As geopolitical tensions between Iran and Israel escalate, the Malaysian government has issued a travel advisory for three Middle Eastern countries -Iran, Iraq, and Jordan - urging its citizens to avoid non-essential travel due to heightened security risks and disruptions in airspace security.

The announcement, made on June 14, by Malaysia’s Foreign Ministry (Wisma Putra), marks a significant shift in regional diplomacy and underscores the far-reaching impacts of the ongoing conflict.

According to a report by The Star, the ministry emphasised that Malaysian embassies in Tehran, Baghdad, and Amman are closely monitoring developments and remain ready to assist nationals on the ground. The advisory also highlighted that Iran and several neighbouring countries have closed their airspace, which is expected to cause significant disruptions to flight schedules.

“Non-essential travel to these areas should be deferred, given the unpredictable nature of the conflict,” said the ministry in its statement, stressing the need for citizens to remain vigilant and follow local authorities’ guidance.

Malaysians residing in or visiting Iran are also advised to update their contact information with the Embassy of Malaysia in Tehran and to stay abreast of any rapid developments. The ministry reaffirmed its commitment to protecting Malaysian nationals abroad and has made emergency assistance available through its diplomatic missions.

Malaysia backs Iran’s right to retaliate

In a bold diplomatic stance unlike many seen elsewhere, however, Prime Minister Datuk Seri Anwar Ibrahim declared Malaysia’s support for Iran’s retaliation against Israel, citing the country’s right to defend its national dignity. Speaking at the closing of the Perak MADANI Rakyat Programme (PMR) 2025 in Lumut, Anwar emphasised Malaysia’s sovereign commitment to standing with nations that have been wronged.

“Malaysia must demonstrate its strength. We are an independent, sovereign nation, and we must stand up for the rights of our friends, including Iran,” said Anwar, as quoted by Bernama.

This follows Israel’s recent airstrikes on Iranian soil, which targeted key nuclear and missile facilities, resulting in the deaths of a number of top Iranian military commanders and scientists. Iran responded with ballistic missile strikes on the Israeli-occupied territories, causing fatalities and significant infrastructural damage reports suggest. According to Tasnim News Agency, cited by Anadolu Ajansi (AA), Israel escalated the conflict with another strike on the Iranian Defence Ministry in Tehran early on June 15.

Anwar praised Iran’s resilience, especially in scientific and technological advancements such as artificial intelligence and missile defence systems, despite the weight of long-standing economic sanctions.

“Iran’s anti-ballistic missile systems are even capable of reaching Tel Aviv,” he noted, further criticising the European Union’s double standards for condemning Iran’s retaliation while remaining silent on Israel’s initial offensive.

Regional markets see oil and currencies react

The latest Middle East crisis has not only triggered political reverberations but has also sent economic shockwaves across Asia. According to a detailed report by Zawya, Asian equities and currencies slid on June 13 as investors sought the safety of the US dollar and gold. The geopolitical instability, compounded by market fears surrounding global trade uncertainty, has firther caused a sharp rise in oil prices with an initial spiking seeing it increase by more than 9%.

This surge in energy prices has exerted pressure on net oil-importing Asian economies, widening current account deficits and weakening regional currencies.

The South Korean won and Philippine peso fell by 1.1% and 0.9%, respectively, while the Indian rupee dropped 0.5%. The Malaysian ringgit, although hailing from a net oil-exporting country, also lost 0.7%, indicating the overwhelming investor pivot to safer assets amid global uncertainty.

Maybank analysts, in commentary to Zawya, noted that while oil price hikes generally benefit Malaysia’s economy, the broader currency pressure from a strengthening US dollar overshadowed those gains. The ringgit's weakness mirrors the retreat in equity markets, with Malaysian stocks down between 0.5% and 0.7%, aligned with declines across Taiwan and Singapore.

Meanwhile, the Taiwan dollar showed brief strength, rising up to 0.5% to a three-year high, before leveling off. A local forex trader told Reuters that intervention by Taiwan’s central bank and reduced momentum from other currencies, like the Korean won, limited its appreciation.

What’s at stake?

The unfolding Israel-Iran conflict is no longer a distant regional skirmish, it has become a high-stakes geopolitical crisis with global economic ramifications.

Malaysia’s travel advisory, Anwar’s outspoken diplomatic positioning and backing of Iran, and the volatile market response illustrate how quickly such tensions can bleed into diplomatic policy and financial stability.

More than ever, the conflict underscores the interconnectedness of politics, national security, and global economics. As a result, Malaysia finds itself navigating a delicate path, upholding the principles of sovereignty and justice, ensuring the safety of its citizens abroad, and protecting its economic interests amid rising uncertainty.

With Iran’s capabilities tested but starting to falter, Israel’s red lines crossed, and world markets already uneasy, the coming weeks will be critical in determining whether diplomacy can prevail, or whether the region descends further into volatility.

Features

South Korea, the US come together on nuclear deals

South Korean and US companies have signed agreements to advance nuclear energy projects, aiming to meet rising data centre power demands, support AI growth, and strengthen the US nuclear fuel supply chain.

World Bank seems to be having second thoughts about Tajikistan’s Rogun Dam

Ball now in Dushanbe’s court to justify high cost.

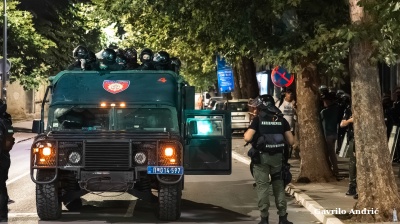

INTERVIEW: From cinema to Serbian police cell in one unlucky “take”

An Italian software engineer caught in Belgrade’s August protests recounts a night of mistaken arrest and police violence in the city’s tense political climate.

_Cropped_1756210594.jpg)

Turkey breaks ground on its section of the TRIPP rail corridor

Turkish project would help make TRIPP the go-to route for Middle Corridor freight.

_Cropped.jpg)

_0_1756011191.jpg)