The Uzbekistan real estate market has entered a sweet spot. A burgeoning population, rising capital inflows, a growing expat community and strong economic growth have combined to lift everyone’s boat. Now major developers are starting to take speculative punts on new upper-end residentials and mixed projects as the real estate sector gathers momentum.

Turkish developer Koc is an old hand at building things in early stage emerging markets, as an early entrant into the Russian market in the 1990s and is now present in several of the Central Asian countries.

Koc was invited to work on the restoration of a monument in Bukhara eight years ago which opened the door to the Uzbek market for the company.

“In the beginning we were developers for other companies, mostly building hotels, but since then the business has diversified and portfolio expanded,” says Izzet Goermez, Koc’s business manager in Tashkent, in an interview with bne IntelliNews during the Tashkent International Investment Forum (TIIF) on June 13.

Over the past three years, Uzbekistan's real estate market has been driven by strong urbanisation trends and a liberalisation of the country’s property and investment laws. The government’s focus on providing adequate housing and infrastructure modernisation has provided more fuel for the fire.

Hotel development has been in high demand after the government’s extremely successful drive to boost tourism, where the number of visitors has doubled in recent years. Koc has been behind the development of half a dozen of the top names in the capital, including the Hyatt, the Hilton, the Ramada and the Wyndham to name a few.

Today the company is working on a total of 18 projects with another half a dozen in the pipeline and while hotel development remains important, Koc has moved beyond hospitality to mixed use, residential and some industrial construction projects to become one of the country’s top four developers.

Increasingly the focus is shifting to residential and mixed-use development. Incomes have been rising steadily and there is a demand amongst the emerging middle class for better quality accommodation.

From 2022 to 2025, the residential real estate sector expanded rapidly, particularly in major urban centres such as Tashkent, Samarkand and Namangan. According to official figures from the State Committee on Statistics, over 300,000 new housing units were commissioned between 2022 and 2024, with the bulk concentrated in multi-storey apartment developments.

In residential development, Koc is often commissioned by the landowner to design and build the project but the company has started to develop its own projects on a speculative basis. The Priramit Tower is a Koc project with 164,000 square metres of office, residential and retail that opened last year.

“There is no shortage of land in Tashkent and people are now starting to invest into real estate,” says Goermez. “They buy because they want a nicer place to live, but it also makes a solid financial investment as well.

Prices have risen steadily, especially in Tashkent, where demand outpaced supply. The average cost per square metre in the capital increased by over 40% between 2022 and 2024, according to local real estate platforms. Government-backed mortgage programmes and subsidies for first-time buyers helped sustain demand, though inflation and higher construction costs created affordability pressures by mid-2024. Apartments with a relatively central location that cost $600 per sqm a few years ago now go for closer to $1,000, according to business people that spoke to bne IntelliNews about local apartment prices.

Koc’s residential projects go from $1,500-$2,000 for middle of the range residential developments but can go as high as $3,000-$3,500 for high-end accommodation. However, these prices are all for pre-build purchases; a $3,000 per sqm apartment is expected to be worth $4,000 as soon as it is completed, and the buyer takes possession.

And the bulk of the deals are done in cash; people buy the apartment outright or at worst pay over 12 months in instalments. Mortgages exist but as yet play almost no role in real estate development.

But the government is already thinking about the development of the market and while pre-sales is good for the developer as it reduces funding needs, in Russia several would-be homeowners lost their life savings after the developer went bust before completing construction. Taking a leaf out of Russia’s playbook, the authorities will introduce an escrow account system similar to that in Russia, where buyers deposit cash in an escrow account that is only released to the developer once the building is complete. The developer is still better off as it can borrow against these deposits more easily and cheaply as the loan is backed by cash, not bricks and mortar.

Another new element driving residential purchases is the increasing inflow of foreigners to Tashkent, says Goermez, coming for work and bringing their families that are demanding high quality residential space and buying rather than renting.

“More foreign professionals are coming to Tashkent from the US, China and France, and they are demanding high quality accommodation. They are coming to live and work and they are buying apartments, also partly as an investment,” says Goermez.

Koc’s Daho 105,000 sqm project that is due to be finished next year is a good example of a more upmarket development on the prestigious Shevchenko street. The building will also include office and some retail and is in a sought-after location commanding prices of $3,000 or more and the apartments have already been 70% sold.

The commercial real estate market has also been buoyed by rising foreign investment and the expansion of retail and service industries. Tashkent has seen a wave of new office and retail developments, though demand remains largely domestic, with international retail giants still hanging back.

The growth of e-commerce and logistics has also driven demand for warehouse and distribution space, especially near transport corridors and special economic zones, but warehousing is still largely being developed by the end user themselves, like the top supermarket chains and leading e-commerce companies.

Industrial real estate benefited from state-led efforts to boost manufacturing and attract FDI. New industrial parks and modern logistics hubs have been launched near key infrastructure, including the Angren and Navoi regions, with demand supported by increased exports and import substitution initiatives.

While residential and mixed use are occupying a lot of Koc’s time, it has also done some industry projects such as the Aksa Energy gas cycle power plant and also took on an engineering upgrade project for the Hilton as well as the construction of Tashkent’s Ontological Hospital including the installation of all the medical equipment.

Features

South Korea, the US come together on nuclear deals

South Korean and US companies have signed agreements to advance nuclear energy projects, aiming to meet rising data centre power demands, support AI growth, and strengthen the US nuclear fuel supply chain.

World Bank seems to be having second thoughts about Tajikistan’s Rogun Dam

Ball now in Dushanbe’s court to justify high cost.

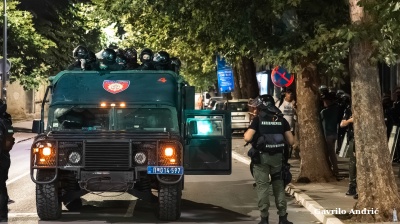

INTERVIEW: From cinema to Serbian police cell in one unlucky “take”

An Italian software engineer caught in Belgrade’s August protests recounts a night of mistaken arrest and police violence in the city’s tense political climate.

_Cropped_1756210594.jpg)

Turkey breaks ground on its section of the TRIPP rail corridor

Turkish project would help make TRIPP the go-to route for Middle Corridor freight.