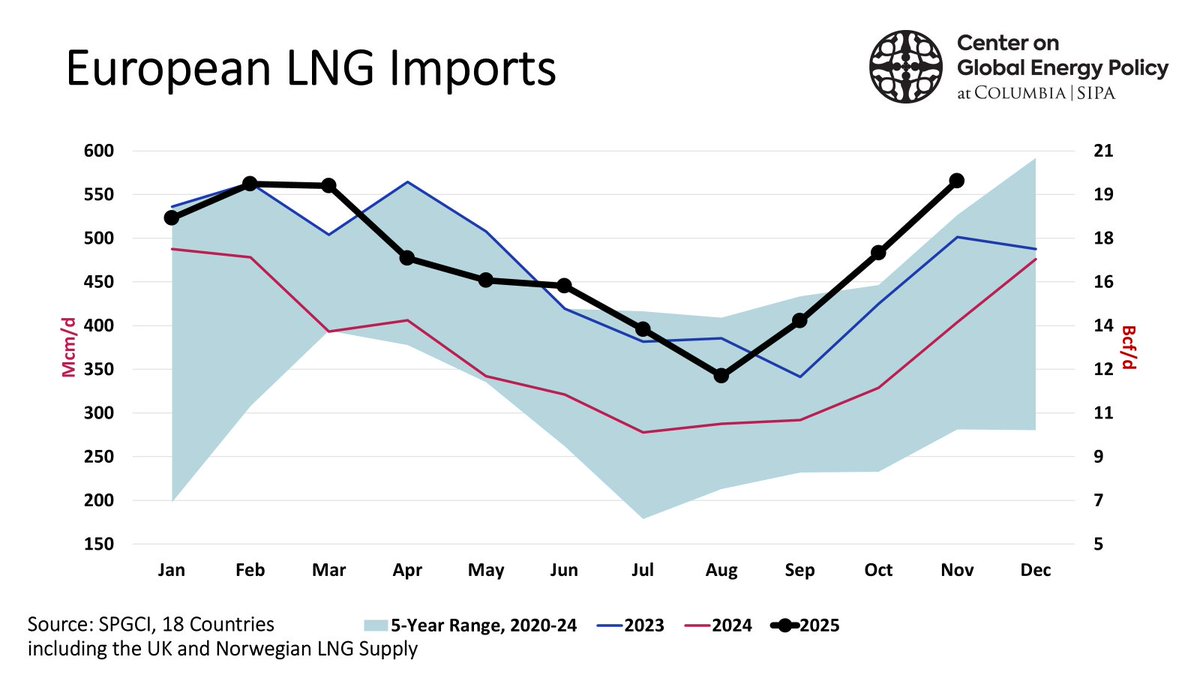

Liquefied natural gas (LNG) imports into the European Union are on track to hit an all-time monthly high in November, driven by a sharp rise in shipments from the United States. The increase offers a timely boost to the bloc’s energy security strategy, as Brussels aims to preserve gas storage reserves until peak winter demand in the first quarter of 2026.

According to industry data and tanker tracking estimates, US LNG volumes are making up the bulk of the surge, with transatlantic flows intensifying in recent weeks. Shipments from the US Gulf Coast to European terminals have accelerated as Atlantic spot prices remain attractive and mild weather conditions limit immediate heating demand in Europe.

As of November 2025, LNG imports from Russia to Europe remain below pre-war levels, but they have not stopped entirely, and volumes are holding steady or slightly declining compared to last year. Despite widespread efforts to reduce dependence on Russian energy, some Russian LNG is still reaching European markets, primarily through long-term contracts and spot purchases from intermediaries.

“November LNG imports are on pace to break the record for a month,” a market analyst told Bloomberg on November 13. “US volumes are providing most of the surge and tanker flows suggest the numbers could climb.”

Europe is attempting to wean itself off Russian LNG ahead of a total ban on LNG imports on January 1, 2027 that is part of the nineteenth sanctions package.

Russian LNG exports to the EU in 2025 are down approximately 10–15% year-on-year, following a modest rebound in 2024. In October and early November, Russian LNG deliveries to EU ports—including France (Montoir, Dunkirk), Spain, and Belgium (Zeebrugge)—continued, but at a lower frequency than during the same period in 2022 or early 2023.

Overall, Russian LNG now represents roughly 3–4% of the EU’s total energy imports by volume, according to estimates from Bruegel. However, in 2022–2023, the share of Russian LNG in overall LNG imports hovered around the pre-war 20% at 15–17%, as Russian LNG was not sanctioned and European buyers scrambled to replace lost pipeline gas. By 2025, Russian LNG’s share has declined to approximately 10–12% of total EU LNG imports, according to Kpler and S&P Global Commodity Insights.

The largest share of Russian LNG is still shipped from Yamal LNG, operated by the privately-owned Russian firm Novatek, with cargoes typically labelled as non-sanctioned due to existing long-term contracts and partial ownership by European stakeholders.

Brussels wants to see that share to drop to zero at the start of 2027, but that will depend on if the other major producers like the US and Qatar can meet the demand, although both countries have large-scale new resources coming online in the next two years.

Keeping the tanks full

The increase comes as European storage sites remain close to full following early autumn injections. The European Commission has signalled its preference to conserve stored gas until January and February, when cold weather and potential market volatility could put pressure on inventories. In that context, higher LNG arrivals in November help delay withdrawals from underground reserves.

“It's a welcome sign for Brussels, which would prefer to minimise storage use until Q1,” Bloomberg reported, citing officials familiar with winter supply planning.

The record-setting pace also reflects long-term shifts in EU gas sourcing, following the steep decline in Russian pipeline imports since 2022. The United States has emerged as the EU’s largest LNG supplier, followed by Qatar and Nigeria. LNG now accounts for more than one third of the bloc’s gas supply.

With more than 90% of EU storage filled as of mid-November, additional LNG arrivals have created logistical challenges at some import terminals. However, mild weather has eased pressure on regasification infrastructure and allowed for higher-than-usual sendout to grid systems.

Looking ahead, traders remain cautious. Cold spells in Asia or disruptions to shipping lanes could tighten global supply and lift spot prices. Yet for now, the influx of LNG—particularly from the US—is helping stabilise the European market and giving policymakers breathing space heading into winter.

“The numbers could climb,” Bloomberg noted, “as tanker traffic and weather conditions continue to favour European destinations.”

Features

LGBTQ+ Russians fleeing Georgia say country mirrors Kremlin's playbook

Russian émigrés who once saw Georgia as a safe haven now warn the country is replicating Russia's systematic persecution of LGBTQ+ people, forcing them to flee once more

COMMENT: Japan and Europe come together in support of Taiwan

Over the past week, two moves in East Asia and Europe clearly signal that the handling of the Taiwan question is entering a new phase - one in which neither Tokyo nor Brussels is prepared to abide by a Beijing-centric diplomatic equilibrium.

The EU’s new supply web

Global turbulence has stalled FDI for now, but the potential for future investment around the EU’s periphery — from the Western Balkans to Ukraine to north Africa — remains strong.

INTERVIEW: Seonghoon Woo - Amogy CEO and a global leader in ammonia powered energy solutions

Ammonia is fast emerging as a key player in the global transition to cleaner energy systems, particularly across Asia where it offers a versatile and potentially carbon-free solution for storage, transport, and power generation.