The plunge in the Turkish lira (TRY) and rise in borrowing costs is likely to push the Turkish economy into a technical recession in the second half of 2018—but that’s the more optimistic picture. According to an August 8 research note from Yasemin Engin of Capital Economics, it is the vulnerabilities that built up in Turkey’s banking sector during its credit-fuelled boom that could turn a recession into a “full-blown crisis”.

Capital Economics has for several years warned about the vulnerabilities in Turkeys’ banking sector. The first risk item is the sheer scale of the credit expansion. Turkey’s private sector credit-to-GDP ratio has risen by 45 percentage points over the past 15 years from below 20% after the 2001 crisis to above 60% since last year. Typically, credit booms on this scale lead to a deterioration in the quality of lending and a subsequent rise in non-performing loans (NPLs), the macroeconomic research consultancy noted.

Capital Economics estimates that the Turkish banking system’s NPL ratio would have to increase from the current official “low and stable” figure of around 3% to approximately 12% to reduce the banks’ overall capital adequacy ratio to below the regulatory minimum of 8%.

“But there are already growing signs that firms are struggling to repay debts, and that banks are trying to restructure these. What’s more, the rise in borrowing costs and likely slump in the economy could cause debt servicing difficulties to mount. Some banks may be more vulnerable than others to souring loans, and rising defaults could lead to a build-up of counterparty risk,” Engin said.

FX-denominated lending

Capital Economics’ second concern is that over a third of bank lending in Turkey is denominated in foreign currencies. IMF estimates suggest that a significant share of domestic lending in FX has been to companies in the construction, real estate and energy sectors, whose incomes are presumably TRY-denominated as against their input costs which are FX-denominated.

Finally, Engin observed, much of the recent credit binge has been funded by borrowing on foreign wholesale markets. Until 2011, banks were able to fund their lending entirely from domestic deposits, which tend to be a relatively stable form of financing. But lending growth has outpaced the expansion of deposits, prompting banks to borrow from abroad to fund domestic lending. Capital Economics estimated that such a route has financed about 30% of new loans since 2010.

“As a result, if foreign funding were to dry up, a credit crunch would ensue,” Engin said, adding “At the very least, the fragilities in Turkey’s banking sector mean the prop to GDP growth from rising credit will fade. But if some of these vulnerabilities crystallise, they could tip the economy into a full-blown crisis.”

Rash of restructurings

It is thought that the total debts currently being restructured by Turkey’s large companies may stand at around $24bn, but there is no official data available. Several big Turkish conglomerates have already begun restructuring processes.

Ferit Sahenk, owner of Turkish conglomerate Dogus Holding, confirmed on August 8 that the conglomerate was about to conclude a €2.3bn and six-year debt restructuting loan agreement with lenders. The restructuring agreement is equivalent to about 42% of the holding company’s loan stock and Dogus Holding would provide €3.6bn worth of collateral for the new loan, Dogus Group CEO Husnu Akhan told daily Milliyet.

Dogus Holding’s total short term loans stood at TRY7.5bn at the end of 2017, or €1.7bn based on the official EUR rate, while its total loan debt was TRY23.5bn, or €5.2bn.

Borsa Istanbul-listed Akis REIT said on July 27 in a bourse filing that it had signed a $40mn debt restructuring agreement with HSBC Turkey. Akis put up its shopping mall Akasya collateral worth $55mn for the loan.

Hakan Caglar, chairman of construction company Emay Insaat, told Bloomberg on August 1 that the company was in debt restructuring talks with lenders. Emay’s total debt was TRY1.2bn as of 2017 and the total value of its stock assets stood at TRY2bn, according to Caglar.

Ali Agaoglu, chairman of one of Turkey’s largest contruction companies Agaoglu Group, on August 7 was quoted by Hurriyet Daily News as denying rumours that the company would file for bankruptcy. Agaoglu also said that the conglomerate was expecting $300mn from the sale of its two wind power plants.

Expected tigthening in monetary and fiscal policies would weigh more on the construction industry which has already begun to show signs of a slowdown, the Contractors’ Association of Turkey (TMB) said on August 1 in its regular sectoral analysis report.

Daily Haberturk reported on August 3 that car rental company Fleetcorp had suspended its activities due to €300mn worth of debts owed to lenders. Fleetcorp’s debt rose to TRY1.8bn from TRY1.2-1.3bn at end-2017, with its debts exceeding the loan limit of TRY1.7bn agreed with lenders. Fleetcorp was selling its fleet on the second-hand market to cover debt payments, according to the newspaper.

News

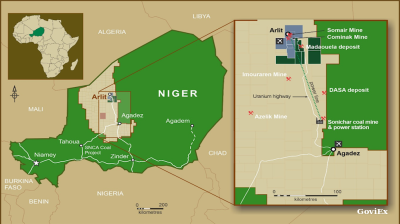

GoviEx, Niger extend arbitration pause on Madaouela uranium project valued at $376mn

Madaouela is among the world’s largest uranium resources, with measured and indicated resources of 100mn pounds of U₃O₈ and a post-tax net present value of $376mn at a uranium price of $80 per pound.

Brazil’s Supreme Court jails Bolsonaro for 27 years over coup plot

Brazil’s Supreme Court has sentenced former president Jair Bolsonaro to 27 years and three months in prison after convicting him of attempting to overturn the result of the country’s 2022 election.

Iran cleric says disputed islands belong to Tehran, not UAE

Iran's Friday prayer leader reaffirms claim to disputed UAE islands whilst warning against Hezbollah disarmament as threat to Islamic world security.

Kremlin puts Russia-Ukraine ceasefire talks on hold

\Negotiation channels between Russia and Ukraine remain formally open but the Kremlin has put talks on hold, as prospects for renewed diplomatic engagement appear remote. Presidential spokesman Dmitry Peskov said on September 12, Vedomosti reports.