Turkey’s central bank ‘cavalry’ finally turned up late in the day on May 23, raising the regulator’s late liquidity window rate by 300 basis points to 16.5% to support the punch-drunk Turkish lira (TRY).

With analysts earlier in the day fearing Turkey was teetering on the edge of a full-blown currency crisis, the rate-setters held an emergency meeting and—despite the speculation that self-declared “enemy of interest rates” President Recep Tayyip Erdogan was standing in the way of tightening—took action which, at least for now, may have pulled the country’s economy back from the edge.

Many observers will see the move as Erdogan surrendering to the markets. Opposition leaders had started to capitalise on the monetary disarray and he may have started to sense the issue was becoming a big vote-loser for him ahead of the June 24 snap presidential and parliamentary elections. Following the hike, Erdogan stated in a televised speech to former lawmakers in Ankara: “In the new government system, we’ll continue to abide by the global governance principles on monetary policy. But we will not let global governance principles finish off our country.”

By 22:40 Istanbul time on May 23, the TRY had recovered to 4.5560 against the dollar having previously sunk 5.5% on the same day to an alarming all-time low of 4.9294 during overnight selling by Japanese traders cutting their losses on long lira positions against the yen. By 10:20 on May 24, it had weakened to 4.6789.

Responding to the rate hike, Timothy Ash, senior emerging markets sovereign strategist at BlueBay Asset Management, said in a note: “At long last. If they had listened to the markets weeks ago and done this back then they may have been able to get away with a lower rate hike. Staggering that the CBRT [Central Bank of the Republic of Turkey] never learns. This is the third time in five years we have lived through the CBRT waiting way too long to hike rates. They never seem to learn. Credibility?”

Analysts will now await further reaction to see whether the central bank will be under pressure to introduce another rate increase at its next scheduled policy meeting on June 7. Ash added that the “net losers” are likely to be real GDP growth and perhaps Erdogan’s re-election chances in the upcoming snap election. “Major question marks will be asked by the electorate around competency of macro management,” he said.

The central bank interim meeting left the overnight borrowing rate unchanged at 7.25%, the overnight lending rate unchanged at 9.25% and the one-week repo rate unchanged at 8.0%.

High time

In tweeted comments made just after the central bank convened for its emergency rate-setting, Turkey’s Deputy Prime Minister Mehmet Simsek—the head of the government’s economic team who is often described as the last “market friendly” voice in the Cabinet—said it was high time that Turkey restored its monetary policy credibility. He added that he supported any action by the central bank to put a brake on the slide in the lira and achieve price stability.

For its part, the central bank said in a statement after its meeting that it would continue to use all available instruments in pursuit of its price stability objective. Its rate-setters, it said, had decided to implement a strong monetary tightening to support price stability. A tight stance in monetary policy would be maintained decisively until the inflation outlook displayed a significant improvement, it also noted, while adding that any new data or information may prompt its monetary policy committee to revise its stance.

Investors in Turkey will watch closely for any rhetoric from Erdogan in response to the rate hike. Pushing his unconventional, contrarian ‘Erdoganomics’ which contends that hiking interest rates actually causes inflation in an emerging economy like that of Turkey, the president last week disturbed the markets by giving a Bloomberg TV interview in London during which he said that should he become the country’s first executive president in the coming election he will hold greater sway over monetary policy.

Aksener seizes on the rout

Meral Aksener, the former interior minister and Iyi (Good) party leader whom many see as having the best hope of defeating Erdogan in the presidential contest, has seized on the lira market rout, describing the president as a “tired driver” who is at the wheel of a “bus heading over the cliff edge”. On May 23, prior to the rate hike, Hurriyet Daily News reported Aksener as calling on the government to “urgently re-establish confidence” in the economy.

She reportedly criticised the government’s economic team for “not seeing the realities” and for not admitting to “its mistakes” of the last past 16 years. Rebutting government rhetoric that the money market and economy were in trouble due to conspiratorial foreign intervention, she said: “If we are under a financial and economic attack as the government claims, the biggest mistake to make is to remain indifferent to this attack. This is to accept defeat from the beginning.”

The TRY's collapse this year is thought to have put many Turkish companies that borrowed in foreign currencies at risk of default and the potent wicked brew of domestic and international economic negatives that have taken the feet from under the lira—including double-digit inflation, a surging current account deficit, the fear that the CBRT’s monetary independence has been lost and the growing attraction of US Treasury yields that is drawing capital away from emerging markets—may well require a bigger rate ‘cure’ than 300bp.

Bloomberg Markets said the move may turn out to be like placing “a sticking plaster on a gaping wound”.

News

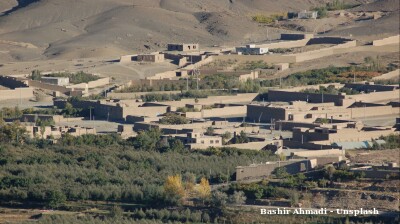

Armenia’s Pashinyan sets out EU membership goal in UN speech

Armenia now the most Western-leaning of the three South Caucasus states as region's geopolitical balance shifts.

China, Russia, Pakistan and Iran push back on Trump ambitions in or near Afghanistan

Trump’s administration has been exploring options for keeping a military footprint in Afghanistan - a move that Russia has already said would have catasrophic consequences.

Germany preparing to enter direct negotiations with Afghanistan’s Taliban government

It has also been speculated that Germany might be readying to accept a liaison presence on the part of the Afghan government, that stops short of full recognition.

Croatian PM angrily rejects Hungarian accusations of war profiteering

"We're the good guy," says Andrej Plenkovic after Hungarian foreign minister claims Zagreb is profiting from disruptions in Russian supplies.

_1758916725.jpg)

.jpg)