The creditors of Croatia’s highly indebted food and retail giant Agrokor approved the debt-for-equity settlement deal on July 4, the company said. 80.2% of the creditors voted in favour of the deal.

Croatia’s largest company, which employs around 60,000 people in the region, is undergoing restructuring after a debt crisis pushed it to the brink of collapse last year. The government stepped in and appointed an emergency manager.

The biggest shareholder in the new Agrokor will be Russia’s Sberbank with a 39.2% stake. Agrokor owes the Russian bank around €1.1bn. Bond holders will have a 24.9% stake. Another Russian bank, VTB, will hold 7.5% in the new company, while local bank Zagrebacka Bank will have a 2.3% stake, the extraordinary administrator Fabris Perusko has said, according to N1 Zagreb.

According to the settlement deal, suppliers can receive between 60% and 80% of their claims. Most domestic and international financial institutions will get up to 20% of their claims, while the return will range between 40% and 80% for bond holders. Small and micro enterprises have the highest percentage of claim recovery, at 100%.

The implementation process is planned to last between three and four months.

The restructuring of Agrokor has become highly politicised, and is a burning issue in Croatia given its importance to the economy. Former deputy prime minister and economy minister Martina Dalic resigned on May 14, following the leaking of her email correspondence showing an alleged conflict of interest in the restructuring of Agrokor. This followed the resignation of the group's original emergency manager Ante Ramljak, also over accusations of conflict of interest.

News

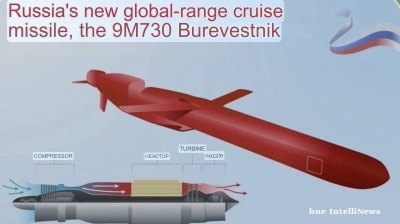

Russia test fires its Burevestnik nuclear-powered cruise missile

Russia’s Burevestnik nuclear-powered cruise missile has no analogues in the world, Russian President Vladimir Putin said, as the Kremlin escalates the unfolding missile arms race with Ukraine another notch.

Russia claims to surround Pokrovsk

Russia’s chief of the general staff Valery Gerasimov triumphantly reported to Putin that 31 Ukrainian battalions have been encircled in Pokrovsk and 18 battalions in Kupyansk, the hottest spot in the war.

.jpg)

Brazil and US to start urgent tariff negotiations after Trump-Lula meeting

Brazilian President Luiz Inácio Lula da Silva and US President Donald Trump have agreed to start immediate negotiations on tariffs and sanctions imposed by Washington, following a meeting in Malaysia that sought to ease trade tensions.

Cambodia and Thailand agree peace deal

Thailand and Cambodia have agreed a peace deal to mark the end of a conflict earlier in the year as Cambodian Prime Minister Hun Manet and Thai Prime Minister Anutin Charnvirakul attended a signing ceremony overseen by US President Donald Trump.