Export-oriented manufacturing in the Western Balkans, particularly in Serbia and North Macedonia, has been a success story in recent years, drawing substantial foreign investment into industrial sectors closely integrated with European value chains. Yet that momentum may now face headwinds from growing geopolitical tensions and uncertainty over future tariff regimes.

“Serbia in particular has an extremely strong track record in attracting foreign direct investment in the last few years,” said Matteo Colangeli, regional director for the Western Balkans at the European Bank for Reconstruction and Development (EBRD).

However, he added, “Especially in manufacturing, the uncertainty over the geopolitical situation and tariffs will have an impact on decisions made to establish new production as the visibility on what will happen is limited.”

With EU-linked supply chains increasingly exposed to shifts in global trade dynamics, investors are recalibrating strategies – a trend that could alter the region’s economic trajectory. “For countries like Serbia and North Macedonia that are very much connected to European value chains, like for example the car industry, I think what will happen with possible tariffs, including targeting EU exports, will play a role in how much FDI they receive,” Colangeli told bne IntelliNews in an interview in London.

The region was one of those seen as having high potential for nearshoring, as international companies rethought their supply chains after the coronavirus (COVID-19) pandemic. While the challenges facing businesses have changed since then, the region does remain attractive for services in particular.

“Certainly the picture has changed over the last year in terms of the dynamics between competing trade blocs and tariffs. That clearly has spillover effects on the Western Balkans, but away from manufacturing, services are less exposed to geopolitical volatility,” Colangeli said.

He highlighted the region’s large pool of technically qualified workers and strong innovation ecosystems. For example, he said, “We see quite a lot of interest in the human capital of the region when it comes to IT, with promising innovation ecosystems, fast growing local companies and significant foreign investments.”

He pointed to Serbia, in particular, as “emerging as a strong hub for ICT services”, noting that the country had also benefited from an influx of Russian and Ukrainian tech professionals.

“The region as a whole is increasingly attractive for ICT services, not only call centres or business services outsourcing but increasingly also higher value added activities like IT engineering, software development and the gaming industry.”

Forecasts lowered

In its latest Regional Economic Prospects report released in May, the ECRD downgraded its forecasts for the Western Balkans, along with those of its other regions of operations. The development bank currently forecasts that growth in the Western Balkans countries will slow from 3.6% in 2024 to 3.2% in 2025, before rebounding somewhat to 3.4% next year. That represents a downgrade of 0.4 percentage points (pp) for 2025 and 0.2pp for 2026 compared to the bank’s February 2025 forecasts.

“Political instability in Serbia and spillovers from slower growth in advanced European economies are weighing on the region’s outlook,” said the report.

Forecasts for all countries in the region were lowered for both 2025 and 2026, with the biggest downward revision, of 0.5pp, for Serbia’s 2025 GDP growth.

Still, as Colangeli points out: “Even at the current slightly reduced forecasts, the region is growing much faster than the EU and most developed economies. I think the growth rate in the region will continue to benefit from substantial infrastructure investments, and the region will gradually integrate further with European value chains.”

At present, income levels remain well below EU averages. “The region has a long way to go before income convergence with EU levels,” Colangeli said.

"As long as it continues on the path toward EU approximation, this should be the basis for faster economic growth rates, which will be needed if the region is to converge to the EU level within an acceptable time horizon – one short enough to discourage brain drain and emigration.”

The prospect of EU membership is already generating tangible benefits for the accession candidates in the region.

“Undoubtedly, for countries that are on a faster track towards accession, the dividend in terms of a boost in attractiveness for investors will materialise,” Colangeli told bne IntelliNews.

Montenegro, considered the frontrunner in the accession process, and Albania, which has made strong progress recently, have seen investment flowing into tourism and energy.

“Albania and Montenegro are countries that do not have a significant industrial base; tourism is the key industry,” said Colangeli. “Moving closer to EU membership will help in attracting more tourists and raising standards and infrastructure in that industry.”

He also pointed to the infrastructure investments that typically accompany EU convergence. “The process of EU approximation will be accompanied by investments in infrastructure that will allow these countries to provide a better tourist offering. Certainly transport infrastructure, but also environmental infrastructure as there is a significant gap to close in waste water treatment, waste management [all aspect of that are very] important for the tourist industry.”

Colangeli said the EBRD is heavily engaged in supporting the energy transition in the region, a process he described as both urgent and uneven.

“We see a lot of investment coming to the region in the energy sector, because clearly getting closer to the EU means sharing the ambition the EU has on the green energy transition,” he said.

“We are heavily involved in helping countries in the region in scaling up renewables, through supporting them in preparing and conducting auctions to allocate capacities for wind and solar projects. Albania and Serbia have already achieved important results through several rounds of auctions supported by EBRD, and we are very much on track to help Montenegro this year on the same path.”

Albania, which already relies heavily on hydropower, has pioneered renewable energy auctions with EBRD support. The bank expects the first renewables tender in Montenegro to launch before the end of 2025, which will be accompanied by follow-on investments – including some from the EBRD itself – into the winning projects.

Still, with the exception of Albania, coal plays a significant part in the energy mix of countries in the region, meaning there are challenges ahead in the transition to clean energy.

“There are countries in the region where coal plays an important part in the generation mix, and the journey for these countries will take decades to come to a close, but decarbonisation is something all the countries in the region are pursuing.”

Energy efficiency is another issue. “The region remains extremely carbon-intensive, two to three times higher than the EU average per unit of GDP. The rationale is compelling to cut some of that waste, especially in buildings. We are already financing energy efficiency in buildings and greening of district heating systems.”

Countries across the region also still lag EU standards in water quality, wastewater treatment and waste management. “These are all areas where we are and will continue to be very active working with governments and municipalities, but also wherever possible helping countries structure and deliver public private partnerships,” according to Colangeli.

Features

World Bank seems to be having second thoughts about Tajikistan’s Rogun Dam

Ball now in Dushanbe’s court to justify high cost.

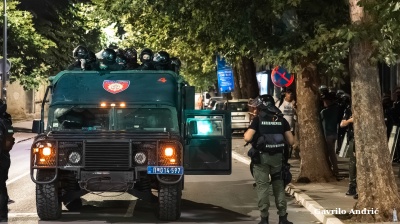

INTERVIEW: From cinema to Serbian police cell in one unlucky “take”

An Italian software engineer caught in Belgrade’s August protests recounts a night of mistaken arrest and police violence in the city’s tense political climate.

_Cropped_1756210594.jpg)

Turkey breaks ground on its section of the TRIPP rail corridor

Turkish project would help make TRIPP the go-to route for Middle Corridor freight.

Disastrous harvest gives bitter taste of food inflation in North Macedonia

Cash-strapped shoppers tell bne IntelliNews’ Skopje correspondent that preparing ajvar and other traditional winter preserves is becoming prohibitively expensive.