the Russian economy is cooling fast as well, sparking a debate over if this is a recession or just an economic slowdown. As a warning sign, Russia’s manufacturing PMI suffered its sharpest fall in three years in July, S&P Global reported this week.

“The Ministry of Finance is issuing debt at a breakneck pace this year—RUB2.8 trillion so far. The impending spending squeeze, as oil market pressures tighten, will leave families worse off,” says Trickett.

Banks providing subsidized mortgages that survived the June 2024 suspension of a generous mortgage subsidy programme that rocked the real estate market now require borrowers to deposit 30.1% of the property’s value upfront, up from 20.1%. Housing prices have fallen, but recent reports say they have not fallen as far or fast as some feared after the subsidies were cancelled. Russia’s chronic labour shortage has also eased somewhat in recent months, but with unemployment stuck at a historic low of 2.2% it remains a problem.

Trickett argues that the economy will come under increasing pressure from the changes in the labour market, which is why Rosstat has shut off access to the wage and retail numbers.

“As the labour market weakens slightly and these shifts in financial flows accumulate, businesses will be caught trying to raise prices to protect their bottom line while slowing wage increases. The current balance is unsustainable,” says Trickett.

Russia’s average monthly salary is nearly RUB100,000 ($1,250) – a third of Russians earn RUB100,000, according to Rosstat – the weakness of import demand has contributed to a stronger ruble, and most forms of investment are declining, which are helping to bring down inflation, but they are depressing consumption too. The extent of these changes has become hard to assess since this data is now being withheld or manipulated. That suggests things have become “dire,” says Trickett.

“Consumer sentiment surveys simply don’t align with spending patterns on goods and services. Something is breaking, and rate cuts alone won’t mend the damage,” says Trickett.

Features

Indian opposition blames government on Trump threats

Under President Donald Trump’s second term his administration has taken a much more hawkish stance that Indian purchases enable Russia to weather sanctions and indirectly fund its war effort

Is AI making us less intelligent? The debate over declining cognitive skills in the age of ChatGPT and smartphones

Anecdotal evidence from educators paints a troubling picture. Teenagers across the world struggle to properly complete tasks in school, particularly those involving writing.

BEYOND THE BOSPORUS: Arm of state bags itself a crypto exchange

Following claims of money laundering, Icrypex becomes the latest of hundreds of companies to be seized by Turkish regime’s TMSF.

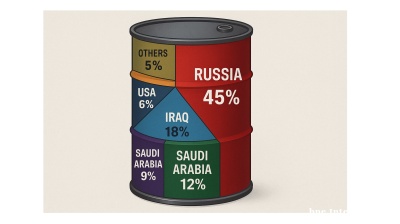

Kazakhstan reviews its big oil contracts looking for a better deal

COMMENT: Kazakhstan is reviewing its big oil contracts Kazakhstan has begun laying the groundwork for a revision of the contracts it signed with big oil in the 1990s when the country was flat on its back.