“Turkey has become pretty much untradable” with investors badly needing some clarity on policy from the Erdogan administration, an analyst concluded on August 28 as the Turkish lira (TRY) resumed its slide.

“Hard to take any firm views/positions from here until we see much more clarity on policy,” Timothy Ash, senior emerging markets sovereign strategist at BlueBay Asset Management said in a note. “[Turkish finance minister Berat] Albayrak a few weeks back in his investor call made some more constructive noises, but at this stage trust/confidence is at a low point in terms of Turkish policy makers—the market wants to see specific delivery on policy whether that is monetary, fiscal or action to clear up problems in the banking sector,” he added.

Turkish ministers—beset by a currency crisis that is in danger of turning into a debt crisis, but sticking to the line of President Recep Tayyip Erdogan that the turmoil is the superficial result of an “economic war” being waged by foreign powers rather than a consequence of economic fundamentals—have been on a charm offensive in the Middle East, China and Europe in recent weeks. Ash said the exercise was perhaps designed to signal to the US that Ankara has other alternatives to support from Washington.

“But aside from a few warm words in Europe, they have only come back with US$15bn in commitments from Qatar—nothing else much from the Middle East, China or Russia,” said Ash.

No big cheque from China, Russia

“The message from Europe is that we continue to value the strategic alliance, but we would recommend that you roll out orthodox policy responses. A similar message I sense from China—and no willingness therein to rattle the US cage at this stage around… trade wars with China by writing a big cheque for Turkey to try and prise it out of the US orbit.”

Moscow, while eager to sell military kit and nuclear power technology, plus energy, to the Turks, has been slow in providing any kind of financial support, Ash noted. “Therein the issues are numerous but relate to the fact that a) Russia is focused on conserving its own FX resources given its own sanctions problems with the US; b) is perhaps unsure how serious Turkey really is about breaking out of the Western orbit; c) has tensions/strains with Turkey ongoing around the looming battle for Idlib in Syria.”

The overall message to Turkey, said Ash, “remains be careful in burning bridges with the US, and the West, as your trade/financing and investment are still so tied up in US/dollar markets. The quicker there is a resolution—face saving—with the US (on [detained US pastor Andrew] Brunson, et al), the better. And the sooner Turkish policy makers focus back on policy orthodoxy at home, the better”.

By around 16:30 on August 28, the TRY had weakened by 0.82% d/d to 6.1921 against the dollar as the dearth of signals from policy makers on what reforms they are prepared to bring forward to address Turkey’s economic woes ate into confidence. The currency’s all-time low of 7.24 versus the USD came in early August.

The surge in the dollar against the TRY seen on August 27 amid increased local market activity following Turkey’s one-week public holiday demonstrated that “lots of the upside pressure on the currency pair is domestic,” according to Cristian Maggio, head of emerging markets strategy at TD Securities, Bloomberg reported.

“I would argue that foreigners are negative on Turkey but look for tactical opportunities to take a position, be it long or short. Locals, however, seem to have a much stronger and long-term negative bias on their own currency,” he was quoted as saying.

Rising double-digit inflation, an extremely wide current account deficit and the reluctance of policy makers to raise interest rates given Erdogan’s unorthodox insistence that they are not appropriate—despite the market consensus that the Turkish economy is overheating—continue to give traders the jitters, not to mention the stand-off between Ankara and Washington over pastor Brunson and the worsening external environment for emerging markets with the US Fed gradually tightening rates.

Short-term volatility in the lira is by far the highest among emerging markets. It has climbed above 40%.

Call to break dollar dependence

Some prominent voices in Turkey are calling on the Erdogan administration to utilise what they refer to as the US-led attack on the Turkish economy as an opportunity to build a new monetary and trade system and break dependence on the dollar.

Cemil Ertem, an advisor to Erdogan, said in a column published on August 23 in Milliyet that Turkey should become one centre in the search for a new monetary system.

He wrote: “We need to internalise this search as a formal element of both our economic and foreign policy.”

Turkey should deepen economic and trade relations with the EU, UK and other countries including Russia with dollar-related financial shocks felt by Turkey and other nations having made the search for new solutions a necessity, Ertem said.

The creation of an IMF-like institution by BRICS nations would shake the foundations of the dollar-based system, he added, writing: “Let’s accept this; with this crisis, the Atlantic Alliance is history, and from now on there is no such thing as American hegemony… Forget the IMF, we shouldn’t even let a crumb of the IMF understanding through our door. If we do that, then we’ll be faced with a real collapse and crisis.”

News

US suspends strategic dialogue with Kosovo amid political deadlock

Washington singles out Kosovo's caretaker PM, leftwing nationalist Albin Kurti, who has a strained relationship with the Trump administration.

Lukewarm support for Polish UN vote condemning Russian drone incursion

Only 46 out of 193 UN member states signed a joint UN declaration on September 12, denouncing Russia’s alleged involvement in a drone incursion into Polish airspace two days earlier.

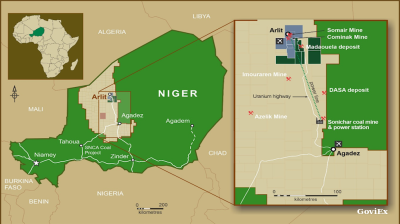

GoviEx, Niger extend arbitration pause on Madaouela uranium project valued at $376mn

Madaouela is among the world’s largest uranium resources, with measured and indicated resources of 100mn pounds of U₃O₈ and a post-tax net present value of $376mn at a uranium price of $80 per pound.

Brazil’s Supreme Court jails Bolsonaro for 27 years over coup plot

Brazil’s Supreme Court has sentenced former president Jair Bolsonaro to 27 years and three months in prison after convicting him of attempting to overturn the result of the country’s 2022 election.